Breaking down

SPX is breaking below the trend line that has been in place since May. Note we took out the 21 day…and are trading close to the 50 day as of writing. No bueno.

Source: LSEG Workspace

NASDAQ as well

NASDAQ is falling below the trend channel. We are well below the 21 day, and breaking below the 50 day as of writing. Note that the HS we pointed out last week is “kicking in”.

Source: LSEG Workspace

Huge

NVDA is taking out the huge $170 level. This is the lower part of the range, as well as where the 50 day crosses. Not pretty…

Source: LSEG Workspace

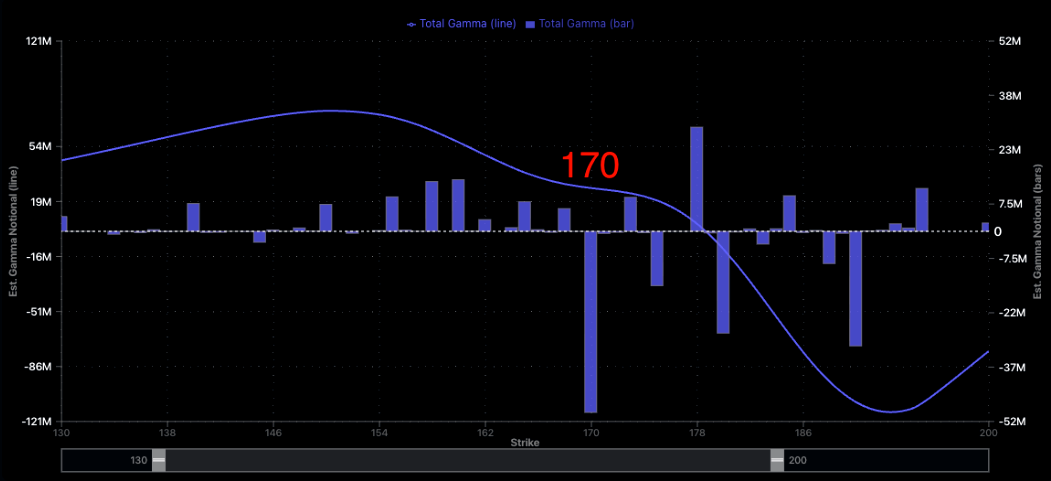

Big negative gamma

Big negative strike at the $170 level.

Source: Spotgamma

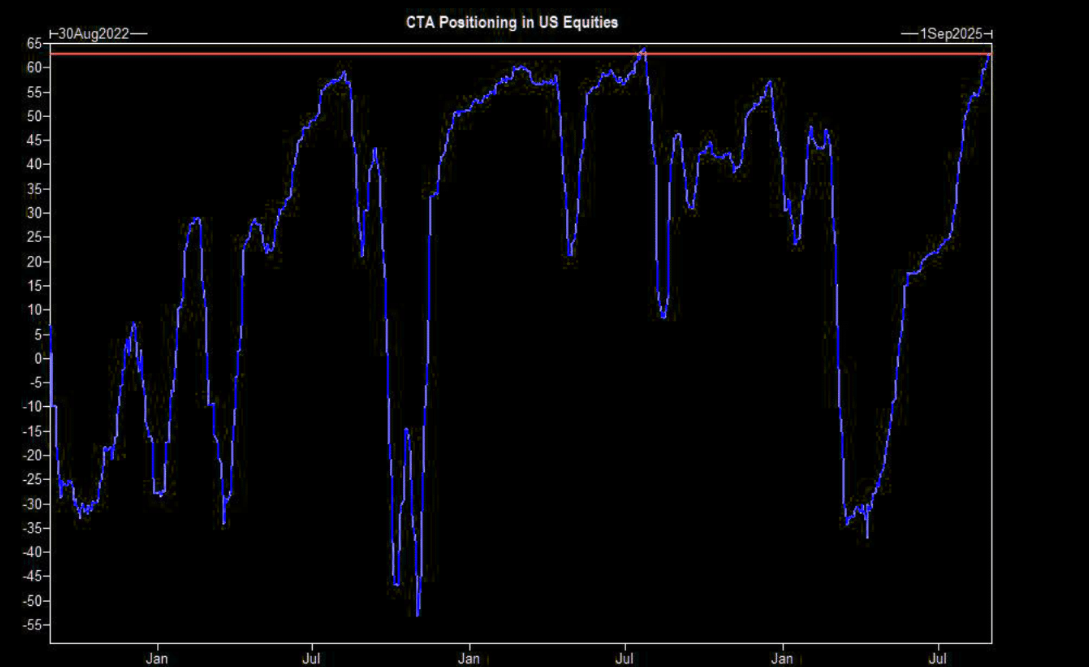

Maxed out

CTA positioning in US equities officially sits in the 100th percentile and is maxed out. They would have to sell >$70bn over the next month in a down-tape.

Source: Goldman

Rising rates matter

While MOVE has been calm, VIX has managed to move higher lately. Chart 2 shows VIX vs. the French 10 year. More on rates here.

