via Goldman Sachs Macro trader

Institutional clients long gross risk and long hedge, which masks the micro length by reflecting less net exposure than you might expect for a world seeing all time highs everywhere. Retail is long everything. CTA are back to long but not overly. Hedge funds grossed up last week. To quote one colleague “investors are uncomfortably long…and at the same time wishing they had been longer.” Clearly a statement of the obvious given year to date performance, but strangely apt for a year that has felt like 4 years and cycles rolled into 9 months.

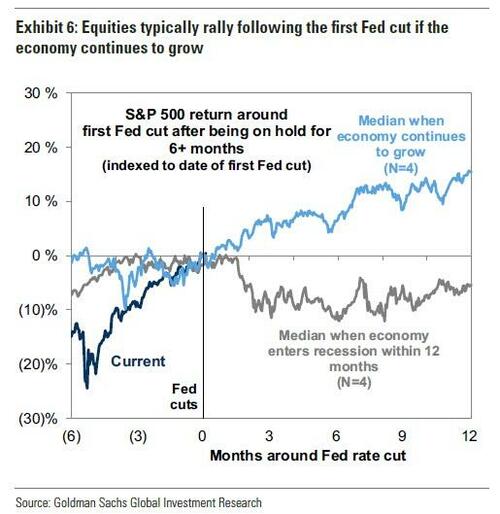

If we break this down into big picture and little picture, the big picture seems clear – a market pricing in no recession (anytime soon), lower rates and the benefits of fed cutting cycle kick off, AI benefits, corporate profits and margins holding up and US supremacy reasserting itself. US markets now housing four $3 trillion plus companies, their 5 largest companies accounting for 20% of the worlds equity market cap…and 9 of the 10 biggest companies in the US effectively AI plays (with likes of Oracle knocking at the door just outside the top 10). Each and every concern, political, fiscal, deficits, geopolitics, $, tariff impact, re-inflation, job market seems to be compartmentalized and ignored. In spite of this, client positioning doesn’t match the headline index euphoria with Russell 2000 joining Nasdaq, S&P, Japan, Korea, Japan in the omni all-time high records falling regularly at the moment.

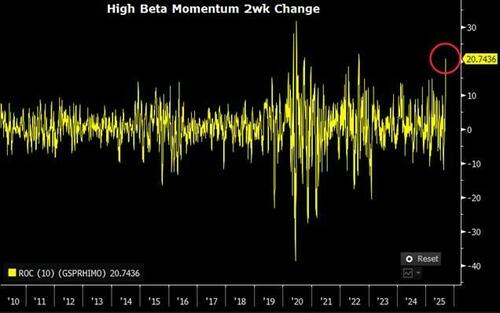

The little picture seems less clear. Narrowness still a defining feature of the market. 5 stocks (all US) accounting for 20% of the global equity market but if you have no Asia it has cost you slippage in last 3 months. Cyclicals catching up as benefit to real economy being factored on back of rate cuts. Small and mid caps also coming into focus again with Russell 2000 just breaching all time high. Push pull of the power of US and its markets vs a want to diversify. In terms of flows, more signals of a late stage junk rally and short squeeze. Some signs of mania and beta chase last week with shorts have been increasingly difficult to manage. Coming into this week fatigue kicking in and perhaps signs of last week being a top of rally stop in and this week seeing a marginal roll over.

The last week saw a rip for all things tech and tech related: “non-profitable tech +8%, most-shorted +6.7%, quantum theme +30%, nuclear +10% over 5 days”, at the same time Nasdaq has been up 3 weeks in a row and 11 of the last 13 days coming into this week. This week a breather of sorts as seasonality, headline levels, digestion all come to the fore.

Are we in a tech bubble? Hard to say yes with Nasdaq having rallied 16 of the last 17 years, delivered ~2,250% of returns…and with the 5 largest companies trading at 28x vs a historical peaks of 40x (2021) and 50x in 2000). That being said, we are staring to see private market get ‘frothy’ again with several raises at close to (or above) 100x ARR and we see likes of Palantir trading at 70x revenues in the public markets. The crowding and correlation point and increased dependence on one trade/theme (ai): I also wonder if it creates bigger risks of short sharp drawdowns (similar to what we saw in Crypto on Monday).

