Finland giver et billede af, hvordan coronakrisen har givet et opsving i online-aktiviteterne. Brugen af kreditkort er kommet over rekordniveauet fra sidste år. Forbrugernes aktivitet er helt i front under denne krise, og de har for alvor taget online-handelen til sig. En Nordea-analyse viser ekstreme forskelle i erhvervsaktiviteten, men altså også med fremgang i nogle sektorer.

Corona Barometer for Finland: Overall activity higher than the year before

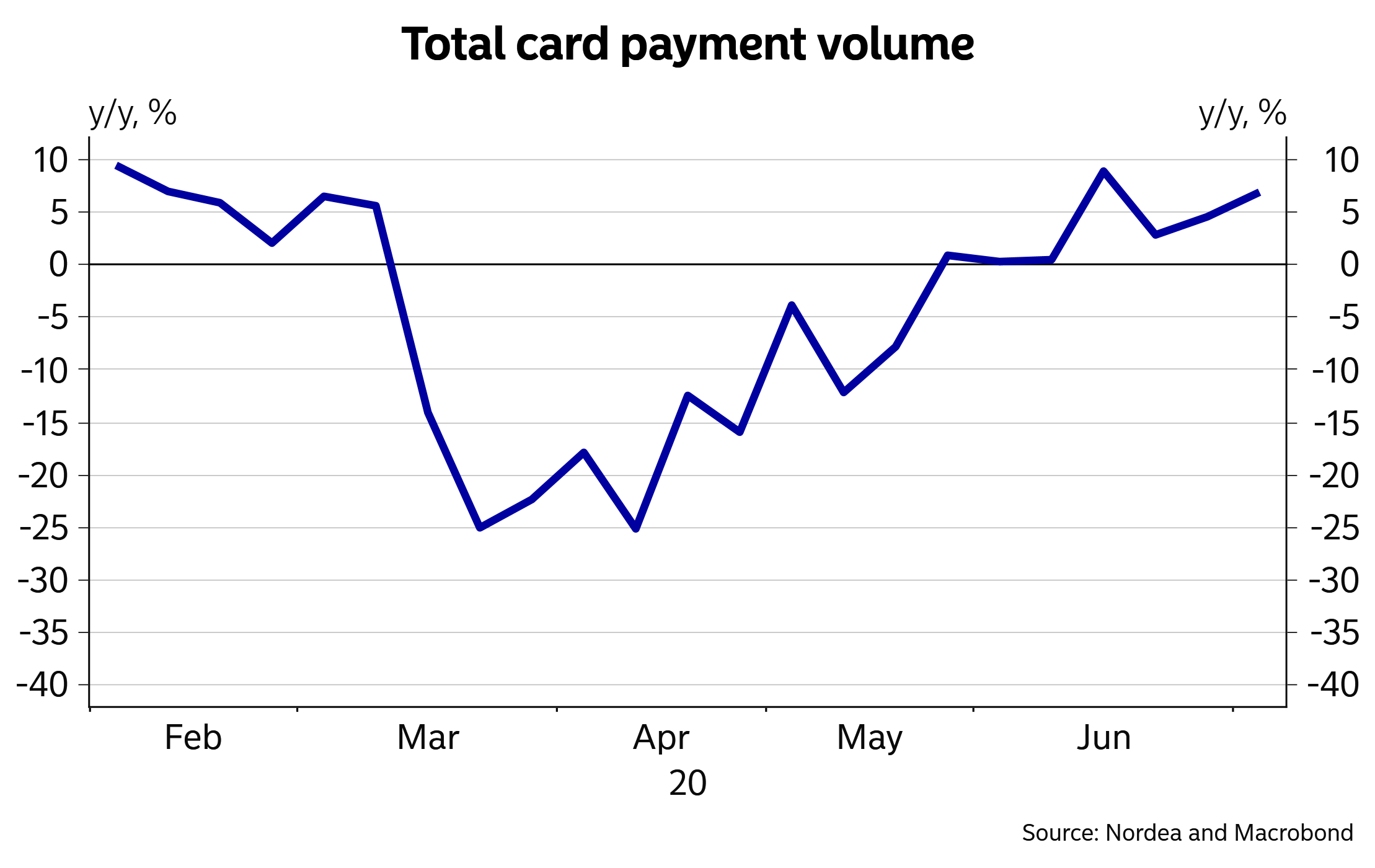

Total card payment volumes are comfortably above levels recorded last year. While sectoral differences remain large, many sectors are experiencing a significant pickup in activity.

In contrast to previous crises, consumers are at the forefront of the corona crisis. The negative shocks emanating from the virus have spread quickest to the service sector and consumption side and not on investments and manufacturing.

