Uddrag fra Goldman Sachs, Bloomberg og Haver Analytics

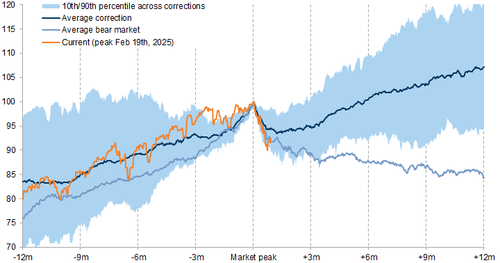

Historical sell-off: The S&P 500 sell-off has been sharper than the average correction in the last 100 years; the index fell 10% in just 22 days, making it the 6th fastest correction in 75 years.

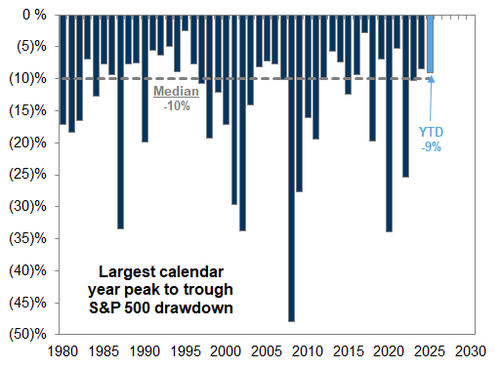

Bottom fishing the S&P 500: The S&P 500 has experienced a median annual drawdown of 10% during the last 40 years.

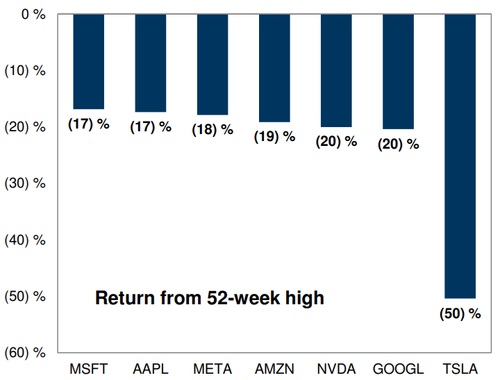

Mag7: Tesla has declined by 50% from its 52-week high, more than twice the fall of other Magnificent 7

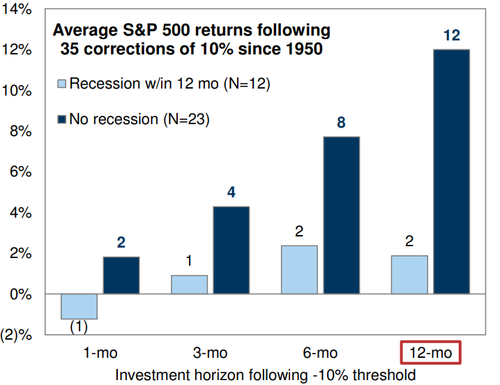

Average S&P500 returns following 35 correction of 10% or more.

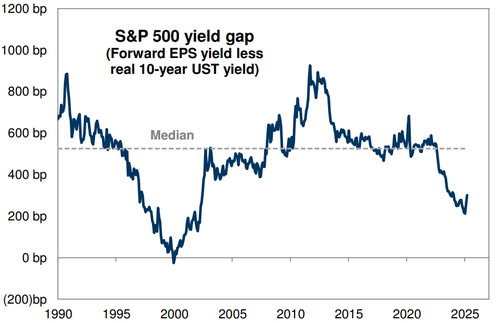

Near historical low: US equities trade near the smallest risk premium since 2002

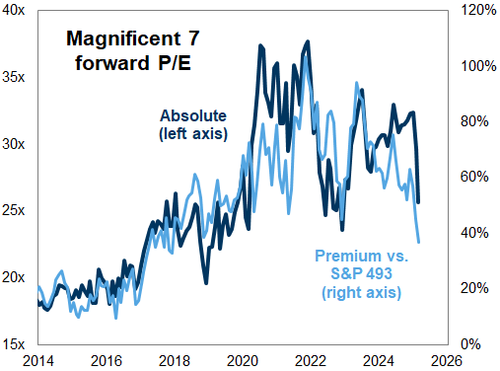

Buying opportunity? The Magnificent 7 trade at their lowest valuation premium to the rest of the S&P 500 since 2017

