Uddrag fra Bank of America:

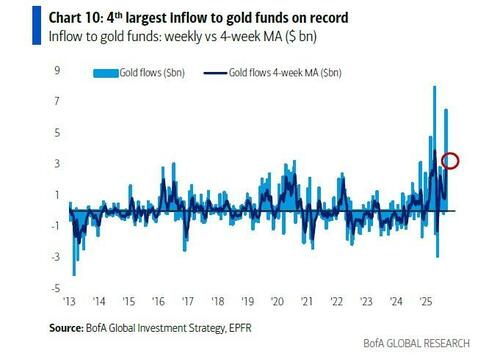

One final observation before we dive deeply into the world of Hartnett’s acronyms, is the week’s fund flows which are as follows: $66.1bn to cash, $17.9bn to bonds, $3.4bn to gold, $0.1bn to crypto, $9.9bn from stocks.

- Cash: huge $266bn inflows to MMFs in past 4 weeks;

- Gold: 4th biggest weekly inflow ever ($3.4bn – Chart 10);

- Municipals: record weekly inflow ($3.1bn);

- Global equity ETFs: 1st outflow in 4 months ($3.2bn);

- US value: first back-to-back inflows since Nov’24 ($0.5bn).

So back to the main topic of the day, Hartnett writes that the 3 biggest investment themes of 2020s have been:

- ABB (Anything but Bonds),

- ABC (Anywhere but China) and

- AI (self explanatory)

To which the strategist says 2025 marks end of ABB & ABC trades, and the start of new ABD (Anything but the Dollar) trade, meanwhile a barbell is needed to play the AI bubble… and finally stay long BIG. Here are the details:

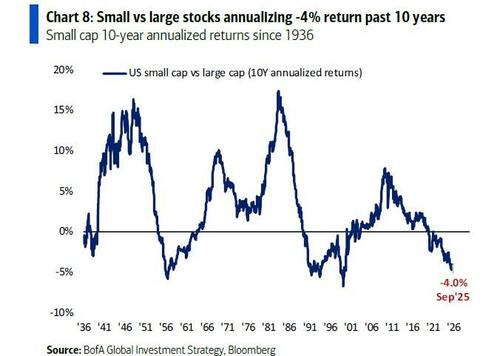

- Bonds: peak nominal GDP growth + bonds back as risk asset hedge -> UST yields heading lower (GT5 to 3%, GT30 toward 4%); cyclical end of ABB +ve for unloved bond sensitives (-4% rolling return small vs large close to 100-year lows)

- International: weaker dollar, end of EU/Japan deflation, EU/Asia fiscal excess, and China tech optimal way to barbell US AI bubble. Said otherwise, “long international“

- Gold: Echoing what ZH has said since inception in 2009, Hartnett says gold is a “hedge against anarchy, dollar debasement risk, so while gold bull has flipped from quiet bull to noisy bull (see inflows) gold will rise further.” Which is precisely what we said 10 days ago.

Hartnett then turns to yet another of his favorite acronyms, namely PPP – or Policy, Profits and Politics – and has this to say:

On Policy & Profits:

- on policy, the coming Fed rate cuts are leading to lower credit spreads, higher bank stocks, higher rate-sensitive stocks (e.g. small cap, homebuilders…) shows investors believe Fed “ahead-of-the-curve.” But what if it isn’t? Well, the levels that signal this is wrong, and the Fed us actually “behind-the-curve” and cutting into further economic deceleration, are: higher credit spreads (IG CDX >60bps), lower bank stocks (BKX <140), lower small cap (RTY can’t break 2400)

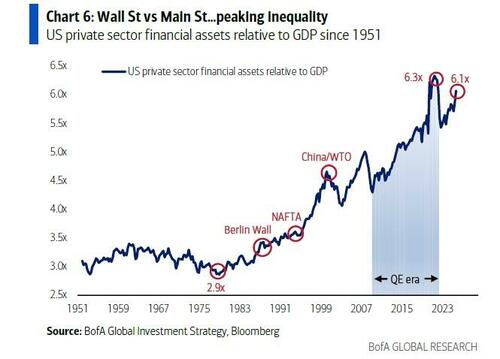

- on profits: weaker labor market (payrolls +64k past 6 months weakest since 2020) are offset by strong K-shape wealth effect. Hartnett estimates using BofA private client data that household equity wealth rose $3tn in 3Q’25 (after rising $3tn in H1’25, and up a massive $9tn in ’24).

On Politics:

- Populism on rise: but populists are impatient (see Argentina: Milei electoral setback on corruption, fiscal austerity, 4-year high in unemployment…stocks -17%, bonds -8%); for the Trump admin, higher US inflation = political risk, higher unemployment (youth unemployment rate 9.4%, up from 4.8% in Apr’23) and wealth inequality (US private sector assets 6.1x GDP)…

… are all social risks, and why Hartnett continues to follow the early 1970s “Nixon Rerun” policy analog (“boom” policies to reduce U-rate + price controls to contain inflation), why US dollar can’t catch a US exceptionalism bid, and why gold and crypto will keep surging, a point Harnett elaborated extensively last week.