Powell hinted that the Fed has already reached one out of two targets and that full employment and inflation “moderately exceeding the 2% target” are not prerequisites for a taper decision. Interesting months are upcoming.

Tapering is moving closer as the Fed finds that the economy has made progress towards the goal. This is fuel to our story of an early tapering process. We find the current Fed stance USD positive with continued curve flattening in 5s30s and clear risks of higher belly rates. Market moves were though very moderate.

The Fed acknowledged that the economy is moving in the right direction and that the tapering process is moving closer as Powell hinted that inflation “moderately exceeding the 2% target” was a prerequisite for the lift-off of policy rates but not for tapering. This likely also means that the Fed can taper before reaching its goal on employment.

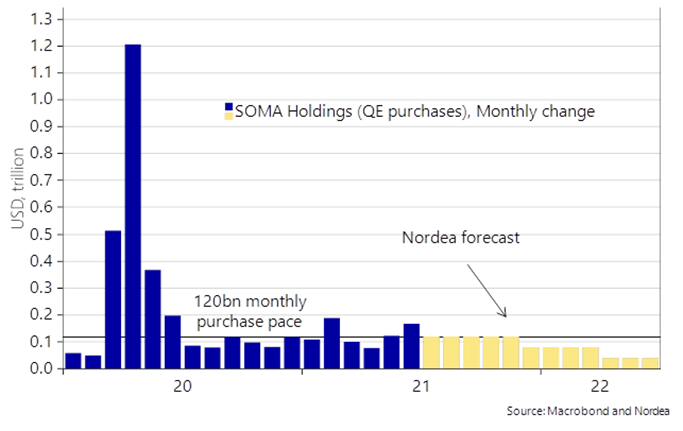

Powell was also asked whether the Fed had already met its inflation target and answered something along lines of “It is clearly a question for the committee to decide, but I can say that the inflation is running clearly above target currently”. Judging from the response of Powell, it seems as if he is moving towards acknowledging that the inflation target is already met. We still find it likely that a tapering decision is taken in September with a formal slowdown of the purchases from December and onwards. We expect the Fed to be able to finalize tapering by the summer of 2022. The big risk to our Fed forecast is now if the Fed assumptions are getting too positive on the economy, which is not unlikely since there are clear signs of a rollover in the global manufacturing cycle.