Fra Zerohedge

While debate rages among Wall Street strategists and pundits whether the current burst of US inflation will prove to be merely transitory as the Fed and Biden admin want consumers to believe (despite UMich showing that 5-10 year consumer expectations for inflation had climbed a 10 year high of 3.1%), or, as even Goldman tentatively cautions, may lead to sustained higher prices over the long term, things in China are simpler: the credit tsunami unleashed in 2020 to offset the covid shutdowns is fading fast, local economic growth is fading fast and the deflationary shockwave triggered by China’s shrinking credit impulse is about to sweep across the globe.

Overnight we had the latest China’s economic data dump for the month of April, which included a large retail sales miss with a print of +17.7% yoy (vs. +25% yoy expected). There were also marginal misses for industrial output (at +9.8% yoy vs. +10% yoy expected) and YtD fixed investment (+19.9% yoy vs. +20% yoy expected).

The bad news was good enough for local stock traders and the Shanghai Comp closed up 0.8% as the weaker retail sales print might lead to a slower wind down of stimulus by the authorities.

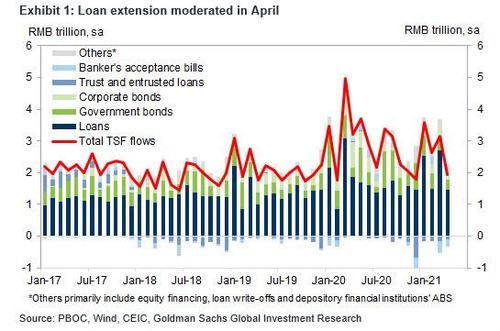

But the bigger news is that China appears to be suffering from a growing credit hangover, as last week’s April credit aggregate data revealed. The latest sequential growth of total social financing (TSF) moderated in April, and was weaker than the average in recent months.

Loans growth also slowed in April from a very strong pace in March, but it was the contraction in shadow lending and low government bond issuance that was the major drag. As a reminder, this is what the PBOC reported:

- New CNY loans: RMB 1470bn in April vs. consensus exp: RMB 1600bn. Outstanding CNY loan growth: 12.3% yoy in April down from 12.6% in March.

- Total social financing RMB 1850bn in April, vs. consensus exp: RMB 2290bn.

Some more details on China’s rapidly slowing Total Social Financing from Goldman:

Among major TSF components, Rmb loans slowed from a very strong growth rate in March, but remained robust, broadly similar to the average in recent months. Medium-to-long term loans to corporates moderated, while short-term bill financing rebounded significantly. Household medium-to-long term loan growth remained broadly robust, while short-term household loans weakened notably, probably related to regulations on consumer credit… Shadow lending and banks’ undiscounted acceptance bills contracted and continued to be the drag.

Bottom line: China’s total social financing and money data again came in vastly below market’s low expectations in April. TSF growth slowed by 0.5pp to 11.7% yoy, a 12-month low and nearly 2pp below the cyclical peak back in October 2020. This means that the 6-month pace of deceleration has picked up to somewhere close to that at the height of the deleveraging cycle back in 2017/18.

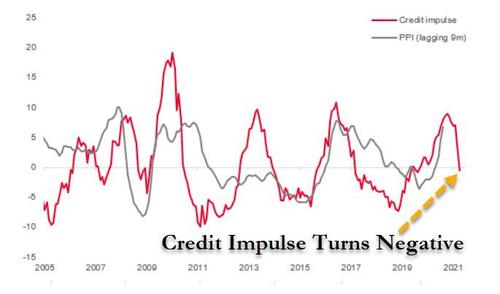

This also means that China’s credit impulse (the 2nd derivative of the credit stock) just turned negative. From peak to negative it only took 7 months this time, compared with 9-10 months in the past . Partly it is because of the large volatility in GDP (which is used as a base for calculating the impulse), but more importantly, Chinese policymakers are quick at scaling down easing this time, definitely much quicker than any of the three post-GFC cycles.

Perhaps even more ominously, China’s broader M2 annual growth slumped to just 8.1% Y/Y, far below the consensus print of 9.2%, and just off the all time low of 8.0%, the post-covid burst now a fading memory.

The slowdown in China’s credit should not come as a surprise after we reported one month ago that China’s central bank had asked the nation’s major lenders – which are all at least partially state-owned which means it wasn’t ‘asked’ but rather ‘ordered’ – to “curtail loan growth for the rest of this year after a surge in the first two months stoked bubble risks.”

Specifically, in a meeting with the People’s Bank of China on March 22, banks were told to keep new advances in 2021 at roughly the same level as last year. The directive targeted not only domestic lenders but also “some foreign banks” which were also urged to rein in additional lending through so-called window guidance after ramping up their balance sheets in 2020.

