resume af udenlandske analyser, bearbejdet til dansk:

Efter et kraftigt årsskifte-rally i sølv, hvor prisen er mere end fordoblet siden efteråret, advarer flere analytikere nu om betydelig kortsigtet nedadgående risiko. Stigningen, som blev udløst af stærk kinesisk efterspørgsel, ETF-tilstrømning og markant detailinvestor interesse, bærer ifølge kritikerne præg af spekulativ eufori snarere end fundamentale forhold.

TD Securities’ råvarestrateg pegede allerede ved årsskiftet på, at handelsvolumen i den største sølv-ETF har nået niveauer, der historisk kun er set ved markeds-toppe. Samtidig handles ETF’en til usædvanligt høje præmier i forhold til indre værdi, hvilket indikerer likviditetsbegrænsninger og stærk spekulativ efterspørgsel. Råvarestrategen forventer, at omkring 13 % af den samlede åbne interesse i COMEX-sølv vil blive solgt i forbindelse med en bred råvareindeks-rebalancering, hvilket kan udløse en markant prisjustering nedad. Ifølge ham minder den seneste kursudvikling om et carry trade, der er løbet løbsk – typisk efterfulgt af et brat tilbageslag.

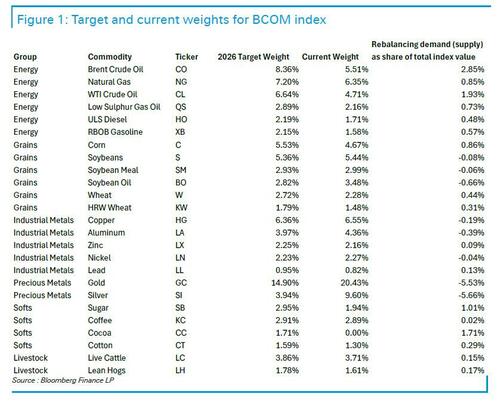

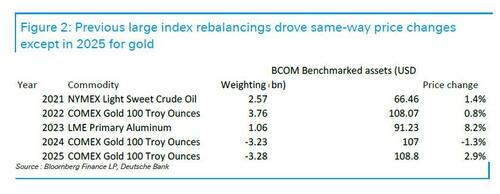

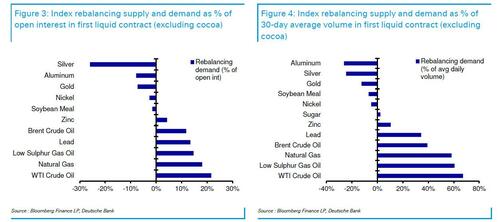

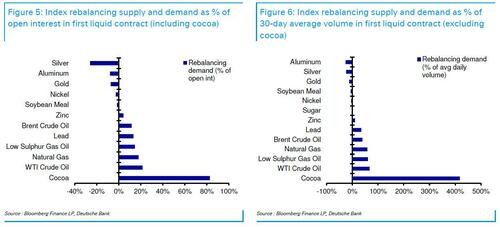

Denne vurdering deles af Deutsche Banks analytiker Michael Hsueh, som fremhæver, at både guld og sølv sandsynligvis vil blive negativt påvirket af januar-rebalanceringen i Bloomberg Commodity Index (BCOM). Rebalanceringen reducerer især vægten af ædelmetaller, mens energiråvarer som olie og gas får øget vægt. Målt på både åben interesse og handelsvolumen ventes salgspresset at være størst i sølv, efterfulgt af aluminium og guld. Historisk har større vægtændringer ofte været ledsaget af prisbevægelser i samme retning, om end der findes undtagelser.

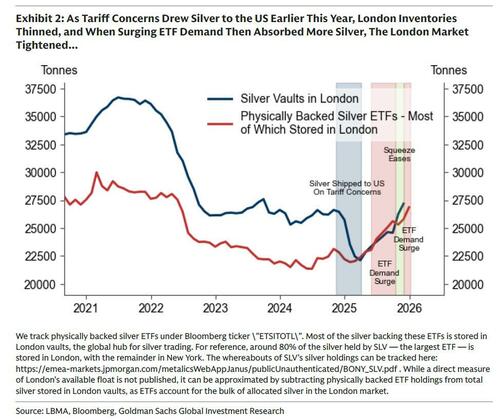

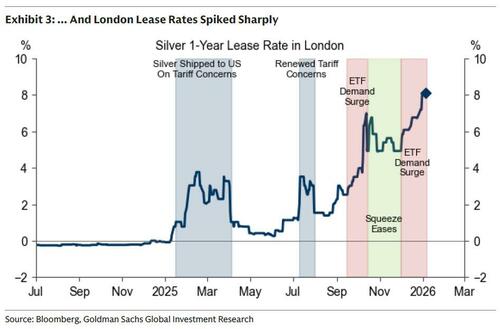

På lidt længere sigt er billedet mere nuanceret. Goldman Sachs’ analytiker Lina Thomas vurderer, at ekstreme prisudsving i sølv kan fortsætte – både op og ned – primært drevet af meget lave lagre i London, hvor referenceprisen fastsættes. En midlertidig likviditetskrise er opstået, fordi fysisk sølv er blevet flyttet til USA i forventning om mulige handelstiltag, samtidig med at ETF-efterspørgslen har absorberet yderligere metal. Resultatet er en markant stramhed i det fysiske marked, hvilket har sendt lejeraterne for sølv kraftigt i vejret.

