Uddrag fra Deutsche Bank, Bloomberg, Google og zerohedge

Five Clues To The Future Of AI From Recent Headlines

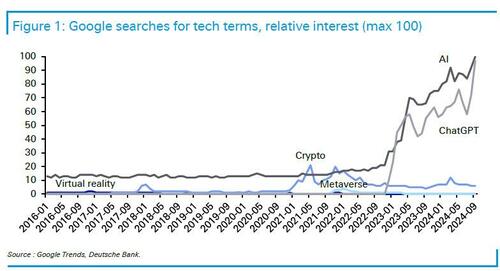

For better or worse, Artificial Intelligence remains a hot topic and the biggest driver behind market gains over the past two years. Google searches for technology terms continue to be dominated by AI, and even though searches for ChatGPT had hit a 2024 low back in July, they have since made a late summer surge as students ease the pain of that first post-vacation assignment with AI-enabled cheating (AI’s only true use-case so far, at least until teachers figure out how to spot AI written essays).

Looking at the Google Trends chart above, virtual reality and the metaverse had their moments in the sun in recent years: crypto, which briefly overtook AI in mid-2021, continues to excite some interest. But searches for AI this month are as high as they have ever been, and 20 times as high as crypto.

In a recent note from DB’s head of global research David Folkerts-Landau, the economist writes that five main themes stand out from the headlines from the last week or so, giving strong clues about the future of AI as the world buckles down for the rest of the year. They are as follows:

- AI is the elephant in the stock room

- Data centers are AI Ground Zero

- AI is still a magnet for funding

- Political appetite is growing for AI regulation

- Real-world uses have yet to emerge at scale

We take a closer look at each one…

1. AI is the elephant in the stock room

‘Magnificent Seven’ Prop Up Stocks Before US Jobs: Markets Wrap (Bloomberg, Sept 5)

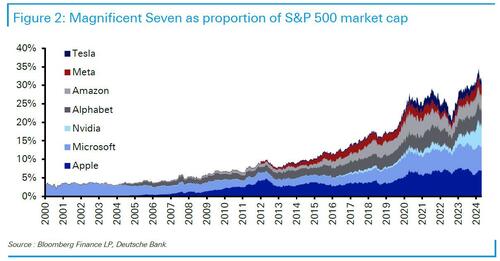

The story of the US stock market and the “Magnificent Seven” tech stocks has become (almost) one and the same. The group now accounts for 30% of the S&P 500’s total market capitalization of almost $50trn – with what looks at first glance like an increasingly strained bet on AI investment paying off.

The rollercoaster ride of the S&P this year, with 14% growth in the first half followed by a flat third quarter so far, has been driven by the big tech companies. The group, up by about a quarter this year, includes Nvidia, the purest play on AI in the public markets, as well some of the biggest investors in its chips.

Shares in the group surged by one third in the year to their peak on July 10, before tumbling 17% in less than a month, as doubts multiplied about the economic outlook and the speed of any payoff from their investments. They have since staged a partial recovery. By comparison, the Russell 2000 has eked out just 3.3% in gains this year.

Smaller tech companies on the index without the deep pockets to invest in Nvidia’s cutting-edge Graphics Processing Units (GPUs) are up just 2% — and still 25% below their peak in late 2021 thanks to a post-Covid investment and inventory hangover and being overlooked in favor of shiny AI investments.

… As investors count on valuations reflecting investment

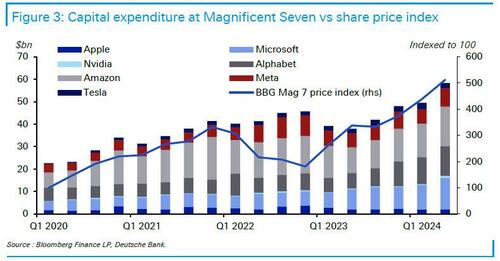

“Glass half-full” types are looking to long-term metrics to support the share price. Yes, shares in the Magnificent Seven have outperformed the S&P 500 for 15 of the past 21 months, and yes, the biggest investors in Nvidia chips – Amazon, Microsoft, Alphabet and Meta – are on course to spend $200bn in capital investment this year.

