Citat Goldman: “this week demonstrated that unsustainable excess in one small part of the market has the potential to tip a row of dominoes and create broader turmoil.”

Fra Goldman/ Talkmarkets / Zerohedge:

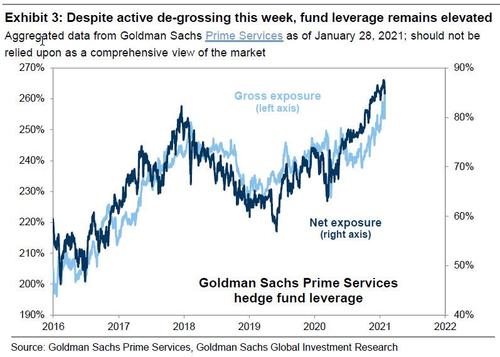

Yet what may come as a surprise to some, even as hedge funds deleveraged aggressively and actively cut risk this week, gross and net exposures “remain close to the highest levels on record” (something which may come as a huge surprise to Marko Kolanovic who has been erroneously claiming the opposite), suggesting that if the squeeze continues, hedge funds are set for much more pain.

According to Goldman Sachs Prime Services, this week “represented the largest active hedge fund de-grossing since February 2009. Funds in their coverage sold long positions and covered shorts in every sector” and yet “despite this active deleveraging, hedge fund net and gross exposures on a mark-to-market basis both remain close to the highest levels on record, indicating ongoing risk of positioning-driven sell-offs.”

With that in mind, here are Kostin’s big picture thoughts:

It was a placid week in the US stock market – provided one was a long-only mutual fund manager. US equity mutual funds and ETFs had $2 billion of net inflows last week (+$10 billion YTD). Although the typical large-cap core mutual fund fell by 2% this week, it has generated a return of +1.3% YTD vs. S&P 500 down -1.1%. However, life was very different last week if one managed a hedge fund. The typical US equity long/short fund returned -7% this week and has returned -6% YTD.

With the average WSB portfolio up double digits this past week, one can see why hedge funds are upset. Anyway, moving on:

The past 25 years have witnessed a number of sharp short squeezes in the US equity market, but none as extreme as has occurred recently. In the last three months, a basket containing the 50 Russell 3000 stocks with market caps above $1 billion and the largest short interest as a share of float (GSCBMSAL) has rallied by 98%. This exceeded the 77% return of highly-shorted stocks during 2Q 2020, a 56% rally in mid-2009, and two distinct 72% rallies during the Tech Bubble in 1999 and 2000. This week the basket’s trailing 5-, 10-, and 21-day returns registered as the largest on record.

Thanks Goldman, and yes, your “brisk assessment” would have been more useful to your clients if it had come before the event (like, for example, this) instead of after.

Kostin then goes on to point out that the “mooning” in the most shorted stocks took place even though aggregate short interest was near a record low (imagine what would have happened had short interest been higher), which is odd because historically, “major short squeezes have typically taken place as aggregate short interest declined from elevated levels. In contrast, the recent short squeeze has been driven by concentrated short positions in smaller companies, many of which had lagged dramatically and were perceived by most investors to be in secular decline” to wit:

Unusually, the rally of the most heavily-shorted stocks has taken place against a backdrop of very low levels of aggregate short interest. At the start of this year, the median S&P 500 stock had short interest equating to just 1.5% of market cap, matching mid-2000 as the lowest share in at least the last 25 years. In the past, major short squeezes have typically taken place as aggregate short interest declined from elevated levels. In contrast, the recent short squeeze has been driven by concentrated short positions in smaller companies, many of which had lagged dramatically and were perceived by most investors to be in secular decline.

Of course, there is nothing “historical” about what happened last week, because – as we all know – the biggest difference between the typical short squeeze of the past and the recent rally in heavily-shorted stocks “was the degree of involvement of retail traders, who also appear to have catalyzed sharp moves in other parts of the market.” Why thank you WSB, but that’s ok – you will be handsomely rewarded.

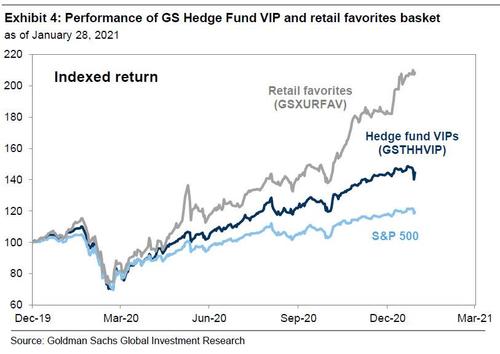

Last week we discussed the surging trading activity and share prices of penny stocks, firms with negative earnings, and extremely high-growth, high-multiple stocks. These trends have all accompanied a large increase in online broker trading activity. A basket of retail favorites (ticker: GSXURFAV) has returned +17% YTD and +179% since the March 2020 low, outperforming both the S&P 500 (+72%) and our Hedge Fund VIP list of the most popular hedge fund long positions (GSTHHVIP, +106%).

So why does this matter? One simple reason: contrary to the bizarrely nonchalant optimism spouted earlier this week by JPMorgan’s Marko Kolanovic who said “any market pullback, such as one driven by repositioning by a segment of the long-short community (and related to stocks of insignificant size), is a buying opportunity, in our view,” Goldman has a far more dismal take on recent events, and writes that “this week demonstrated that unsustainable excess in one small part of the market has the potential to tip a row of dominoes and create broader turmoil.”

He then picks up on what he said last weekend when responding to Goldman client concerns about a stock bubble, which we summarized in “Goldman’s Clients Are Freaking Out About A Stock Bubble: Here Is The Bank’s Response“, and which turned out to be 100% warranted, and writes that “most of the bubble-like dynamics we highlighted last week have taken place in stocks constituting very small portions of total US equity market cap. Indeed, many of the shorts dominating headlines this week were (prior to this week) small-cap stocks. But large short squeezes led investors short these stocks to cover their positions and also reduce long positions, leading other holders of common positions to cut exposures in turn.”

As a result, Goldman’s Hedge Fund VIP list declined by 4%. Which is a problem because as Kostin concludes, “in recent years elevated crowding, low turnover, and high concentration have been consistent patterns, boosting the risk that one fund’s unwind could snowball through the market.”

Translation: if WSB continues to push the most shorted stocks higher, the entire market could crash.

And since Kostin admits that “the retail trading boom can continue” as “an abundance of US household cash should continue to fuel the trading boom” with more than 50% of the $5 trillion in money market mutual funds owned by households and is $1 trillion greater than before the pandemic, what happens in the coming week – i.e., if the short squeeze persists – could have profound implications for the future of capital markets.