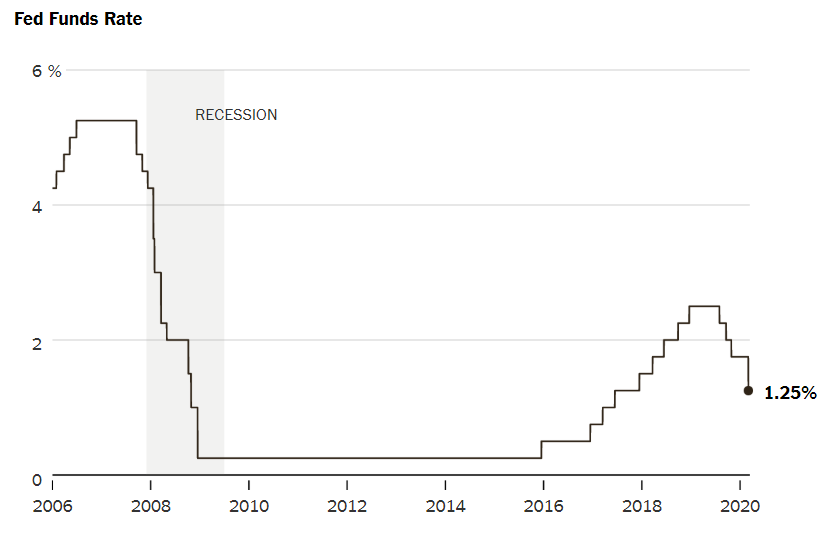

ABN Amro venter, at den amerikanske centralbank vil sænke renten igen meget snart, med to gange 25 basispoint på de ordinære Fed-møder i marts og april – efter undtagelsessænkningen på 50 point i denne uge.

Uddrag fra ABN Amro:

Global Daily – More Fed cuts on the way

Fed View: Two more rate cuts to cushion virus blow – Following the emergency 50bp cut yesterday, which we flagged the risk of on Monday, we expect the Fed to subsequently cut rates twice more by 25bp, at the March and April FOMC meetings – as a base case. As a risk scenario, we cannot rule out further intermeeting moves – potentially more aggressive than we have pencilled in – if financial conditions tighten in a disorderly manner and/or there are signs that economic activity is being significantly hampered by virus containment efforts. Our forecast is somewhat more aggressive than market pricing in terms timing, rather than magnitude – markets expect 43bp of cuts by the April FOMC, and 66bp by the December FOMC. Our base case is that activity will have stabilised and begun recovering by the end of Q2, and this should give the Fed sufficient confidence that the economy has achieved ‘escape velocity’ from the downturn.

What is the rationale for more easing? Chair Powell struggled to make the case for the Fed’s emergency easing of policy in his press conference yesterday, leading to a fall in equity markets, with investors perhaps wondering if the Fed knew something they didn’t about the spread of the coronavirus in the US. We think the real driver of the emergency move was probably less sinister. Even if the virus proves to be well-contained, it is clear that it is already having effects on the behaviour of various economic actors, and the reduced travel and public gatherings by themselves can have a significant impact on economic growth, as we discussed in yesterday’s Daily. This will in turn hit business confidence. While the Fed cannot neutralise these effects, it can use its available tools to cushion the blow, and to prevent the economy from sliding into a recession.

The second key consideration is financial conditions – Consumer confidence tracks moves in equity markets remarkably closely in the US, with a lag. Sharp falls in equity markets can therefore affect the real economy by weighing on consumer confidence. While the Fed is not in the business of propping up markets for the sake of it, disorderly market moves of the type we saw last week arguably pose undue risks to the growth outlook. Markets already appeared to stabilise on Monday before the emergency cut – making the move more surprising – but the Fed probably did not want to take its chances and opted to pre-empt any possible renewed market stress.

The fiscal taps might also be opened, but contents matter – Congressional House lawmakers are currently focusing on a $8bn package to deal with the coronavirus outbreak, which should be passed by the end of the week. This is far too small to provide any stimulus to the economy (at 0.04% of GDP), but it is focused on the practical response to contain the virus rather than being a stimulus measure. Following the passage of this, discussions will quickly progress to a stimulus package. While president Trump has been pushing for a temporary payroll tax cut, the Democrats control the House, and so far the House Ways and Means Chair Richard Neal has dismissed this, favouring instead a $1trn infrastructure plan. The argument for stimulus is likely being complicated by the electoral cycle, as Democrats will be reluctant to enable an immediate stimulus to growth unless the economy looks like it is heading for a recession. An infrastructure plan meanwhile would take long enough to come on stream that it would provide a bigger boost to growth beyond the November election. (Bill Diviney)