It feels like a market/economy/backdrop mired in mixed messages. Headline index levels shouting that all is good, yet beneath the surface sticky inflation (that could accelerate) and starting to see the end of pass through working and falling volumes, margin compression and job cuts appearing. All of this at time when AI is supposed to be offsetting some of these impacts with potential and efficiency….which ironically if true, also probably adds to more job cuts. The Fed cutting into a cyclical uptick, an equity market at all time highs and an economy still close to full employment (relative to history).

In spite of the market rip of late, performance has been trickier. Last week was the first negative alpha week for 6 weeks for the fundamental community, systematic funds were down 1.3% (according to PB data) and we saw key performance spreads move wrong way in several places. HF VIP basket vs most shorted basket -5.9%, mega cap tech vs non profitable -5.7%. In fact last week, of 11 US sectors…only 3 were up…with Tech doing 99% of the heavy lifting up 3.5% on the week with industrials and energy both up less than 20bps each!

Investors starting to worry about positioning and skews, with hedging of momentum, hedging of size and hedging of consensus appearing in our flows of late.

AI. So many cross currents in last week. The Nvidia/Open AI $100bn deal with its circular dynamics, as Ai and Ai capex continue to fuel. Elsewhere we are starting to see impacts of AI in a couple of places….GS research pointing at Factset miss and 20% move lower as potentially AI pricing power related…..Fiverr up 10% on back of a 30% reduction of workforce on the back of AI efficiency and ability to do more with less. Palo Alto networks launching the first of a 10 part Ad series created by AI that hit market in one week and for $1000 vs a traditional time to market of 9 months and millions of dollars.

Europe. Here we are again. Back asking questions around what the story is? What the catalyst is? And whether Europe can get its act together, move faster and execute? Since then US tariffs have impacted many countries, sectors and companies. Various European countries are dealing with fiscal, debt and growth issues. Several European countries are operating with fragile political frameworks (France having had 5 PM’s in 2 years just one example!). We see US benefiting from all things Tech and Ai and increasingly solving for America first. We see China benefiting for a new trading relationship with likes of India and Africa and being able to supply deflationary goods to new markets (often at the expense of European competitors). We see sectors being disrupted (luxury, industrials, autos) on the back of spending patters, politics and emergent competition (China EV’s as one example). Even Draghi one year on from his report sounds a bit grumpy about the progress made.

Public vs private. Capital formation is changing and the public markets (especially Europe) need to evolve and respond. As companies can increasingly tap private equity and private credit for scale single stop solutions for liquidity/exit/capital…the public market route is no longer the obvious option and is increasingly declined by sellers of assets. The public markets have been impacted in a number of ways. De-equitization and the shrinkage in numbers of public listed companies. The theme of private for longer and PE and founders scaling their companies in private markets with healthy and substantial access to capital while remaining private. As well as the broader growth of Private equity and Private credit from a $1 trillion AUM industry to an over $12 trillion one. The impacts of which are everywhere. The combined market caps of the Mag 7 at the point of IPO was about $130bn ($26bn if you exclude facebook). Google was a $23bn company at ipo, Amazon was a $438m company, Tesla $1.7bn, Apple $1.2bn and Microsoft $778m and finally Nvidia ~$600m. Since then around $20 trillion of market cap has been created in the public markets. That value has resided with mainly “public” investors – mutual funds, sov wealth funds, passive/active, hedge funds etc etc. Fast forward to today, a lot of this value is being retained on the private side. IF you take some of the larger tech companies in the world – Spacex, Open AI, Databricks. Stripe, Shein, Bytedance, Revolut – over $1 trillion of value has been created in the private markets (so far) as these companies have remained private for longer and scaled nonetheless… but have robbed the markets of access of some of that value creation. The other main theme has been the PE community benefiting from the reduction in active assets under management. If you just look at FTSE 250 over the last 5 years a huge number of UK companies have been taken private by PE as public markets failed to recognize the potential value there (Darktrace, Cobham, Ultra, Calisen, St Mowden, Aggreko, Just group, Spectris to name a few). In fact in 2025, 50% of $1bn plus lbo’s are taking assets into the private or keeping them in the private markets. As I read headlines about Stada being sold to PE, or Tenet electing to remain private rather than go Public via IPO, I see a growing shift towards taking the ‘private route’. The public markets need to evolve and respond and compete to attract these companies to take the plunge.

