Morgen Stanley forsøger i en analyse at vurdere, hvad der kommer efter coronakrisens toppunkt, og banken forventer en meget langstrakt genstart. Banken venter ikke, at økonomien kommer på niveauet fra før krisen før i slutningen af 2021. Men hvad betyder det så for investorerne?

Uddrag fra Morgan Stanley:

As the growth in new cases of infection appears to be slowing in some hard-hit regions, what comes next? A look at what needs to happen before the world can “reopen.”

Our analysis has found that recovery from this acute period in the outbreak is just the beginning and not the end. We believe the path to reopening the economy will likely take time. It will require turning on and off various forms of social distancing and will only come to an end when vaccines are available, in the spring of 2021 at the earliest.

The Path Forward

As the growth in new daily cases has started to decline in Italy, markets have turned their attention to the U.S. Over the past 10 days it has been striking to see how investors and the public at-large have reacted to the first signs that new COVID-19 cases in New York are beginning to stabilize. And while we understand the desire for optimism, we also caution that the U.S. outbreak is far from over.

To analyze management of the coronavirus in the U.S., we recently completed a state-level model that suggests a multiphasic peak. In particular, we expect the coastal regions, led by New York, to peak in mid- to late-April. However, we expect the rest of the country to follow slowly, trailing the coasts by around three weeks.

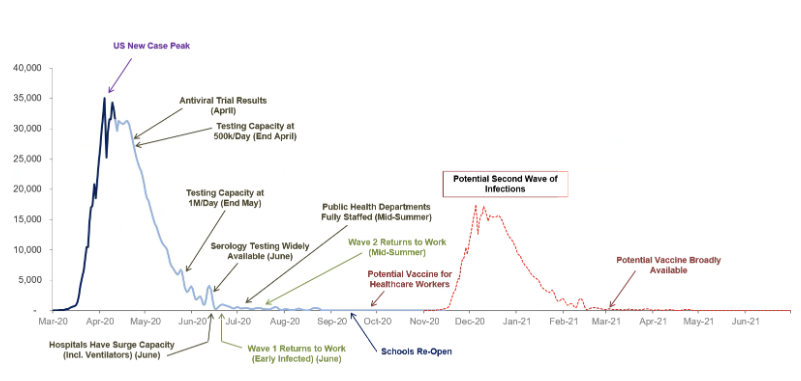

Projected timeline and milestones for a return to work in the U.S.

(Actual/estimated new case count, United States, non-cumulative)

While this “second peak” is unlikely to be as severe as the first (roughly 10,000-15,000 new cases daily vs. 30,000-35,000 in the first peak), it means that the U.S. outbreak will have a very long tail.

This much longer tail would put the total U.S. time to peak at about four times that of China and twice as long as in Italy, driven by the slow uptake of social-distancing measures and lack of robust testing.

New York currently has the highest testing ratio in the U.S., yet is still testing at a per capita rate just half that of South Korea’s most impacted city, Daegu. Based on the data, we believe an initial U.S. reopening is on track for mid- to late-May at the earliest.

The Return to Normalcy

It’s important to stress that this won’t be an easy or direct reopening. A confident “return to work” can only happen after we see:

1. Adequate surge capacity in hospitals;

2. Broad public health infrastructure to support testing to catch new hot spots early;

3. Robust contact tracing to curtail those “hot spots”;

4. Widespread availability of serology testing (blood tests to see who is already immune to the virus).

The process of returning to work will likely happen in waves, starting in the summer. Unfortunately, we think a large number of workers still won’t be able to return to work until a vaccine is abundantly available, since social distancing can’t be fully relaxed until we have herd immunity (meaning about 60% of the population has been vaccinated). Furthermore, large venues, such as sports stadiums, concert halls and theme parks, are also likely to remain shut or have attendance capped at 10%-25% of prior levels.

Based on this view of the delayed peak and slow return to work, our U.S. economists have revised their U.S. growth forecasts. As my colleague Ellen Zentner, Chief U.S. Economist, writes, “After a 38% annualized drop in growth in the second quarter of 2020, we now see a shallower rebound in the third quarter, and we do not see activity returning to its pre-virus level until the end of 2021.”

Progress on Vaccines

Despite the significant concerns we raise about the path to a U.S. recovery, we continue to believe that the market is underestimating the impact that the drug pipeline can have on the public policy response to the virus.

As I stated previously, only a vaccine can provide a true solution to this pandemic. Toward this goal, governments will need to be proactive, investing in large-scale vaccine manufacturing, even before we see successful results for all viable vaccine candidates—even if some of those candidates don’t ultimately make it to market. Only by building production capacity now can governments provide the billions of vaccine doses we will need to meet demand for the 2021 season.

That said, in the interim, promising antivirals and antibody therapies are in the pipeline, with data starting in April and continuing through the late summer. We believe that at least some of these drugs can be successful and help to turn severe cases into milder forms of the disease.

Such an outcome could reduce the potential strain on hospitals and allow public-health officials to support a broader reopening of the economy before a vaccine is available. Thus, with therapeutics available in the near term and a vaccine on the horizon, the market could start to “look through” the slow U.S. recovery and back to pricing in future growth.

Adapted from a recent edition of Morgan Stanley Research’s “Sunday Start” series (Apr 12, 2020) featuring supporting work by the Biotech equity analysis team (Matthew Harrison, Zhen Zeng, Kostas Biliouris, Connor Meehan, Max Skor and Thomas Lavery) . For more information on the coronavirus and markets, ask your Morgan Stanley representative or Financial Advisor.