Uddrag fra John Authers:

Get Ready for X+1 Day |

Yes, it could just about happen, even though it probably won’t. The debt ceiling debate now demands to be taken seriously, which explains a bad day for stocks in New York. On the face of it, this is a binary event: Either the US defaults, with potentially catastrophic consequences, or the debt limit rises and the world keeps spinning on its axis. But there’s more to it than that. Rather than worry about the so-called X-date, when default can no longer be avoided (possibly as soon as Thursday of next week), it makes more sense to plan for what happens the day after. X+1 Day, if you will, matters a lot.

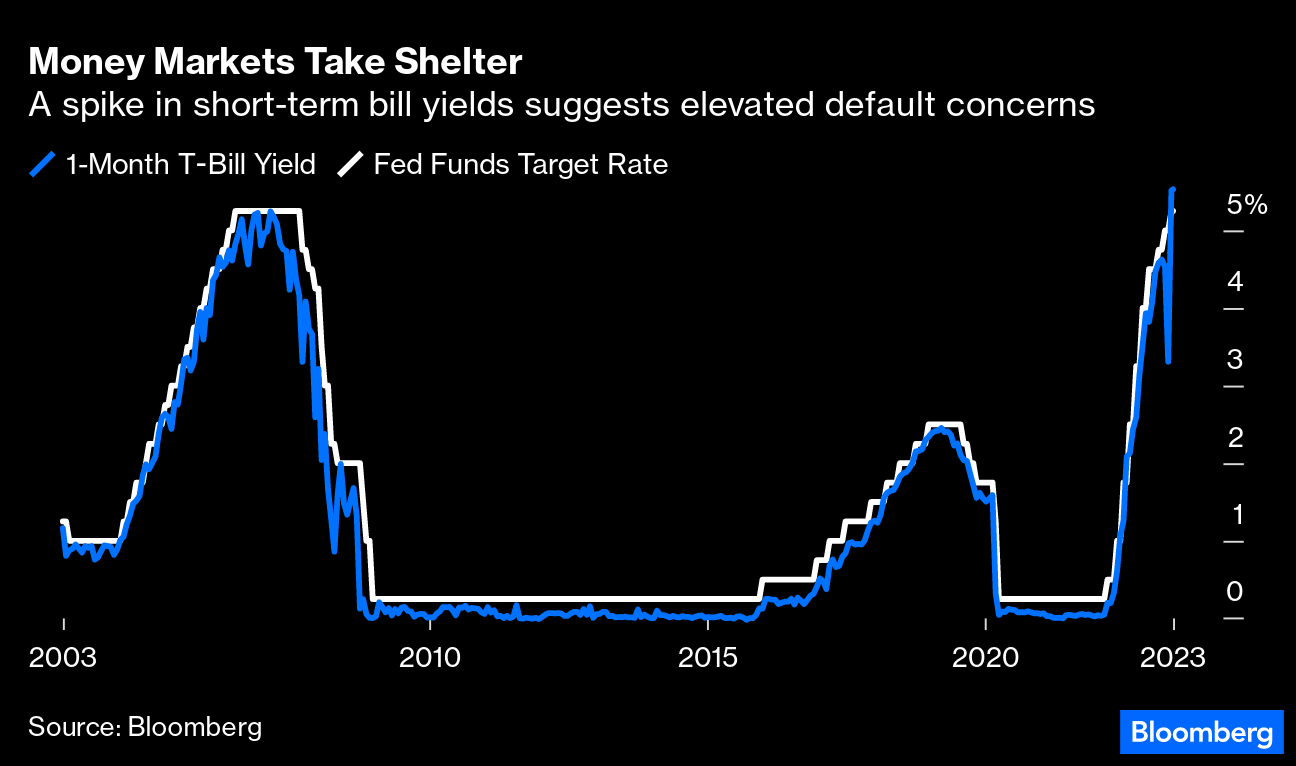

To demonstrate that a default now looms as a real possibility in the minds of money market traders, here is Exhibit 1. The yield on the one-month Treasury bill, just about the safest investment on the planet, is higher than even before the Global Financial Crisis, and at the highest spread over the fed funds rate in that time. The recent volatility for an utterly boring investment is exceptional. Fear of a default is the only explanation:

Even if the technical markets that would be most directly affected by a default are complaining loudly, it’s hard to say that the political crisis has had any broader market impact as yet. Phil Toews, CEO of Toews Asset Management, said on the sidelines of the Inside ETFs conference:

With the exception of the Credit Default Swaps on US debt, markets are just completely ignoring the debt ceiling issue. And today is the first day we’ve had any kind of slight decline in the stock market. Prior to that, for the last two weeks, we’ve seen negligible moves and, in fact, what you’d expect to be the risk off trade of moving money into Treasuries has gone the opposite way. So we’ve seen bonds lose money even coming into this potential debacle.

For a dramatic illustration from the ETF world, look to the relative performance of the most popular funds tracking the S&P 500 and long-dated Treasury bonds, known by their ticker symbols of SPY and TLT. When stocks are outperforming bonds, that should mean that investors have plenty of risk appetite. Amazingly, stocks reached a post-pandemic high by this measure on Monday. The price changes on Tuesday changed little: