Uddrag fra Goldman/ Zerohedge

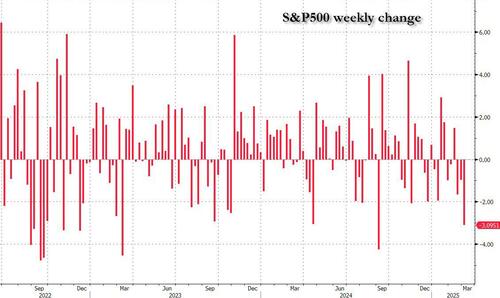

It was another brutal week as markets grappled with what Goldman said was “an avalanche of things” (the top 10 of which are listed below). The S&P tumbled -3.1%, but it would have been far worse had Friday’s comments from Powell not pushed the S&P from its worst week in years; Equal Weight S&P -2%, NDX -3.7%, RTY -3.9% & Momentum Longs (GSCBHMOM) -9%.

The long/short unwind got materially worse Thursday through Friday though ‘pain’ was felt the most anecdotally on Goldman’s desk

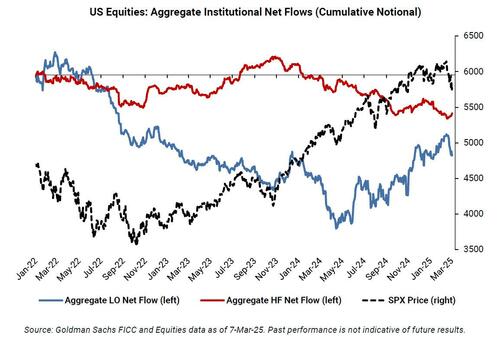

From a flow perspective, Asset managers were steadily reducing risk in relative out-performers and started rotating into defensives late in the week (staples, telcos, and insurers).

Discussing last week’s action, Goldman’s Share Sales Trading desk writes that long-onlies finished -$5b net sellers while HFs finished +$1.5b net buyers, although the bank’s far bigger Prime Brokerage saw a far more sell-skewed bias across the HF community, consistent with the flavor of last week’s activity. Largest Sell Skews: Tech, Financials, & Discretionary… Largest Buy Skews: Comm Services.

As noted above, here are the most topical points and reasons cited by Goldman’s trading desk for the ongoing rout:

- Growth Concerns (payrolls + ISM manuf.. follows weak confidence readings)

- Tariff Fatigue magnified by thematic re-pricing in AI

- Global Complexity (Ger & Fra Yields breaking out + China higher again on JD, BABA QwQ-32B AI Model)

- Technicals Weak (SPX flirting with 200dma 5732, counterbalanced by most major indices & single stock bellwethers approaching technically “oversold” levels)

- Systematic Supply (CTAs have sold almost $60bn of US equity delta in the last week, ~30bn SPX)

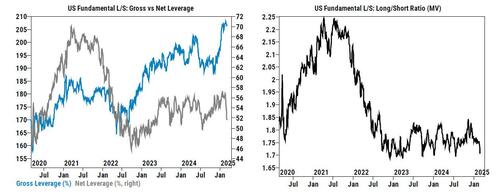

- Positioning Elevated (HF Gross Leverage rose +1.1 pts this week and sitting in 100th percentile vs past 1-year // Nets remained ~flat and in 47th percentile vs past 1-year, more below)

- Liquidity very challenged making new lows

- Long-Only Risk Reduction (seen in relative out-performers such as HCare, Utilities, & Semis)

- Consumer Woes (think: ANF, FL, ROST, VSCO, Cruise lines, etc.)

- Poor Seasonality (bounce set up for 3/14)

Next Week: The S&P implied move through 3/14 (the day before the government shutdown) is 3%. Focus for the week remains on tariff headlines, as well as sell-side conference season (concentrated in Industrials, Consumer, and HC). CPI on Wednesday the big macro event, while FOMC is in blackout period ahead of March 18/19 meeting. On the micro front, earnings are largely behind us (ex a few late reporting consumer names & ORCL Mon + ADBE Wed).

Here are some additional thoughts from Goldman across sectors:

- Healthcare:: continued to show defensive qualities as broader market volatility has ticked up (XLV +50 bps this week vs. SPY -3%, QQQ -3.4%) though wasn’t left unscathed as well-owned momentum long corners of the sector saw notable pullbacks with the macro (ISRG -10%, LLY -5.4%, BSX -4.6%). Meanwhile M&A remained in focus with WBA acquired by PE and continued focus on SWTX / MRK GY.

- Consumer:: Most companies generally spoke to a soft start with most blaming weather (BURL, ROST) and others blaming a tough macro. Off price names generally got a pass on earnings day vs spec retailers (ANF, VSCO) who did not. Biggest focus was the painful squeeze in staples shorts late in the week (CPB, MDLZ, KHC, GIS).