While we urge readers to go over some of our big level (and correct) observations laid out last December in “In Historic Reversal, China’s Credit Impulse Just Peaked: What This Means For Global Markets“, the latest Chinese credit data means that SocGen’s forecast for sharply lower credit impulse in the coming years will be validated. And as this all too critical metric fades, virtually every asset across the globe will be affected (especially if it is joined by the double whammy of the Fed also tapering in late 2021/early 2022).

And speaking of SocGen’s accurate predictions, we pull up the latest comments from the bank’s China watcher Wei Yaho who last week wrote that the implication of China’s rapid credit impulse reversal is mounting downward pressure on China economic growth and inflationary impulse/spillovers later in the year: “Just earlier this week, the market was spooked by China’s PPI surge to close to 7%.

However, today’s credit data point to a peak of PPI soon and a clear downtrend afterwards. Implicitly a quickly falling credit impulse in China has never been kind to industrial metal prices, among other inflation-sensitive assets. So in the current inflation cycle, China for once is quickly conceding its role.”

Or, as SocGen’s Albert Edwards summarizes, “Wei suggests that while the market is currently spooked by recent data like the US CPI or China’s PPI or indeed surging copper prices, as we move into H2 things are set to cool.”

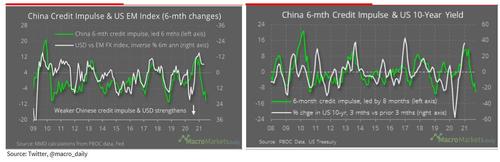

Edwards also grabs two charts from Macro Markets which show the China Credit impulse as a 6 month change below rather than a 12m change as in the chart above. “The charts speak for themselves” Edwards notes and adds that “important though the US is, China also needs to be watched closely, especially with regards to global commodity prices and the role they have played in driving inflation higher. In that sense, maybe the current commodity driven inflation fears will dissipate just like they did in the aftermath of the 2008 GFC.”

One final reminder: the credit impulse first reaches assets that are driven primarily by the Chinese economy (Chinese bond yields and industrial metals). Next to be impacted are inflation breakevens and sovereign yields in Western economies.

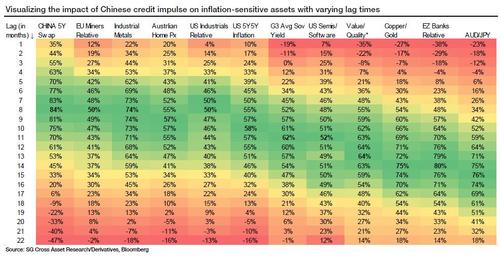

The peak correlation for other growth-sensitive assets such as eurozone banks and AUD/JPY arrives with bigger lag of around 4-5 quarters. This result, while logical, is quite significant, as it gives us a playbook for the ebb and flow in Chinese credit impulse.

The table above shows the correlation between different assets and Chinese credit impulse for varying lag times. The extent of the differences between lags in correlations is exemplified in the left-hand chart below. While peak correlation for Chinese interest rate swaps arrives with an eight-month lag, the peak correlation for eurozone banks manifests itself with a lag of 14 months (read more here “In Historic Reversal, China’s Credit Impulse Just Peaked: What This Means For Global Markets“).

Looking ahead, with high correlations and short lag times, Chinese interest rate swaps and industrial metals should be the first assets to be adversely impacted by the topping of the Chinese credit impulse. Australian house prices and US 5Y forward 5Y inflation will likely also be hit in this first group.

The mining and industrial sectors also have short lag times, but their correlation is slightly lower. The other highly correlated group of assets, including eurozone banks, also gets strongly affected by credit impulse, but the rather large lag time opens the door for other factors to influence the price action of these assets as well.

Low correlation with certain assets suggests that Chinese credit, while being one of the drivers, may not be the main driver of price performance for these assets (e.g. semis/software ratio, sovereign yields in the West and value/quality ratio).

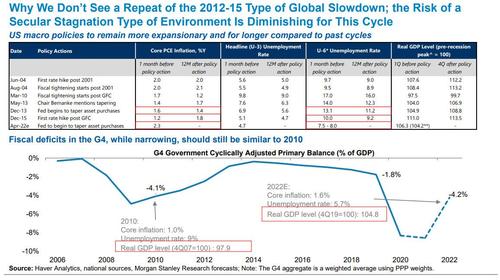

Bottom line: China’s credit impulse is now officially in contraction, and while there is delayed impact across the globe, with the lag on various assets ranging between 1 and 22 months, the fact that China is now an active headwind to inflation suggests that in the very near future the market’s fears about soaring inflation will soon transform into worried about disinflation or outright deflation, similar to what happened in the post-2011 episode although addressing just this concern, Morgan Stanley said today that it doesn’t see a repeat of the 2012-2015 type of global slowdown as the risk of a secular stagnation environment is diminishing for this cycle.