Goldman Sachs har analyseret aktiemarkedernes nedture – bear markets – og kommer til den konklusion, at coronakrisen kan føre til et relativt hurtigt opsving for aktierne, selv om den økonomiske genopretning vil blive langvarig. Det skyldes, at krisen er en “event” snarere end en cyklisk eller strukturel nedtur, og markederne stiger altid relativ hurtigt efter “event-nedture.” Derfor kan krisens virkning på aktiemarkederne være overstået senest næste år.

Uddrag fra Goldman Sachs:

Equities

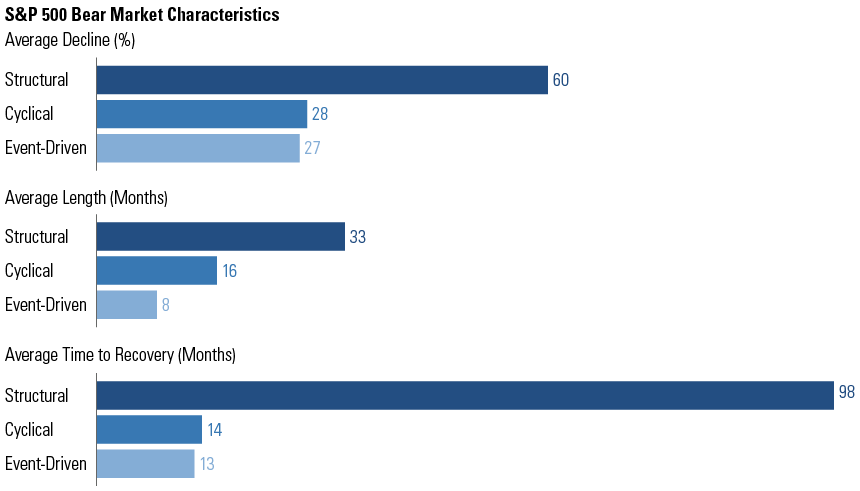

Understanding bear market DNA may influence how quickly one positions for recovery. Structural bears, which result from painful asset imbalances, tend to be deep and long. Cyclical bears are linked to the business cycle and tend to be intermediate in magnitude and in recovery. Event-driven bears are catalyzed by one-off shocks and are relatively quick to recover. While the essence of COVID-19 is event-driven, the economic devastation of virus containment transcends both cyclical and structural risk, suggesting a potential deep contraction but rapid recovery.