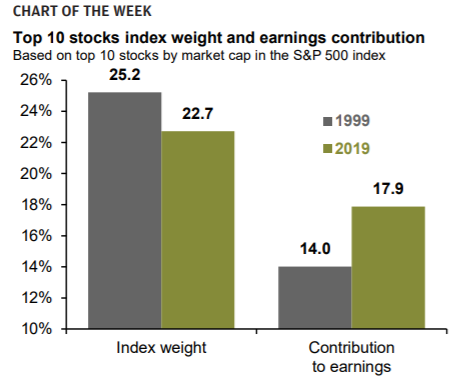

De ti største selskaber i USA udgør en mindre værdi på markederne end for 20 år siden, og der er færre high-tech selskaber blandt dem end for 20 år siden. Markedet er altså blevet mere jævnt fordelt, og de store selskaber tjener forholdsvis mere end for 20 år siden.

Uddrag fra J.P.Morgan:

As traditional market-cap weighted equity

indices continue to reach new all-time

highs, investors are increasingly concerned

that the bulk of returns are coming from

just a handful of mega cap companies.

Indeed, history shows higher concentration

in fewer names can lead to equity market

bubbles and subsequent large drawdowns

as experienced during the ’00-’01 tech

bubble.

However, while concentration risk

is worth monitoring, returns attributable to

these companies are, in part, justified given

they are contributing a greater share to

overall earnings, yet account for less of the

index’s overall market cap. As highlighted

in this week’s chart, the top 10 companies

in the S&P 500 currently make up 22.7% of

the index’s market value, relative to 25.2%

in 1999, yet accounted for roughly 18% of

earnings generated last year, relative to

14% in 1999.

Moreover, these mega cap

companies are more evenly distributed

across sectors, suggesting more stable

earnings: today, only three technology

companies are in the top 10, compared to

six in 1999. Given this, while it may be

appropriate to lock in some gains achieved

by these large companies, investors should

take comfort in the fact that these mega

caps are “pulling their weight” with respect

to earnings and focus on striking an

appropriate balance between risk and

protection in the later stages of an expansion.