Source: LSEG Workspace

Source: LSEG Workspace

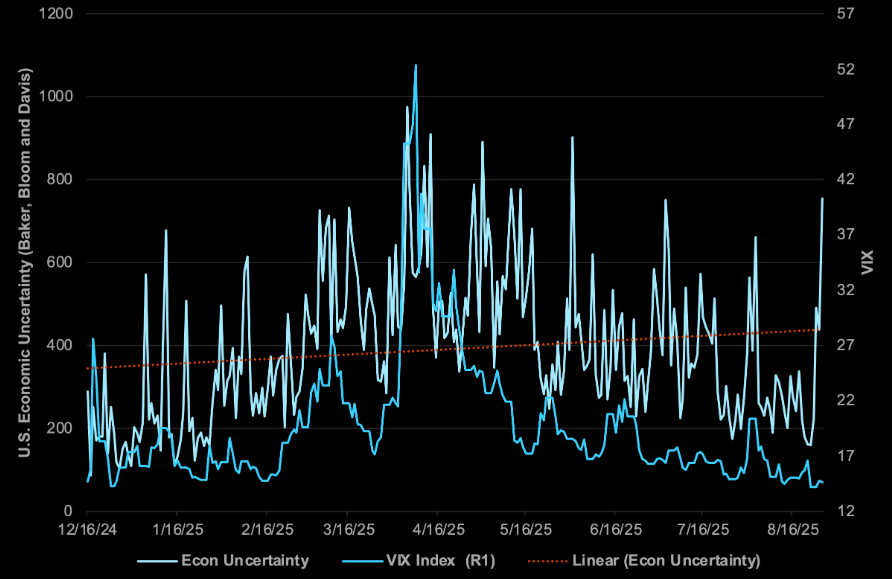

Rising risks

Will VIX start to notice the rise in economic uncertainty?

Source: BCA

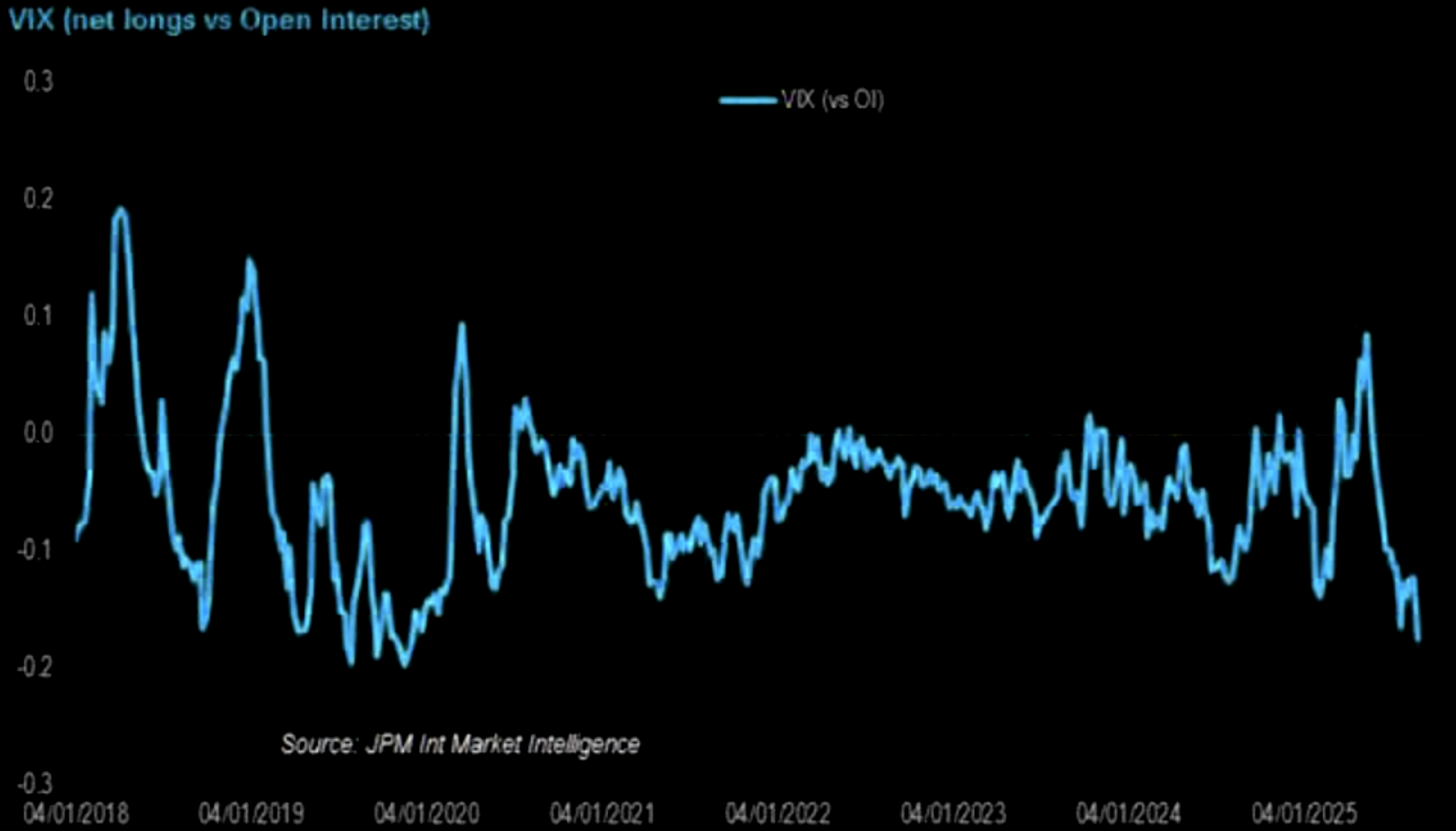

Where are you?

VIX longs are gone, say hello to the huge shorty…

Source: JPM

Under the hood stress

Watch rising skew closely…The crowd is long and are paying up for downside protection (in terms of volatility). Full VIX note here.

Source: LSEG Workspace

Precious breakout

Gold continues marching higher post the school book break out. RSI has come up sharply, although overbought can stay overbought for longer than most think possible. A proper close above $3500 and things risk going much more squeezy…

Source: LSEG Workspace

Exploding higher

Gold volatility, GVZ, showing that classical “gold trades with an upside skew” behavior. Make sure to roll into higher strikes if you played the call spreads logic . You are gaining from direction as well as the move higher in volatility.