In our weekly Monday series “Fab Five Fundamentals” we look at 5 non-esoteric observations out over the weekend that are bullish. As always, this does not necessarily represent neither our current macro nor current trading view. Disclaimer: this is in no shape or form a “full analysis” – these are just datapoints – this time mainly focusing on the earnings outlook.

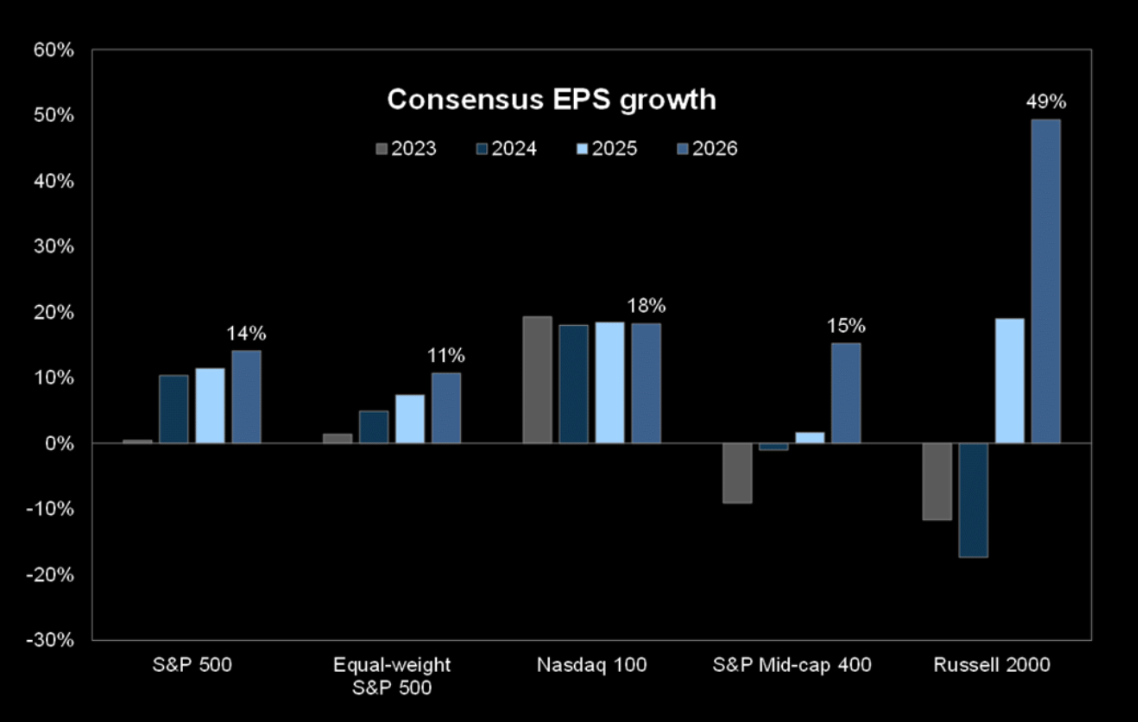

Pretty decent earnings growth

The consensus numbers for earnings growth for the US different indices are pretty decent.

Source: FactSet

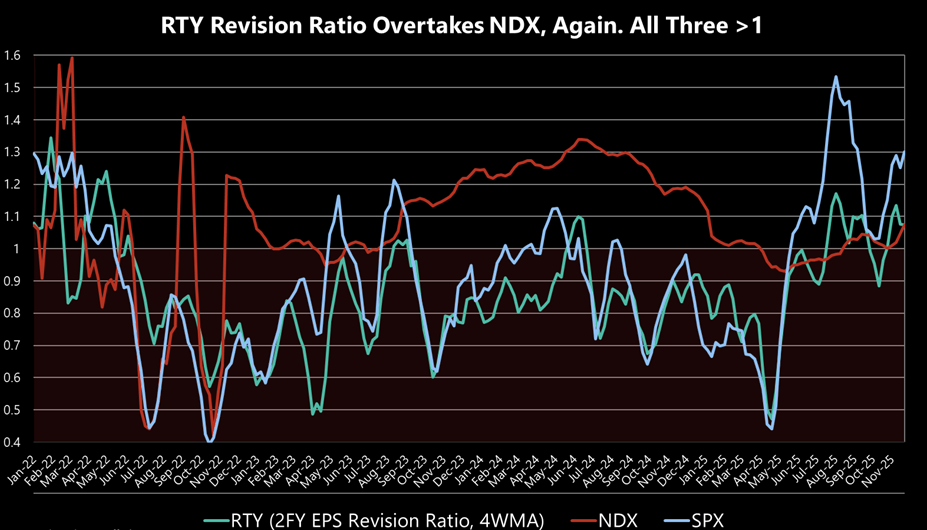

Best, broadest revisions in several years

Jefferies: “….some of the best, broadest revisions we have seen for several years, as we show below. Not only are EPS revisions for all three indexes (SPX, NDX, RTY) resurgent in recent weeks, but they are also all >1 at the same time for the first time in 18mo. This may bode well for both upside and market breadth.”

