By Peter Garnry of SaxoBank

Summary: Shipping stocks are enjoying tailwind from the pandemic that has lifted shipping rates and profitability. Our view is that the current dynamics will continue in 2021 and thus shipping stocks could continue to perform well, but longer term we prefer more broad-based logistics companies. In today’s equity update we also take a look at US momentum stocks and highlights an inspirational list of stocks that could be hit hard if we get an equity market correction in the near future.

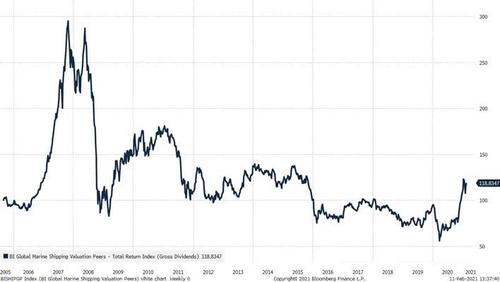

This week the world’s largest container shipping company reported Q4 earnings showing a solid tailwind from the pandemic with revenue up 16% y/y reaching $11.3bn and 84% y/y increase in EBITDA reaching $.2.7bn. This translate into a healthy operating margin increase from 15.3% to 24.1% in just one year. This is part of the overall trend of rising costs everywhere in the global supply chain with UPS reporting 8% increase in average revenue per piece in their Q4. A global composite container freight index is running at levels 3x higher than normal at this time of the year.

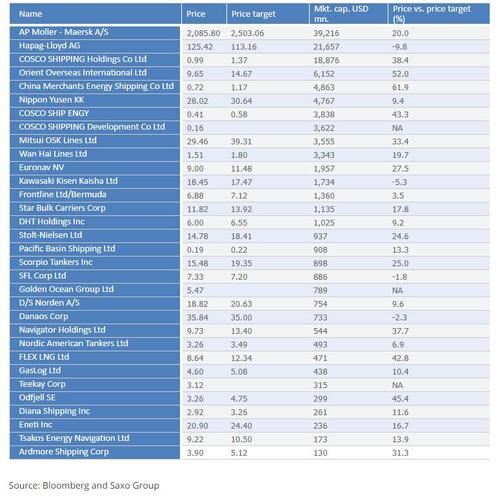

For those investors that want exposure to shipping stocks the list below is a good starting place. It shows all the shipping stocks in the Bloomberg Global Marine Shipping Index that can be traded on Saxo’s trading systems. We have included the consensus price target from analysts covering the stocks and calculated the spread in percentage to the current price. Analysts are quite positive on the industry with an average price target 21% above current market prices.

Is a new momentum crash on the horizon?

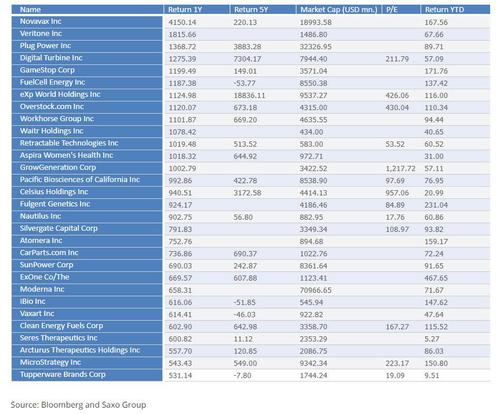

Equities are grinding higher everyday and the speculative fever is running high with Bitcoin price action and the short squeeze in GameStop and other shorted stocks as recent evidence. If we look at the Russell 3000 Index in the US, we observe 720 stocks with a one-year total return above 50%. Yes, you read correctly and note that the starting point for the calculation is before the major selloff started. In the finance literature, many different authors have covered a concept called momentum crashes (read here, here, and here).

Momentum crashes mean different things to different investors. The ones that implement equity factor strategies in long-short versions tend to view momentum crashes when the equity market bounces back from a huge selloff as the one in 2008 when the losing stocks shorted suddenly reverses big time creating large losses in the short component of the portfolio relative to the gains on the long component.