- Financials:: Despite a heavy week for micro with major conferences in Fins, Real estate, and payments, positioning was the main driver of stock performance. Almost every single crowd long across cohorts (AJG, COF, LPLA, FI, C, WFC, HOOD) underperformed while common shorts (JKHY, WU, FIS) outperformed. Capital markets still remains pressured with willingness to defend extremely light. REITs overall outperformed, but crowded longs (CBRE, JLL, PLD) underperformed despite what was a positive message on industrial REITs and brokers at the conference per feedback

- Tech:: Not much evidence of price-agnostic, aggressive, risk-reduction type flow on our High Touch desk. Goldman continues to see Long Only reduction across Semi names & Semi infrastructure. When you zoom out, there is a very clear trend of selling this group from the bank’s largest clients. Late in the week (today) very clear theme buying defensive assets (Cable, Telecom Services).

- Industrials:: Positioning has been the main theme of the week driven by the tariff deadline that came and passed with uncertainty on the other side of Tuesday increasing. Market dislikes uncertainty which has driven a continued sell off in momentum. We saw builders, materials outperform on the week. Energy lagged with the XOP down 6% as OPEC+ surprised the market with increased production in April restarting. Some single name standouts include HII +12% as Trump announced renewed investment in shipbuilding during the state of the union. FMC +12% as well as relatively new CEO bought new stock. Flipside is a list of very popular longs with GTLS leading the downside off 22%, CVNA -21%, NRG -19%. Looking forward the outcome people want the most is certainty on the path of tariffs. Host of analyst days next including ETN FAST as well as FERG earnings and industrial conference away will hear more updates from corporates on real time thinking given the uncertainty.

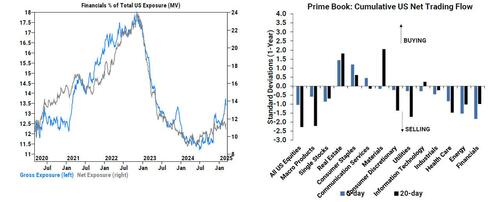

Turning to Goldman’s Prime Brokerage, we find the recent bearish trend has accelerated, as it pushed gross exposure to record highs, while net exposure continues to shrink. As shown below, US Fundamental L/S Gross leverage rose +0.3 pts to 206.9% (98th percentile three-year), while US Fundamental L/S Net leverage fell -2.1 pts to 51.3% (31st percentile three-year). As a result, the Fundamental long/short ratio fell -2.3% to 1.660 (tied for the five-year low).

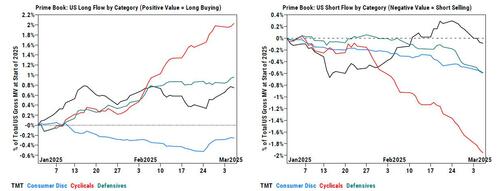

Taking a closer look at HF activity, Goldman PB strategist Vincent Lin writes that US equities were net sold for the 4th straight week (9 of the last 10), driven by short sales outpacing long buys 1.7 to 1. This week’s increase in gross trading activity (a proxy for shorting) was the largest in 7 weeks.

Some more details:

- Macro Products (Index and ETF combined) made up 45% of the overall net selling and were net sold for a 10th straight week, led by short sales. US-listed ETF shorts increased +0.7% week/week (now up +7.2% month/month), led by shorting in Sector, International, and Broad-based Equity ETFs.

- Single Stocks were net sold for the 3rd straight week and at the fastest pace since Nov ’24 (-1.3 SDs), driven by short sales outpacing long buys (1.5 to 1). Every region (sans Europe) was net sold, led by North America and EM Asia.

- Single Stocks saw the largest net selling since Aug ’24, led by short sales, while Macro Products were modestly net bought for the first time in 10 weeks, as long buys slightly outpaced short sales.

- 10 of 11 global sectors (sans Staples) saw increased shorting on the week, led in notional terms by Info Tech, Financials, and Health Care.

- 8 of 11 sectors were net sold, led in notional terms by Financials, Energy, Health Care, and Info Tech, while Staples, Real Estate, and Comm Svcs were the only net bought.

- HFs added risk across TMT, Defensives, Cyclicals, and Consumer Discretionary this week, as 10 of 11 US sectors (sans Staples) saw an increase in gross trading activity, led in notional terms by Info Tech (short sales > long buys), Health Care (short sales > long buys), Financials (short sales > long buys), and Consumer Discretionary (short sales > long buys) and broad-based on a subsector level.

- HFs net sold US Financials stocks for a 2nd straight week and at the fastest pace since Nov ’24 (-1.8 SDs, 92nd percentile 5-year), driven almost entirely by short sales. Most subsectors were net sold on the week, and all saw an increase in shorting, led by Capital Markets, Banks, and Consumer Finance.

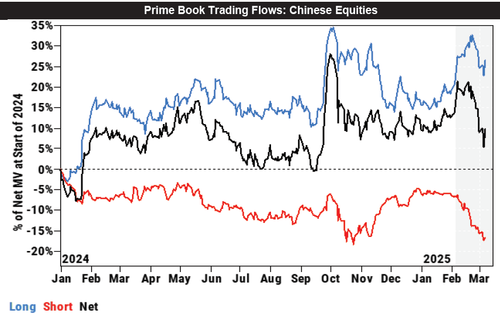

- Finally, HFs net sold Chinese equities for the 4th straight week, driven by both short and long sales. Post DeekSeek, China was by far the most notionally net bought market on the Prime book YTD thru Feb 17th, around which HFs have reversed course – net flow in Chinese equities is now roughly flat on a YTD basis.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her