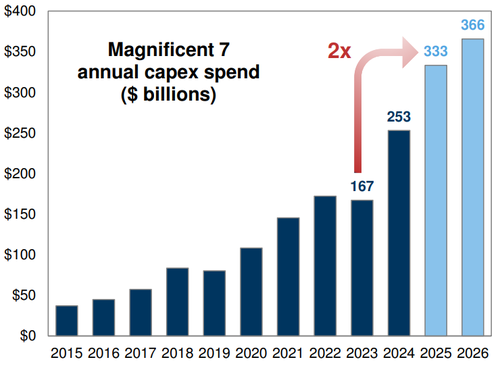

$333bn in 2025: Mag 7 will spend 2x as much on capex in 2025 compared with before ChatGPT

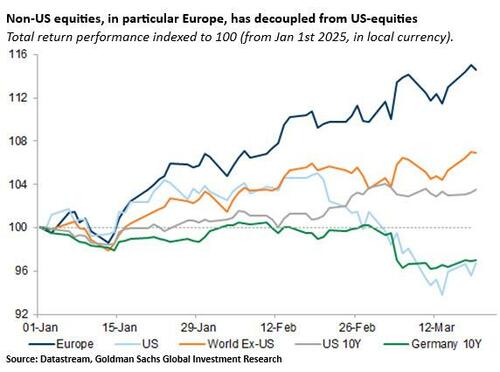

Non-US equities holding up well despite this sell-off (which is unusual) and US macro showing signs of weakness.

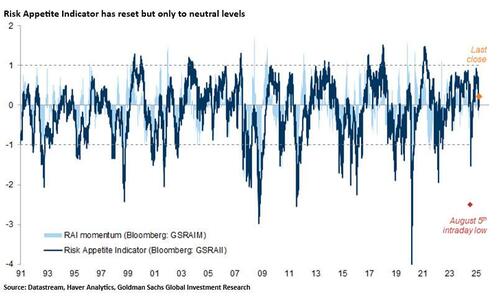

Goldman’s Risk Appetite Indicator (RAI) has declined but despite the sell-off only at neutral levels as the breadth in the sell-off been limited.

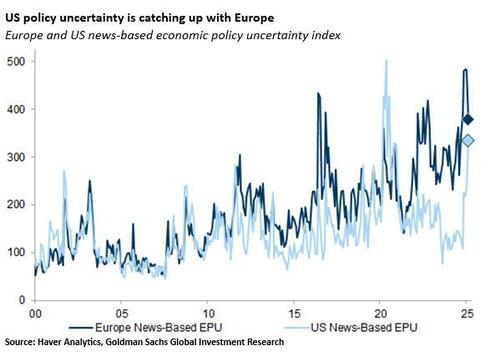

Reversing Gap: Policy uncertainty in the US catching up to Europe leading to cyclicals underperforming defensives.

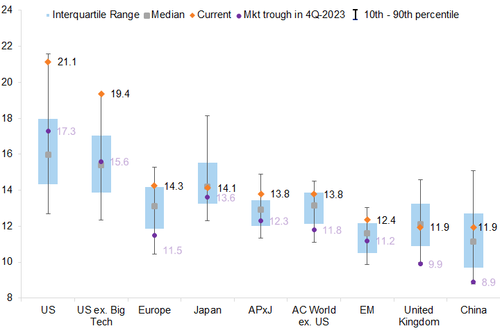

Valuation: Non-US markets are not particularly inexpensive relative to their own history

Not much growth-risk priced into European equities which increases the risk in the short term on disappointments on growth.

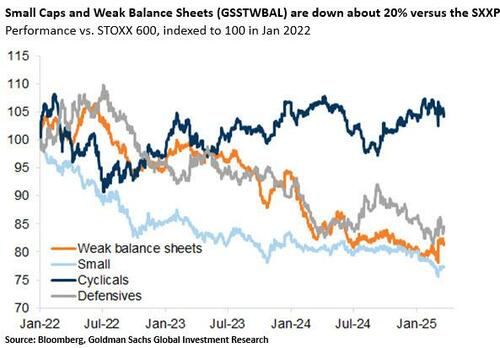

Looking at Europe, small-caps & weak-balance sheet companies are underperforming and are down c.20% since the start of the cutting cycle.

The weak balance-sheet basket is also underperforming more than its historical relationship with rates.

