Uddrag fra Marketear:

‘

Buy-the-dip in US exceptionalism

From contrarian to consensus back to contrarian in warp speed – it seems like being long Europe is now again somewhat of a contrarian trade. Several Wall Street banks have in the past days said that the outperformance has gone too far and that it is time to get back into the US supremacy trade again. Here is a summary of what Morgan Stanley is saying.

MEGA vs. MAGA

As the US exceptionalism narrative has faded over the past few months, European stocks have gained momentum. Global investors have increasingly allocated capital to Europe across assets. However, Morgan Stanley equity strategists think that the European outperformance has run its course, for now.

Source: Morgan Stanley

Follow the flow

Money is flowing into Europe….

Source: Morgan Stanley

Folge dem Geld

Fund flows into Europe particularly driven by Germany.

Source: EPFR

The earnings connection

Part of the story is that the relative earnings revision breadth has favored Europe YTD.

Source: FactSet

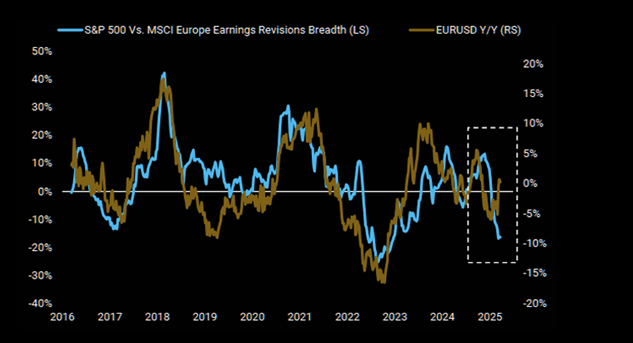

Tail-wind becomes a head-wind…

That earnings tail-wind could reverse in 1Q earnings season with weaker USD/EUR.

Source: Morgan Stanley

Oh no – not good

Earnings expectations in Europe (consensus) may have already peaked and appear to be declining.

Source: Morgan Stanley

Very overbought

From a tactical perspective…

Source: Morgan Stanley

Sigma boy

From very oversold to somewhat overbought.