Source: Jefferies

Rebounding

Morgan Stanley: “Earnings revisions breadth is rebounding; a constructive sign.”

Source: Morgan Stanley

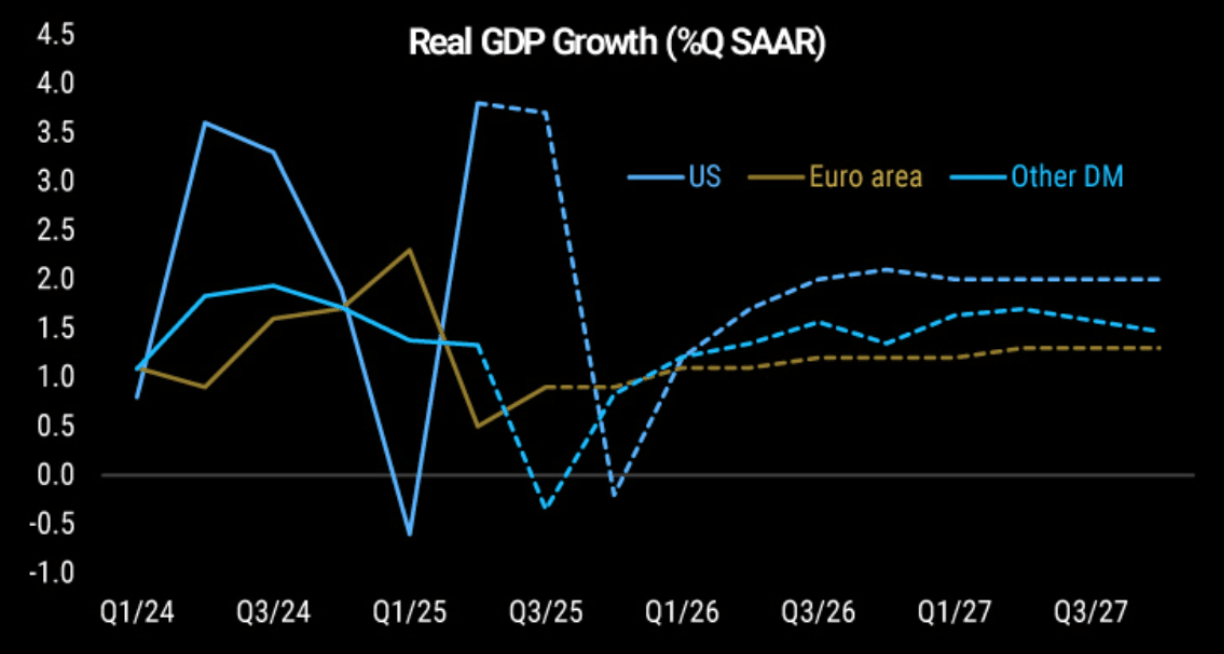

US the place to be

US GDP growth outperformance relative to DM peers should resume over 2026 and 2027.

Source: Morgan Stanley

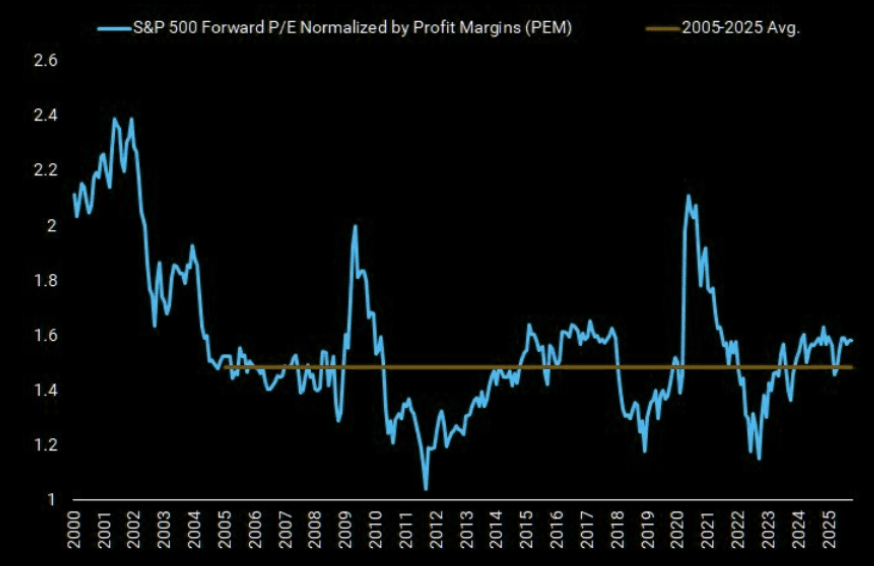

After some adjustments…

After adjusting for profit margins, valuations look much more reasonable.

Source: Morgan Stanley

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her