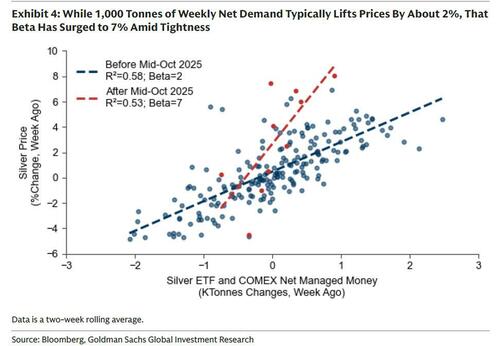

Ifølge Goldman forstærker lave lagre prisreaktionerne: hvor 1.000 tons ugentlig nettospørgsel normalt løfter prisen ca. 2 %, har effekten under de nuværende forhold været op mod 7 %. Så længe likviditeten i London ikke normaliseres, kan priserne derfor stige yderligere, selv efter den kraftige optur. Samtidig er spekulative positioner på COMEX fortsat under historiske gennemsnit.

Risikoen ligger dog i en genopretning af likviditeten, eksempelvis hvis sølv vender tilbage fra USA til London. Hertil kommer nye kinesiske eksportkontroller på sølv, som kan fragmentere markedet yderligere og øge volatiliteten. Samlet peger analysen på et marked med høj kortsigtet korrektionstrussel, men fortsat strukturel ustabilitet og geopolitisk risiko på længere sigt.

————————

Uddrag fra Zerohedge:

Over a month ago, before its exponential year-end meltup and when silver was trading at about half its current spot price, we laid out the bullish case for silver in “No Longer Gold’s Quiet Sidecar”: Silver Surges To Record High As China Demand Exacerbates Squeeze, which materialized just days later, sparking the a record-breaking surge for the precious metal. However, after the move which also saw unprecedented retail and ETF, not to mention market maker euphoria, it may now be time to cash out some chips.

The bearish thesis was first noted by TD analyst Daniel Ghali who in a Dec 31 note (available to pro subs) first wrote that trading volumes in the largest silver ETF have reached extreme levels only rivaled by that seen at prior market tops, amid historically dislocated premiums to NAV, while the historically elevated premium to NAV for this product continues to point to a speculative fervor from retail investors, augmented by liquidity constraints. Even so, Ghali warns that this volume will “likely pale in comparison to the $7.7bn in upcoming selling activity and associated trading activity from the broad commodity index rebalancing over the coming weeks.”

Specifically, the TD analyst expects a massive 13% of aggregate open interest in comex silver markets to be sold over the coming two weeks to result in a dramatic repricing lower, associated with a continued liquidity vacuum. After all, since November, silver’s devilish blow-off top hasn’t been a reflection of demand, supply, or fundamentals. To Ghali, the recent meltup is “analogous to a carry trade that has blownup. What comes next is the dramatic repricing that has historically followed in commodity cycles.”

Today, Ghali’s observation was picked up by Deutsche Bank precious metals analyst Michael Hsueh who in a note this morning (also available to pro subs), writes that “gold and silver are amongst the commodities which will likely be negatively affected by BCOM index rebalancing during the month of January.”

Hsueh says that he based his analysis on the new weights published by Bloomberg, and explains that according to Bloomberg, the Bloomberg Commodity Index is calculated on an ER basis and reflects commodity price movements. The index rebalances annually weighted 2/3 by trading volume,1/3 by world production and weight-caps are applied at the commodity, sector and group levels.

The roll period typically occurs from 6th-10th business day. The change in the gold weighting from 20.4% to 14.9% is likely determined by the BCOM “index rule that no single commodity can exceed a 15% weighting, seeking to maintain diversification.” Also according to Bloomberg’s index documentation, “The inclusion of Cocoa and the new 2026 target weights will take effect during the January 2026 roll period.

After the close of business on the fourth business day of January (the CIM Determination Date), BCOM will calculate the new Commodity Index Multipliers (CIMs ). The new CIMs will be implemented during the January roll period, when all commodities roll over five business days, and will remain constant throughout 2026.” (source)

Hsueh concludes by saying that the BCOM index rebalancing “Negative for precious, positive for crude oil” and notes the following:

- Index rebalancing will run from Friday 9 January through Thursday 15 January inclusive.

- When scaling by open interest in the first liquid contract, rebalancing supply should be largest for silver, aluminium and gold (descending order). Rebalancing demand should be largest for WTI crude oil, natural gas and low sulphur gas oil.