But their price-to-earnings ratio is in the mid-30s, well below the 90 times earnings ratio reached by Microsoft and 160 times by Oracle at the time of the dotcom bubble. Their AI exposure ranges from foundation models to cloud offerings as part of much larger portfolios. Consequently, unusually for incumbents, they have an incentive to promote rather than scupper adoption.

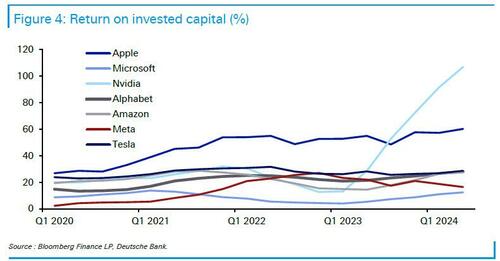

Crucially, their return on invested capital ranges between mid-teens for the laggards Microsoft and Tesla, to nearly 30% for most of the group and more than 100% for Nvidia. That compares with an unweighted average of 11% for the 11 sectors in the S&P 500.

Is this overinvestment? Alphabet CEO Sundar Pichai told analysts in July that the owner of Google has no choice: “The risk of underinvesting is dramatically greater than the risk of overinvesting for us here”. That echoed Meta CEO’s Mark Zuckerberg’s comment on a Bloomberg podcast the same month that “there’s a meaningful chance that a lot of the companies are overbuilding now and that you look back and you’re like, oh, we maybe all spent some number of billion dollars more than we had to.”

However, so far Meta has been a case study in AI investment paying off. The company posted a 22% increase in advertising sales – an uplift of almost $7bn — in the second quarter, thanks in part to its Advantage+ AI automated product promotion tool, which it says generates a 32% increased return on advertising spend for customers using it for shopping campaigns.

Concerns still persist though, ranging from Nvidia’s dependence on a handful of companies for its sales, to the view that models will soon be commoditized, to doubts over the capability, value and reliability of the technology.

2. Data centers are AI Ground Zero

Blackstone Buys Australian Data-Center Operator for $16.1 Billion (Wall Street Journal, Sept 4)

While betting on eventual AI applications may be a shot in the dark, investors continue to pile into the picks and shovels of infrastructure, starting with Nvidia’s cutting-edge chips. Most of those will end up in data centers.

The cloud is a misnomer, suggesting an ethereal miasma that is everywhere and nowhere. In fact, data centers are very physical. By some measures, there are over 10,000 worldwide, half of which are in the US. Each has thousands of servers running millions of virtual machines.

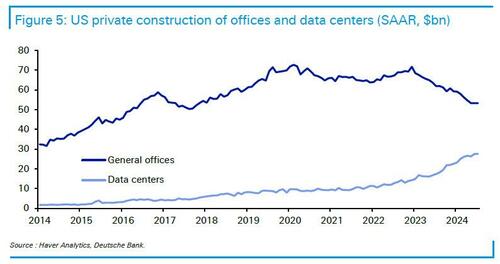

Blackstone and the Canadian Pension Plan Investment Board’s agreement to buy Sydney-based AirTrunk last week puts an enterprise value of over AUD 24bn on the largest data center platform in the Asia Pacific region. There will likely be about $2 trillion of capital expenditure to build and facilitate new data centers over the next five years – of which half will be in the US, Blackstone said.

Demand for computing power shows no sign of abating. Dario Amodei, CEO of Amazon-backed Anthropic, the maker of the Claude 3 chatbot, said that today’s most advanced AI models will cost around $1bn to train and that training the next generation will cost more 10 times more.

Compare that with the trifling $4.6m cost of computing power to train OpenAI’s GPT-3, which came out in 2020, and the estimated $100m for GPT-4, which came out last year.

In terms of GPUs, Meta’s latest large language model (LLM) Llama 3 was trained on two clusters of 24,000 Nvidia H100 chips and Zuckerberg recently said Llama 4 will need ten times as many.

Meanwhile, Elon Musk said last week that his company xAI just brought online “the most powerful AI training system in the world” with 100,000 H100s and that the system, known as Colossus, will double in size in a few months.