Therefore, in order to support policy makers and effectively analyse the real-time effects of the coronavirus on economic activity, it is essential to have on-demand data that gives an accurate representation of the consumption side of economic developments. Nordea’s card statistics are exceptional in allowing for this.

We are closely monitoring the latest economic developments in Finland and have launched a new publication series to provide you with the latest updates on a weekly basis. With this new data, it is now possible to get a robust overview of the developments within different sectors and areas of the economy, such as dining, retail sales and leisure.

********************************************************************************************************

Read the full publication in a PDF version here.

Card data is now available up until week 28, which is the week ending on 12.7.2020.

The main findings of this week’s Corona Barometer are:

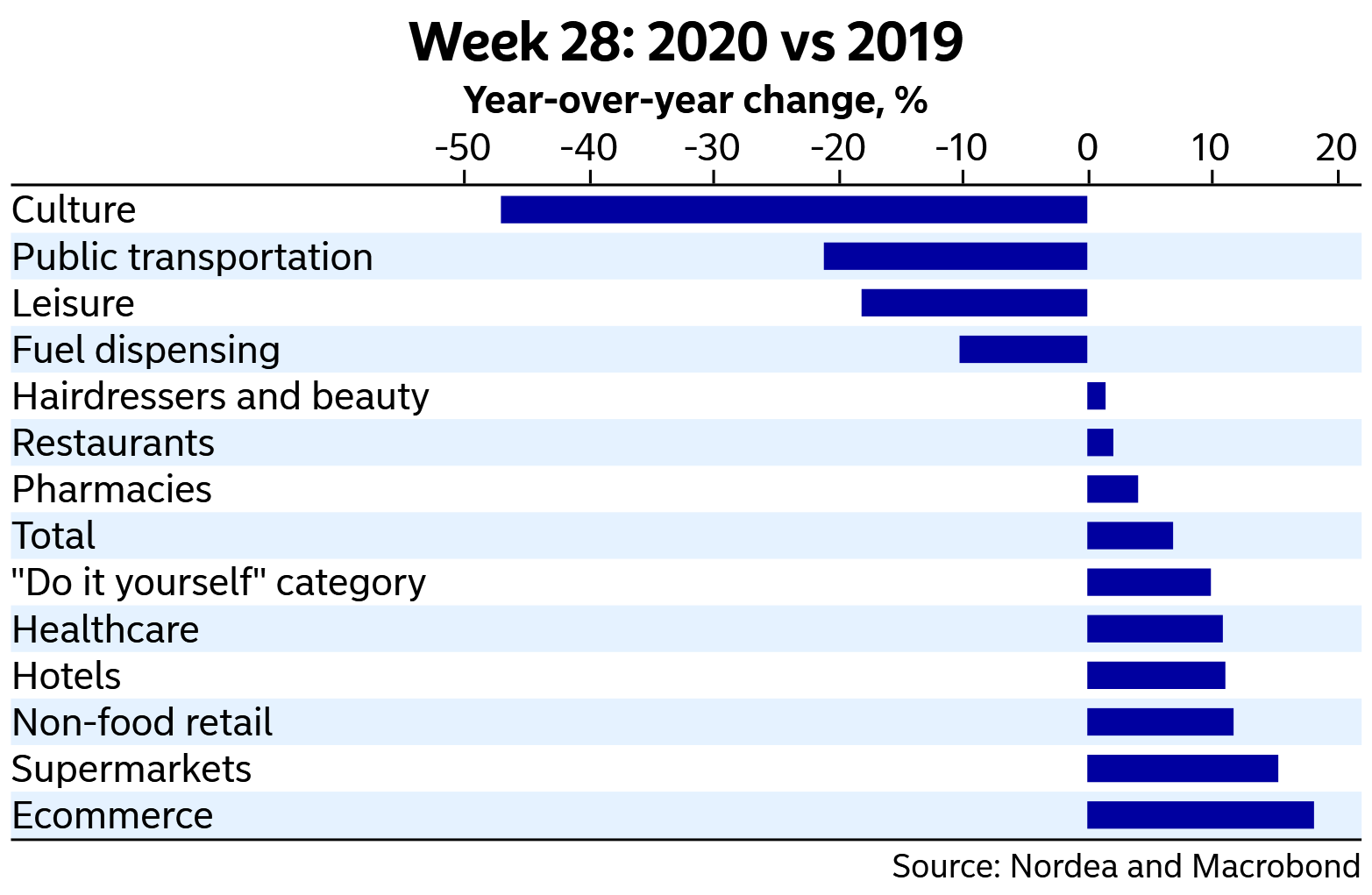

- Activity in several different sectors is higher compared to the year before.

- This possibly driven by pent-up demand and increased confidence in the economic recovery.

- The service sector is experiencing a solid recovery, as card payment volumes are very close to those recorded last year.