- When scaling by average daily volume, rebalancing supply should be largest for aluminium, silver and gold (descending order). Rebalancing demand should be largest for WTI crude oil, low sulphur gas oil, and natural gas. Note that rebalancing supply and demand occur over a number of days however, not just one day.

- The impact of 2.4 million troy oz of gold selling may be worth 2.5-3.0% on the gold price using an ETF sensitivity, depending on lookback windows and whether one uses weekly or monthly changes (with weekly changes showing the higher sensitivity).

- Looking back over the last five years of index rebalancing events, we examine the largest weighting change of each year and compare with the price change between the 5th and 11th business days (just outside of the rebalancing period). We find that significant weighting changes were related to price movements in the same direction over 2021-2024 but in 2025, a reduction in the gold weight was accompanied by rise in the gold price.

Here are his observations charted:

But while the near-term may see some (potentially significant) profit-taking, the longer-term remains bright as Goldman’s precious metals analyst Lina Thomas writes in a note predicting that “Extreme Silver Price Action Likely to Persist On Thin London Inventories” (more in the full note available to pro subs).

Thomas writes that she expects extreme price swings to persist —both up and down — and advises volatility-averse clients to remain cautious. That said, the recent price action directionally reflects private investor inflows on Fed easing and on a potential ‘diversification’ theme, but a liquidity squeeze in London — where silver benchmark prices are set — amplifies the moves.

Speculation around US trade policy — with silver on the Critical Minerals List and theoretically eligible for tariffs of up to 50% (despite its exemption in April 2025) — prompted pre-positioning of metal into the US earlier in 2025, drawing inventory out of London and reducing the available float. As the rapid recent rise in silver ETF demand — which is backed by physical silver — absorbed more metal, the London market is temporarily running short of deliverable silver.

To manage this temporary shortage in the London market, Thomas writes what every self-respecting gold (and silver) bug knows all too well: traders turn to the leasing market, where holders of physical silver lend it out for a fee. The cost of borrowing silver (the lease rate) spiked sharply signaling near-term tightness.

Of course, thinner inventories create conditions for squeezes, where rallies accelerate as investor flows absorb remaining metal in the London vaults and reverse sharply when tightness eases. While 1,000 tonnes of weekly net silver demand typically lifts prices by about 2%, that beta has surged to 7% amid tightness (and vice versa).

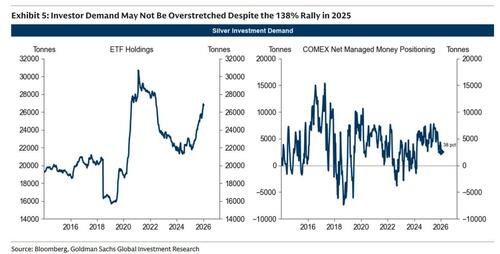

According to Goldman, BCOM rebalance notwithstanding, as long as silver remains dislocated in the US and liquidity in London is not restored with silver from elsewhere, prices could rise even further if investor enthusiasm persists. ETF holdings remain below their 2021 peak and are likely to rise further on Fed cuts and a potential ‘diversification’ theme, while net managed money on COMEX is below historical averages — suggesting investor demand is not overstretched despite the 138% rally in 2025.

Curiously, while ignoring the BCOM rebalancing, the Goldman analyst warns that “downside risk to silver prices is significant if London liquidity is restored, for example, if silver currently stuck in the US returns to London.” To this, Goldman still sees US tariffs on silver as unlikely, and thus policy clarity could trigger some metal to move back out of the US, easing London tightness and driving a price pullback.

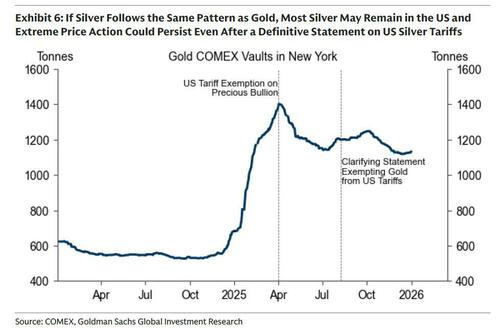

That said, despite a clear statement that gold remains exempted from US tariffs in August, most gold has stayed in New York COMEX vaults, reflecting lingering policy tail risk. If silver follows the same pattern, most silver may remain in New York COMEX vaults and extreme price action could persist even after a definitive statement on US silver tariffs.

Adding to this, China — a leading silver exporter — introduced export controls on January 1, requiring permission for outbound shipments of silver. While such measures do not necessarily signal imminent restrictions, the mere prospect could fragment the silver market further, reduce liquidity, and amplify price volatility.

Disruption risk may prompt participants to secure their own stockpiles rather than share buffers globally. This shift from a pooled global system to isolated regional inventories would create an inefficient structure — transforming a smooth, integrated market into one prone to sharp, localized price swings. We view the recent Chinese export controls on silver and other critical minerals such as tungsten and antimony as part of a broader global trend of commodities being deployed as geopolitical leverage.