Saxo Bank analyserer effekten af coronavirussen, og der er flere spørgsmål end svar, også om den økonomiske genopretning. Alle prognoser fra begyndelsen af året er gjort til skamme. Den største økonomiske risikozone ligger i Fjernøsten og Stillehavsregionen.

Uddrag fra Saxo Bank:

Summary: Based on current market expectations, the risk is elevated that the Covid-19 outbreak will cause a deflationary impulse resulting from the negative shock to global aggregate demand and stronger USD.

The consensus for 2020 at the end of 2019 was that EM equities will outperform on the back of weaker dollar index, fading trade tensions and positive credit push from China, and that European equities will continue their upside move fueled by Brexit visibility and hopes of green new deal. But it was without counting the Covid-19 outbreak. Financial markets are repricing the likelihood that the virus will have an economic impact beyond the first quarter of 2020, and that we may see repeated and localized pockets of infection popping up around the world, as it is the case in Italy and in Spain, that will temporarily disrupt economic relations.

Before we discuss the known and unknown consequences of the coronavirus, we want to bring to your attention the great job done by the CSSE at Johns Hopkins University to track the emergence of new cases all around the world. This is a very useful tool for everyone, especially in financial markets, who wants to understand better what is happening on the ground.

MANY UNANSWERED QUESTIONS

First, we need to be humble regarding the coronavirus crisis. Its raises more questions than answers, such as:

- What is the real level of contagion at the global level? A study recently published by the Center for Infectious Diseases at Imperial College estimates that “about two-thirds of the cases of Covid-19 from China have remained undetected worldwide”.

- How do we explain the chain of contamination? In some cases, patients have not traveled to China and were not in contact with infected people.

- What will be the answer of the US and European governments if the infection spreads more? Will they decide to close borders and put in quarantine major cities following the example of China?

On the economic front, there are also many unanswered questions:

- What will be the exact hit to China Q1 GDP? I would say this is a relatively minor question.

- What matter most is whether there will be a Q2 rebound and how strong will it be?

- What will be the exact effect on travel, tourism and global supply chains and when should we expect a return to normal? The latest hard data, especially coming from Europe, hasn’t provided much details. The coronavirus crisis hasn’t destabilized Europe and the United States yet. We will certainly have more visibility on the macroeconomic impact when March data will be released.

WHAT WE KNOW SO FAR

That being said, we are not completely in unknown territory and we start to gather information and data providing key inputs on the economic consequences of the crisis.

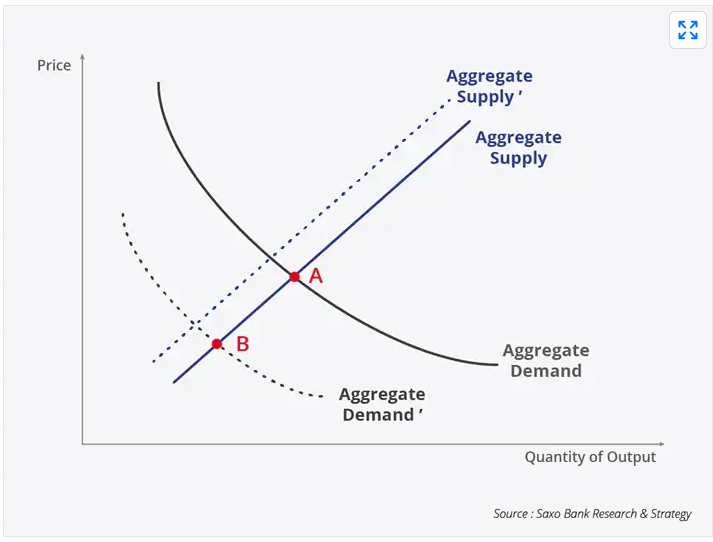

- The Covid-19 outbreak is an unconventional crisis for policymakers as it is causing both supply and demand disruptions. The supply shock relates to the inability of firms to resume operations, especially for Chinese SMEs, while the demand shock is mostly centered on Chinese consumers, but it could hit global aggregate demand as coronavirus spreads all around the world. Based on market expectations, the probability is elevated that the initial supply shock will be offset by a global aggregate demand shock. This is represented in the chart below by the shift in the demand curve to the right. Thus, if it proves to be correct, the main risk would not be an inflationary shock but rather a deflationary shock, which could be amplified by strong USD. This is actually consistent with current market-based inflation expectations.

- The euro area is less exposed than the United States or Japan to supply chain disruptions as it relies less on intermediate inputs from China in its domestic production, but it is more exposed to Chinese export demand and inflow of tourists from Asia. We expect that lower demand for travel and tourism will weight on services in coming months, especially in countries where tourism represents a high share of GDP, such as France.

- Global CAPEX are doomed to fall further. Even before the coronavirus outbreak, it took another dive in January 2020, for the third month in a row. Japan machine tool orders, which is a very old school business cycle indicator we often refer to, confirm that we should be prepared for postponed investments, maybe job cuts and CAPEX woes.

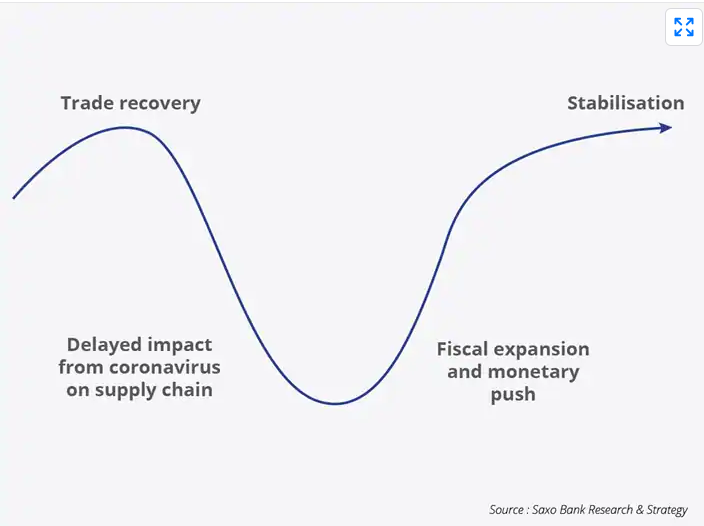

- Contrary to market belief, we may see a U-shaped rebound rather than a V-shaped one. In other words, it means that in many parts of the world, the recovery will be very gradual and will depend on the quickness of policy response. The main risk-zone is concentrated in the APAC region, which amounts to 45% of global GDP. In these circumstances, the role of fiscal policy is to stimulate demand, including via direct cash handout like in Hong Kong, while the role of monetary policy is to make sure to avoid credit market freeze and a tightening in financial conditions. A bad, or too slow, monetary policy response could increase deflationary impulse risk, which seems to be an emerging market fear considering recent discussion with clients.