Den økonomiske aktivitet i eurozonen er fortsat meget lav, viser PMI-tallene for industriens aktivitet i maj. Der er sket en forbedring fra 13,6 point i april til 30,5 point i maj, men det er stadig langt under 50 point, dvs. før der er fremgang og før Europa kommer ud af den økonomiske nedlukning. Servicesektoren er langt hårdere ramt end industrien. Nordea venter dog en meget høj PMI i løbet af de kommende måneder.

Uddrag fra Nordea:

Euro area Macro Flash: PMIs remain below 50

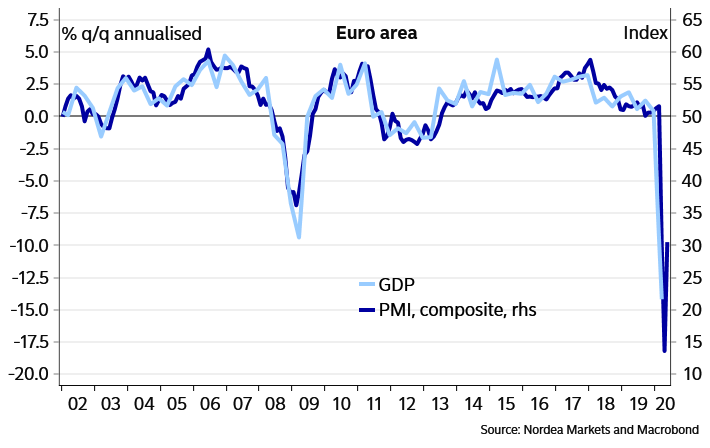

Deep contraction continued in May. Readings must exceed the 50-mark to point to a “re-opening” and a return towards more normal activity levels. We expect very high PMIs in the coming months.

Deep contraction in economic activity continued in May, according to the flash Euro area PMI, which remained far below the 50-mark in May. A rise from 13.6 in April to 30.5 in May implies less deep contraction compared with April’s lockdowns, but readings must exceed the 50-mark in the coming months to point to a “re-opening” and a return towards more normal economic activity levels. Activity in services continue to suffer more than activity in manufacturing.

Today readings were largely in line with consensus, though consensus itself spanned close to 50 index points from the lowest to the highest calls in a Reuters poll. China’s first PMI readings following the gradual re-opening also remained below 50, partly guiding expectations. The coming months should see very high PMIs.

Chart 1. GDP and PMIs

The composite PMI in Germany bounced back to 31.4 from 17.4 in April. Activity in both manufacturing (36.8) and services (31.4) continued to fall in May albeit at a slower pace than in April, as the readings remained firmly below 50. Export sales remained particularly weak as demand is still in a slump in both sectors. This leads to firms continuing to cut output prices for the third month in a row, accommodated by lower input and commodity prices.

On top of that, firms indicate that also the workforce needs to be cut, suggesting that Germany’s attempt to shield workers with its subsidised Kurzarbeit scheme is unlikely to prevent a sharp rise in unemployment in Europe’s strongest labour market. Germany is gradually lifting its lockdown, with many shops already reopened and restrictions on restaurants, hotels and campsites lifted this week in several regions.

The French composite PMI increased to 30.5 from 11.1 in April as businesses turned a little less pessimistic. The slowing decrease in activity was driven by increased readings in both the manufacturing (40.3) and service sectors (29.4). The sharp declines from April were moderated on most fronts in May. Subcomponents of new business, employment, input and output prices softened in May, but continue to signal strong contractions.

Despite supportive policies and easing being launched, French businesses also remain very grim on their 12-moth outlook, with manufacturers being the most pessimistic. The data for the survey was collected May 12-20, which is the first week since the easing began from the very strict lockdown in France. Businesses could reopen from May 11, but not cafés, restaurants, museums and cinemas, and working from home is still recommended if possible.