Ved at bruge fem nye teknologier er det muligt at begrænse CO2-udledningen dramatisk, og trods enorme investeringer på 50 trillioner dollars kan det skabe gigantiske nye indtjeninger på mellem 3 og 10 trillioner dollars.

Uddrag fra en omfattende rapport fra Morgan Stanley:

As glaciers retreat, sea levels rise and temperatures increase, it’s clear that climate change is well underway, due in large part to the ever-increasing amounts of CO2 in the earth’s atmosphere. However, with potentially $3 trillion to $10 trillion of earnings before interest and taxes up for grabs, decarbonization could present a material economic and humanitarian opportunity.

The question, then, is how to best mitigate carbon emissions, which have now reached 53.5 gigatons (Gt) per year, the highest level in human history.

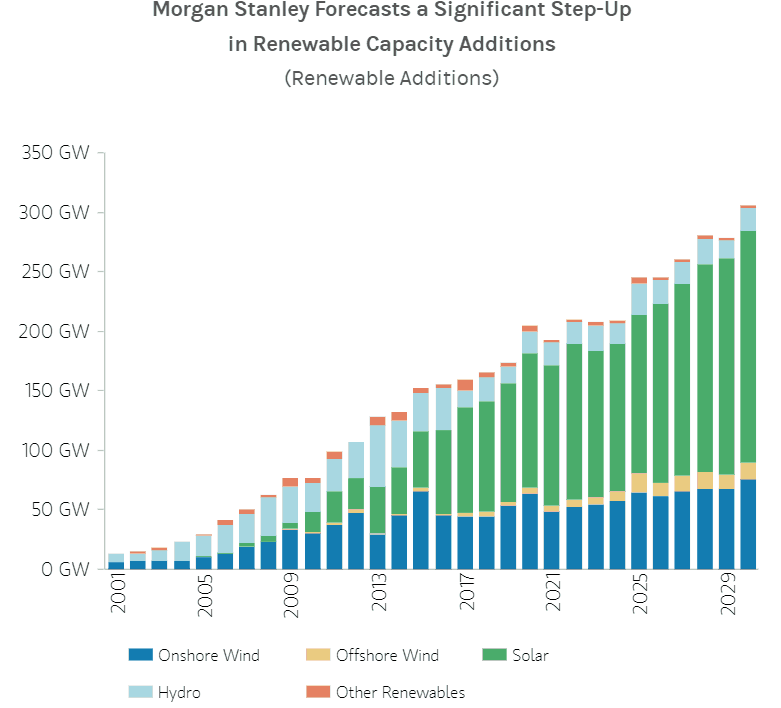

In a new BluePaper from Morgan Stanley Research, a cross-team collaboration of more than 50 Morgan Stanley economists, analysts and strategists estimates that reducing energy-related carbon emissions—the largest segment of CO2 emissions—is indeed possible utilizing five decarbonization technologies: renewables, electric vehicles, hydrogen, carbon capture and storage (CCS), and biofuels.

Although getting there won’t be easy—“net zero” emissions will require $50 trillion in investment by 2050—accelerating the adoption of these technologies could remove 25Gt of carbon emissions annually by 2050.

“The economic costs to decarbonize are substantial. But clear opportunities to reduce emissions exist and the benefit to choosing the right path could also mean significant returns on investment,” says Jessica Alsford, Head of Sustainability Research for Morgan Stanley.

Source: IEA, IPCC