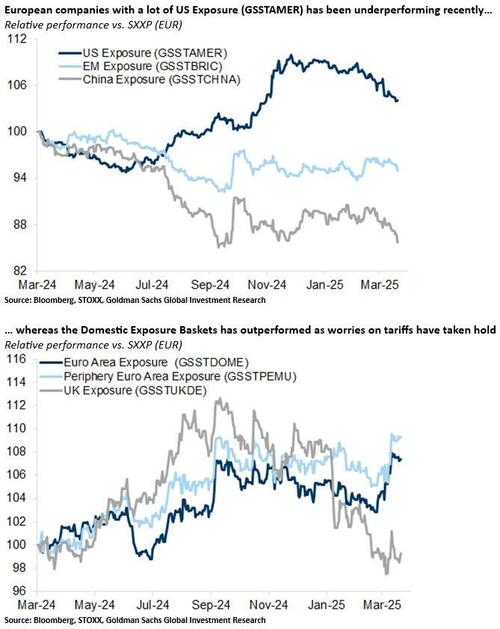

US exposure baskets have started to trade down as we are seeing investors have rotated into companies who have a larger European exposure.

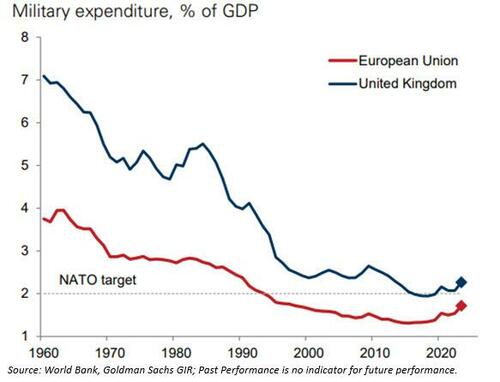

Defense Spending has fallen as a share of GDP since 1960 everywhere, but especially in the EU.

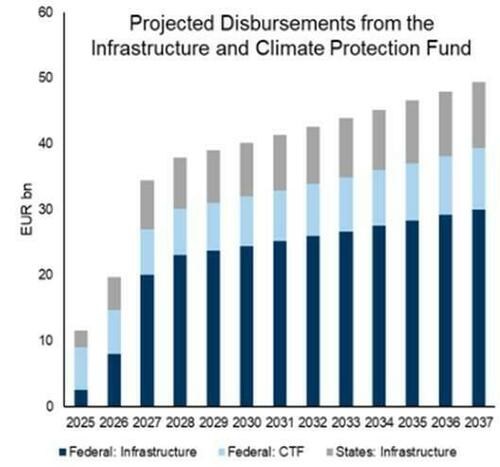

Germany: where will the money go?

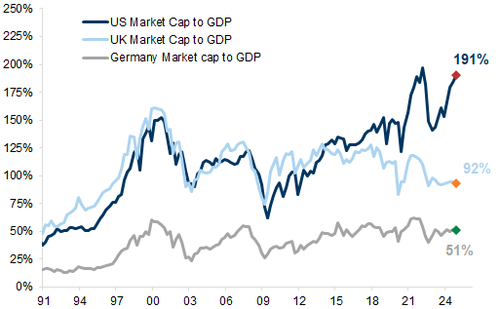

Still upside in Germany? Market Cap to GDP

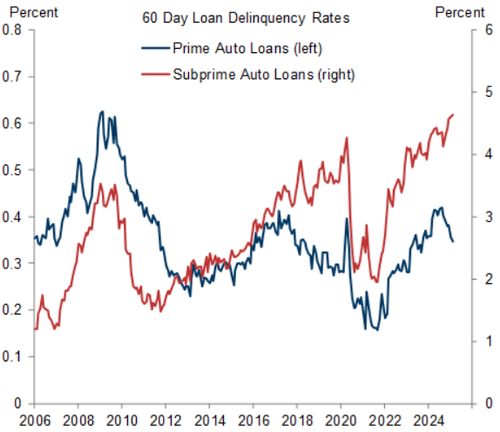

US Consumer: Subprime auto loans highest in two decades

US Consumer: credit card charge off rates highest in decades.

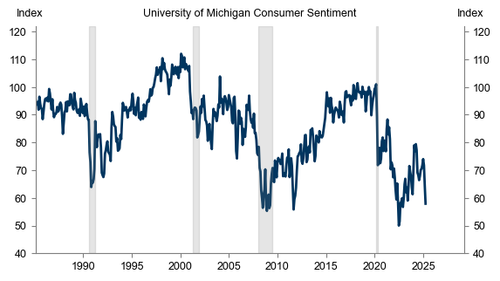

US consumer sentiment: Michigan consumer sentiment testing historical lows ex Covid

Record polarization: Democrats expect inflation to explode to 6.5% this year while Republicans expect no inflation…