… As the hyperscalers drive growth and energy demand

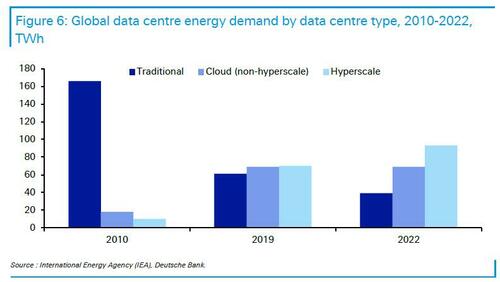

The hyperscalers continue to lead growth in data center energy demand. These companies, led by Amazon, Microsoft, Alibaba and Alphabet, provide cloud computing and data management services to organizations demanding flexible computing on a grand scale.

Energy demand from data centers has been stable over the past decade or so at around 200 TWh. But during that time the proportion accounted for by hyperscalers has surged from little more than a rounding error, to around one third five years ago, and since then has neared half of the total.

That has turned the hyperscalers into significant offtakers of renewable energy, buying directly from the sellers.

Amazon has been far in the lead, according to International Energy Agency data. It bought more than 20 GW of renewable energy from 2010 to 2022, about two thirds solar and one third wind. Meta and Microsoft each bought over 10 GW.

Access to renewable energy will become increasingly important as demand rises. Training GPT-3, already a minnow by today’s standards, generated an estimated 502 tonnes of CO2 equivalent emissions, and Microsoft said earlier this year that its carbon emissions have risen nearly 30% since 2020, mainly due to constructing data centers, though it aims to be carbon neutral by 2030.

Champions of AI’s environmental credentials point out that AI is just the tool needed in the long term to improve data center and power generation efficiency, more accurately forecast weather and encourage a decisive move to renewable energy. It will also need to address the need for water-intensive cooling systems.

3. AI is still a magnet for funding

Exclusive: OpenAI co-founder Ilya Sutskever’s new safety-focused AI startup SSI raises $1 billion (Reuters, Sept 4)

Ilya Sutskever commands Lionel Messi-like star power in Silicon Valley thanks to his work on the pioneering AlexNet image recognition system in 2012 and then his role as Chief Scientist at ChatGPT maker OpenAI, which he left in May.

Even so, it is quite a feat to create a company valued at a reported $5bn just three months after it was created and with a mere 10 employees. Bankrolled by investors including Andreessen Horowitz and Sequoia Capital, Safe Superintelligence (SSI) has raised $1bn in cash to develop safe AI systems that far surpass human capabilities, according to Reuters.

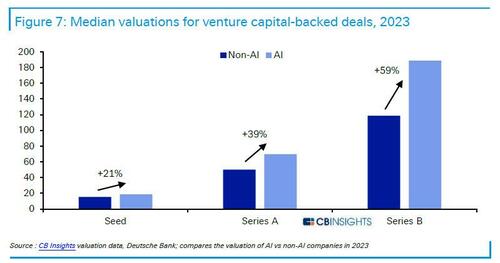

Although investors are no longer signing cheques for any company with AI in the name, Sutskever is not alone in attracting generous funding in the private markets, which offer the kind of pure AI exposure that is hard to achieve in publicly traded companies.

OpenAI itself is reported to be in talks to raise billions of dollars at a valuation of more than $150bn, up from its current $86bn valuation. And Tokyo-based Sakana AI, a maker of energy-efficient foundation models founded in July last year, became a unicorn with $1bn valuation after raising several billion yen from investors including Nvidia last week. It can’t have hurt that, like Sutskever, the founders had Google pedigree, along with the founders of most of the leading AI companies, from Anthropic to Cohere, Mistral and Perplexity.

There are other options though. Some company founders have decided to throw their lot in with the data-, distribution- and compute-rich behemoths of the industry, such as (Google alum) Mustafa Suleyman and most of his Inflection team moving to Microsoft in a $650m deal in March.

Adept’s co-founders struck a similar deal with Amazon in June, while Character.AI’s cofounders agreed to rejoin their previous employer last month. Where? Google, of course.

