Uddrag fra Goldman, SocGen, Bloomberg, Goldman og Zerohedge

After the recent market rout, which wiped out over $6 trillion in global equities, there is just one question on investors’ minds: is the unwind of the carry trade – which is what prompted the unprecedented speed of the global selling – finally over?

The answer depends on who you ask.

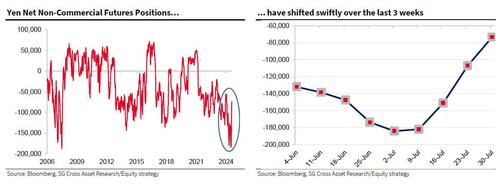

We start with the most balanced take, in this case coming from SocGen, where the French bank writes in its latest equity strategist note that one measure of the USDJPY carry unwind is at the ‘beginning of the end’. As The bank’s strategist Manish Kabra writes (full note here), “a soft US CPI, combined with a hawkish move by the Bank of Japan, is driving a reversal of the USJPY carry trade, which is underpinning risk-off sentiment for the Nasdaq-100. While the JPY is still far from fair value, CFTC positioning on the JPY shows that a majority of the shorts were reversed in July.”

Offering a slightly more nuanced view, SocGen’s FX guru Kit Juckes writes that it’s not so much the carry trade that matters, as how the Mag 7s will react, to wit: “the biggest threat to market stability isn’t what the FX market does, but what US equities, particularly tech stocks, do. The rally was huge, the valuations were stretched and Warren Buffet’s liking for cash is making headlines again. If that market keeps falling, it will affect the economy and the Fed. Otherwise, there’s little that will worry the Fed. The labor market remains tight, the economy is still growing. That would change if equities fell too far/fast, and it would change if the August jobs report at the start of September was very weak. Otherwise, we should expect a parade of Fed speakers hinting at a 25bp cut next month.”

He may be right, but for now all attention is focused on the current state of decomposition of the $20 trillion carry trade (as we defined first here). And here JPMorgan chimes in with a far less cheerful view: speaking on Bloomberg TV, Arindam Sandilya, co-head of global FX strategy, said that the recent unwinding in carry trades has more room to run as the yen remains one of the most undervalued currencies.

“We are not done by any stretch,” he said adding that “the carry trade unwind, at least within the speculative investing community, is somewhere between 50%-60% complete.”

Meanwhile, those expecting a recovery in carry trades to levels prior to the yen’s rally will have a long time to wait as the technical damage inflicted on portfolios from the short, sharp move “is not easily undone,” Sandilya said.

“A good case outcome is stabilization in markets around current levels, maybe a shallow recovery at best,” he said. “But in many of these instances you tend to get continuation of the moves, if at a lower velocity than what you had before.”

As everyone is aware by now, yen carry trades — borrowing at low rates in Japan to fund purchases of higher-yielding assets in Japan and abroad — have long been popular among investors as volatility remained low and traders bet Japanese interest rates would remain at rock bottom. It has been instrumental in propelling the Mag 7 stocks to their ludicrous heights. But an 11% appreciation in the yen against the dollar over the past month has turned many of those extremely crowded trades into money-losers, and the subsequent rush to close out short yen positions jolted both emerging and developed markets that used to be destinations for investors deploying the strategy for higher returns.

Which is why if JPMorgan is right and there is materially more upside for the yen (and thus duration to the carry trade unwind), the pain for the market will last a long time as all the vestiges of the carry deleveraging are unwound.

Yet as often happens when analyzing any market fulcrum topic, a clash has emerged between the two most important trading desks, that of JPM and Goldman: while the former expects the carry pain to go on for some time, the latter published a note this morning in which it argues that the pressure to cover yen shorts is now effectively gone., meaning that the carry pain is on its way out.

Here, according to Goldman trader Anton Tran, are the bank’s core thoughts on carry positioning

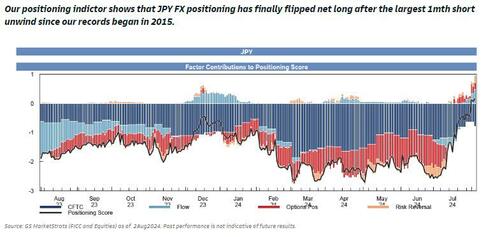

- Positioning Score: Goldman’s FX team’s Positioning Score indicates that the JPY short has been mostly washed out, and positioning is now slightly long. This would be a sign that market is close to bottoming out.

Commenting on the chart below, Goldman trader Jerry Shen says that based on the positioning report that looks at more tactical flow of funds in FX, investors are actually net long as of this week, this doesn’t mean you can’t see a more structural unwind of carry flows but should help contextualize the ‘where are we in the move’ conversation (data as of Aug 2). Charts below.

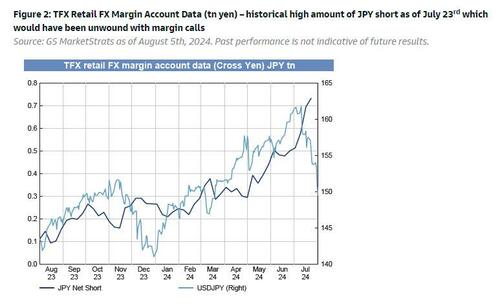

- Retails: the latest data as of July 23rd indicate that there was historical high of JPY short position with leverage (~$5bn). Goldman believes those positions accelerated USDJPY drop involving margin calls; the bank’s FX sales desk believes 60-80% positions have been swept by the market move.

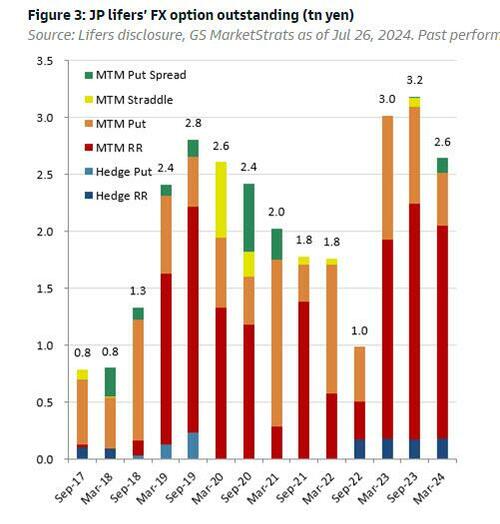

- Lifers: The bank is of the view that there will be no repatriation type of flows from JP lifers, as it is difficult for them to tactically increase hedge ratio.

- Dealers: their short gamma position from lifers’ put purchase would be another factor of USDJPY drop, especially around 142-147.

- Pensions: Goldman estimates that $12bn of USDJPY purchase will be required for rebalancing, which would further mitigate the down trend of USDJPY.

So with Goldman far more optimistic on the timeline of the carry trade unwind, by extension the bank is also more bullish on various downstream assets such as the Nikkei, which the bank’s trading desk believes is at “very attractive levels here given fundamentals” even as the Research Strategy team remain cautious for the time being, to wit: the near-term outlook remains uncertain given potential for further liquidation and some uncertainty about the fwd macro environment (economic growth, where JPY settles, US economy, etc). Since consensus EPS estimates have not changed recently, sharp downside revisions are likely given USDJPY move.

Finally, according to Goldman, which as noted above is bullish, the biggest question is who buys Japan from here: Foreigners have been burned, retail have likely been as well, what about domestics?.