Uddrag fra Zerohedge, Apollo og Goldman Sachs

In addition, we will soon begin to see higher inflation because there are a significant number of product categories where China is the main provider of certain goods into the U.S. market.

In May, we will begin to see significant layoffs in trucking, logistics, and retail—particularly in small businesses such as your independent toy store, your independent hardware store, and your independent men’s clothing store. With 9 million people working in trucking-related jobs and 16 million people working in the retail sector, the downside risks to the economy are significant.

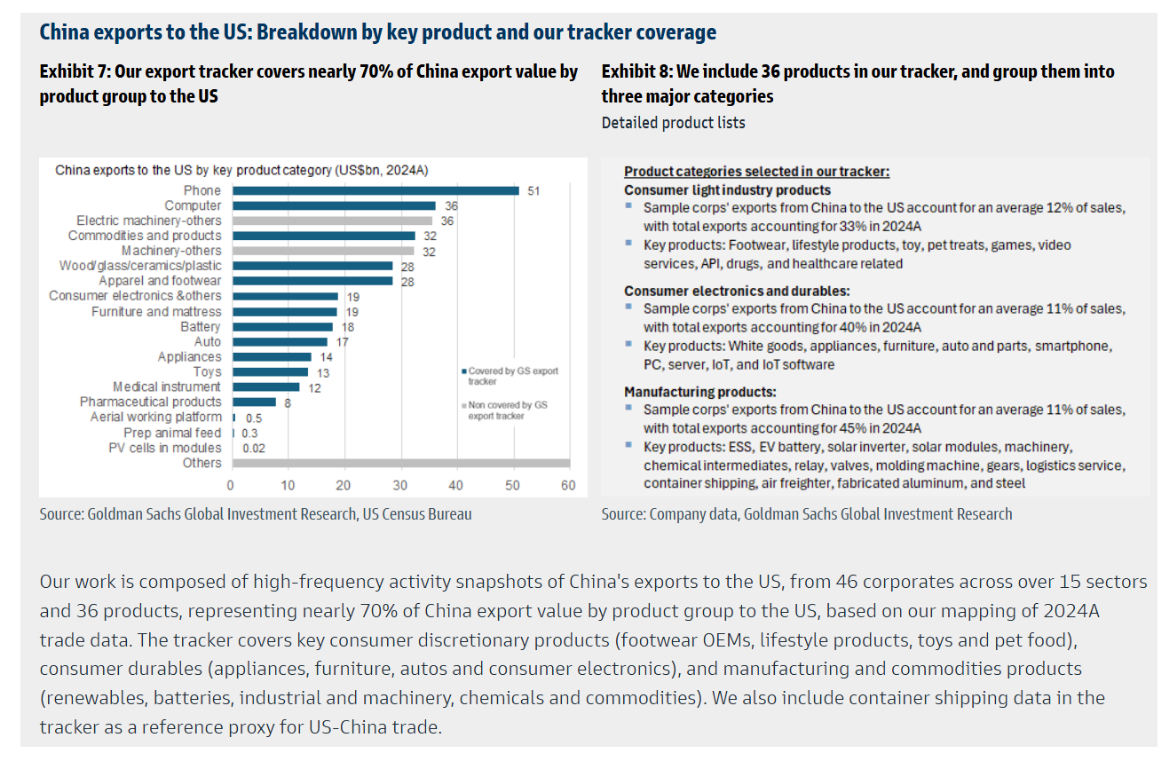

In a separate note, Goldman analyst Trina Chen outlined which Chinese products are most likely to be impacted if shortages materialize over the next couple of months.

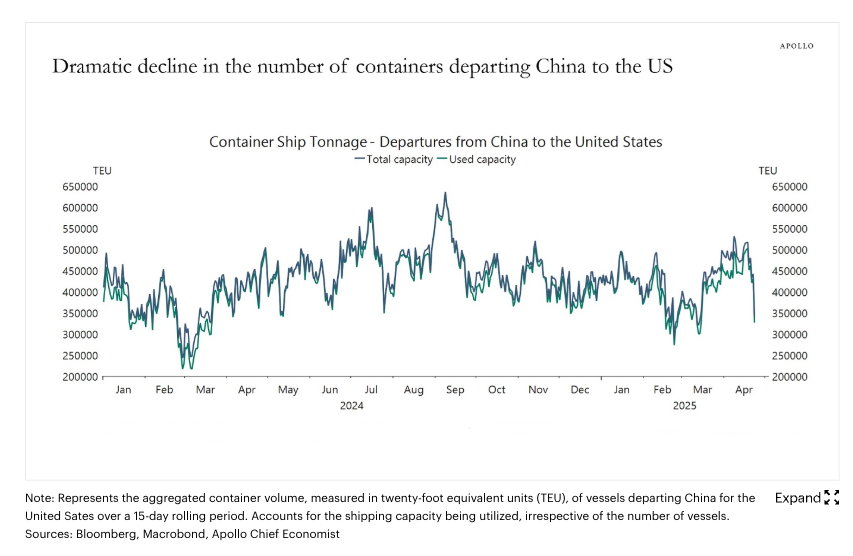

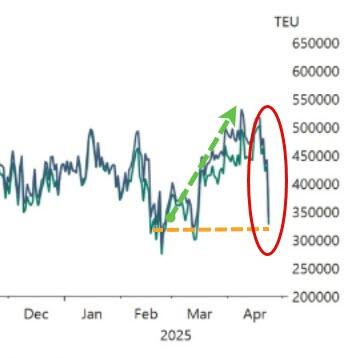

Slok’s chart above illustrates that the front-loading surge in imports ended abruptly just ahead of President Trump’s “Liberation Day” tariffs. The sharp drop in containerized volumes from China came off previously elevated levels. More or less, this was a natural lull that developed and quickly reversed due to tariffs.