… As infrastructure and research investment surges

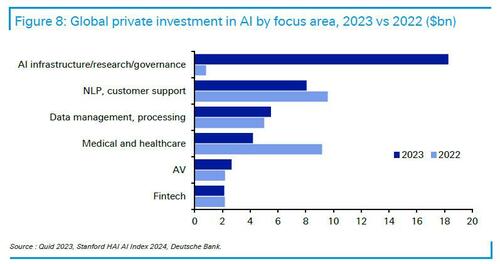

Global private investment in AI slipped slightly to $96bn last year from a year earlier, with two thirds in the US at $67bn, far ahead of the EU and UK at $11bn and China at $7.8bn, according to data from Quid.

However, it surged in strategic sectors. More than $18bn, or a third, of the $57bn in sectors tracked by Quid was devoted to AI infrastructure, research and governance last year, up from barely $1bn in 2022. The boost to strategic investments came at the expense of investment in AI medical and healthcare areas; oil and gas; and drones.

The geographical difference was starkest for the “tech du jour”, generative AI, where private investment in the US surged to $23bn, including Microsoft’s $10bn reported investment in OpenAI in January. The EU and UK, and China, failed even to clear $1bn.

4. Political appetite is growing for AI regulation

California’s divisive AI safety bill sets up tough decision for governor Gavin Newsom (Financial Times, Aug 29)

Critics who say the European Union is too far from Silicon Valley to regulate AI should have no problem with California passing a bill to regulate the technology emerging in its own backyard.

As one of the US’s first significant frameworks for governing AI systems, SB 1047 reflects a growing political appetite worldwide to recognise the benefits while, in the words of the bill, “avoiding the most severe risks” and guaranteeing access. The bill was watered down from earlier versions and passed by state legislators on August 29. It now needs to be signed into law by Governor Gavin Newsom by the end of this month. California says it is home to 32 of the world’s 50 leading generative AI companies.

SB 1047 has been controversial, with provisions obliging companies operating in California to implement a series of safeguards before training advanced AI models. Critics from the industry including OpenAI, Google and Meta lined up to say it will stifle the growth of the industry, while Anthropic, Musk and AI-godfather-turned-conscience Geoffrey Hinton gave it their blessing.

Still, SB 1047 is a pale shadow of the EU’s AI Act, which came into force on Aug. 1, with the majority of its provisions effective in two years’ time.

The risk-based act, three years in the making, is the world’s first horizontal legal framework regulating the technology. It contrasts with the patchwork approach relying on existing regulations and ad hoc tweaks that has been largely followed in the US and UK. Nonetheless, it will have global ramifications as it applies extraterritorially where it impacts citizens of the 27-member bloc.

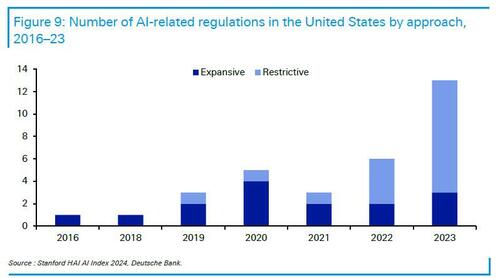

Words usually run ahead of actions. The number of AI-related bills proposed in the US skyrocketed from one in 2016 to 181 last year, according to Stanford’s AI Index Report, yet only about three bills a year have been passed – and one last year. Governments lack the expertise to regulate a moving target that applies across sectors and borders. (For more, see our AI Risk and Regulation 101 report.)

In the absence of specific AI regulation, the environment is being shaped by a cascade of antitrust and copyright cases.

Just recently, Nvidia was reported by Reuters to be facing questions from the US Department of Justice on its hardware bundling practices; the European Commission questioned Microsoft’s partnership with OpenAI and Google’s move to put its AI service on Samsung phones; US, EU and UK authorities said they will cooperate to enforce competition in generative AI; and three music publishers accused Anthropic of stalling in trying to dismiss the lyric copyright case they brought against it last year.

