Merrill ser lidt flere positive tegn i amerikansk økonomi, men jokeren er dog fortsat coronavirussen.

Uddrag fra Merrill:

Deflationary effects from the Coronavirus put the Fed back in play

Chief Investment Office Macro Strategy Team Positive incoming economic data so far this year have confirmed our belief that the path

of least resistance for the U.S. economy would be up after the Fed cut interest rates and the effect of other central banks’ rate cuts started to be felt around the world. The global economic surprise diffusion index has turned sharply positive, reflecting increasingly more upside surprises than downside surprises.

The U.S. improvement has been broad-based, ranging from better-than-expected employment growth, consumer and small-business confidence, home sales and manufacturing/ nonmanufacturing surveys to productivity growth and fourth-quarter 2019 corporate earnings. The big jump in the Institute for Supply Management (ISM) manufacturing new-orders index from 47.6 in December to 52 in January has been particularly encouraging given its early-signal properties and disconcerting plunge into contraction territory through late 2019. This improvement, along with continued positive

signals from the Organisation for Economic Co-operation and Development (OECD) leading-indicator index and a “phase one” U.S.-China trade deal have kept U.S. equity prices around record highs and corporate credit spreads generally narrow, consistent with a sustained economic expansion.

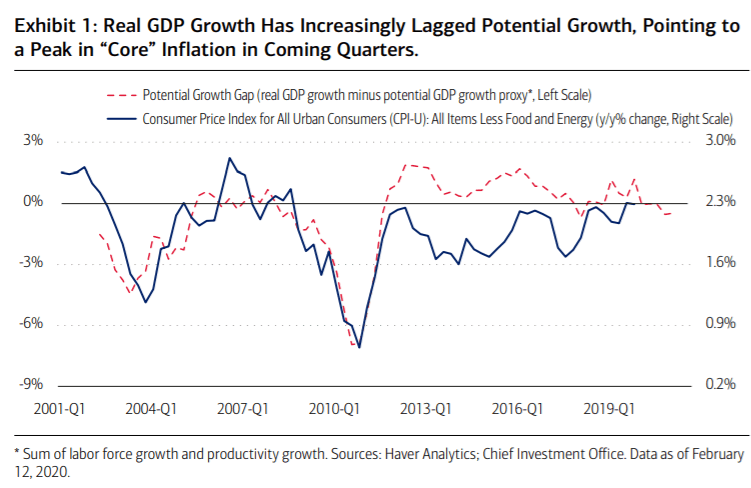

That said, leading growth indicators for manufacturing, consumer income and spending, hiring, and housing remain consistent with only moderate real GDP growth around 2.25% in 2020 (similar to 2.33% in 2019). It would take another leg up in consumer and business confidence for growth to accelerate much in coming quarters, which is unlikely absent a quick resolution of the Coronavirus problem. Until that becomes apparent, risks to growth and inflation will more likely remain to the downside in light of bigger

potential disruptions to global economic activity and a conceivable eventual hit to consumer and business confidence.