… As anxiety about AI ratchets up

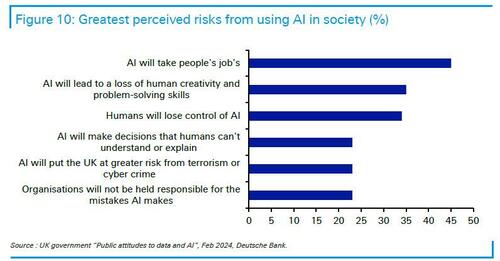

Fears about AI typically revolve around truth, jobs and safety, emerging both from intentional misuse and from dependence on novel, flawed and potentially – at some stage – autonomous technology. The regular person though has no doubt about the greatest concern, with almost half of UK citizens surveyed this year saying that they fear that AI will take people’s jobs.

Another global survey by Ipsos found that more than half of people said it is likely that AI will change how they do their current job in the next five years – and one third said it will replace their job in five years.

5. Real-world benefits have yet to emerge at scale

The Effects of Generative AI on High Skilled Work: Evidence from Three Field Experiments with Software Developers (Zheyuan et al, Sept 3)

Few large enterprises are yet using generative AI at scale. Most early adopters are digital-first companies or consultancies using off-the-shelf or tweaked versions of third-party applications like ChatGPT for internal data analysis, marketing materials and coding that can be checked by humans.

The gap between high experimentation and low uptake is particularly striking in regulated industries such as financial services and healthcare. In theory, they have the most to gain from accessing and analysing mountains of unstructured data, but in practice they also have higher stakes than most.

Nonetheless, the evidence is mounting of generative AI being able to generate novel research ideas, spot irony and generate game engines that may actually be a simulation of the real world. That’s on top of its now well-known ability to summarise, translate and riff on more or less any subject.

Last week, researchers including Princeton University’s Zheyuan Cui reported back from a field survey of almost 5,000 software developers, finding a 26% increase in the number of completed tasks among those who used Github Copilot, an AI-based coding assistant. Notably, they said, less experienced developers showed higher adoption rates and greater productivity gains.

… As critics gather

Every revolution has its naysayers – but naysayers don’t necessarily make a revolution.

Generative AI is certainly flawed. Much of the evidence of higher productivity (though not the report cited above) comes from controlled experiments. Elaborate workarounds have not yet solved the problem of hallucinations, bias or irrelevance – even with reliable data. While Generative AI is surprisingly good at some activities, it is surprisingly bad at others, such as making mathematical calculations, let alone reasoning, learning abstract concepts or developing an internal model of the world to actually understand it.

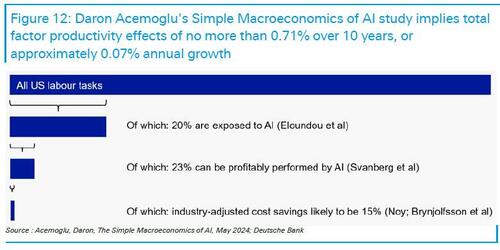

There’s also a question mark over whether the productivity ends justify the investment means. A US National Bureau of Economic Research paper by Daron Acemoglu, a professor of economics at the Massachusetts Institute of Technology, in May suggested that few benefits of AI will trickle down once the proportion of tasks, the economic viability and the actual cost savings are taken into account.

However, generative AI tools will only get better from here. And indeed even if they never did, it would take years for companies and individuals to find and implement the best use cases. (For more on the challenges and opportunities for enterprises adopting AI, see our report Where’s my AI revolution? Practical ways you can get less chat, more action.)

History is full of examples of technology taking years to apply, often depending on pivotal adjacent innovations like Ford’s moving assembly line that supercharged the mass production of cars almost 30 years after Karl Benz’s first commercial production of motor vehicles with an internal combustion engine.

Similarly, Apple’s iPhone, created in 2007, really came into its own some five years later when improved hardware, greater connectivity and enhanced mapping and payments software enabled the rise of killer apps for food delivery, music and social media. Its new iPhone 16, launched yesterday, is a bet on an AI future, with an enhanced voice assistant, photo editing and writing aids – as well as free access to ChatGPT – due to roll out in the months to come.