Late cycle, early cycle or post modern cycle. It is hard to gauge where we are in the cycle… or even if cycles exist. You could argue post GFC we have seen one extended 16 year cycle or you could argue that we’ve had 5 or 6 cycles in that period… just with very short sharp ‘recessions’ relative to history. Perhaps a ‘Moores law’ of efficiency appearing where every blip is met with quicker/faster and more effective solutions enabling the new ‘cycle’ to start. Which brings us back to question, is this the tail end of one cycle or in fact the start of a new one? One with de-regulation, with transformational tech, with lower rates and cost of capital, with high employment and high savings and a flurry of corporate activity and government spending? Are we heading into 2000/01 and bubble terriory or could we be in 1998 and the music is about to hit full volume.

Competition and Capitalism. The US system is one of meritocracy – one that believes in equality of opportunity with no ‘class’ boundaries or ceilings…arguably a pure form of capitalism where merit and effort can deliver ‘riches’ to anyone. Within such a system individuals can supercede entrenched elites and the historically wealthy in a perpetual game of competition. People driven by wealth, status or power. Companies driven by size, brand and importance, forever striving to be bigger, better, newer, faster and more profitable. Fueling that eco system is capital that ‘believes’….capital that is willing to take risk for return rather than solving for protection and survival. A market that has traded up ~30% in last 100 days, a corporate landscape that has announced $1.1 trillion in M&A since June and $300bn in August alone (no beach time for Americans it seems!).

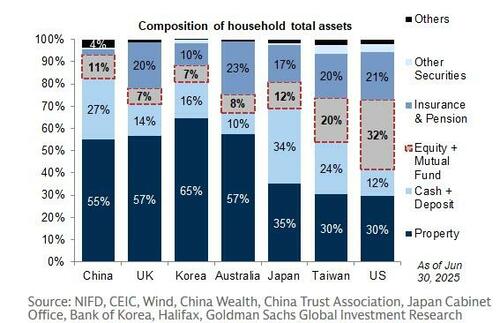

Savings vs experiences. In a world of higher taxes, more depreciation and shifting stores of value, the traditional mindset (one that I was brought up on) may be out of date. Get a job, buy a house, save money and then retire might plausibly move to get a job (or 3 jobs), spend as much as you can, speculate and trade and don’t worry about rainy days. The US consumer is now heavily long US markets, with that their wealth and spending power is a much a function of the market level and performance as it is employment.

I overheard a personal trainer explaining to a customer how his levered ETF exposure to Nasdaq had made him as much money in 2025 as his job. Many have debated what fair value is…what constitutes cheap vs expensive…and I’m not sure anyone has a good answer or if it even matters. If Palantir can trade to 100x ARR and we can have $500bn valued private companies a lot of traditional believed truths may no longer be fit for purpose. For now, the market is in full beta chase, fomo and risk on mode. Anyone that has sat on sidelines has gotten ‘relatively’ poorer and that has been compounded $ weakness as it’s first amongst equals as a store of value weakening (if only a little).

All in. I was reading about the story of Marvel over the weekend. In the 1990’s a comic book company with a stellar stable of characters but a company that was on the verge of bankruptcy having filed for Chapter 11 in 1996 with $600m of debt. What came next was a fire sale of some of their prized assets….Spider man to Sony, X-men and Fantastic four to Fox and the Hulk to Universal. With the proceeds they ensured survival, but what was left a flock of lesser known more niche super heros. What to do? In the end they swung for the fences. They took Iron man – a complicated billionaire wisecracking genius hero and they cast Robert Downey Jr (fresh off rehab and jail time) to be the face of this new ‘franchise’. What next…..Iron man 1 in 2008 and $585m….a character that arguably ‘launched’ the Marvel cinematic universe….one that emboldened decisions like Black Panther…..and the face of the Avengers for over a decade. Disney came knocking in 2009 and bought Marvel for $4.24bn…. and since then the MCU has grossed ~$30bn at the box office….and ~$40bn in retail sales – less a collection of super hero comic book characters but a brand with a catalogue of ever green films, toys, clothes, games etc.

Some charts to finish:

1. Momentum: now and forever

2. Momo and Tech: 5 year chart of the GS US TMT Momentum Pair (pair of 12-mo winners vs 12-mo laggards)

3. Bubble bubble toil and trouble: Paolo Schiavone – “Bottom line: This isn’t a recession. It’s the end of the rolling recession — and the start of a financial-conditions-driven rally. As liquidity eases, risk flows downhill: from quality to junk, from fundamentals to speculation. “ We’re not trading fundamentals anymore. We’re trading liquidity, positioning, and the tape. Fig 2: ARKK technicals bullish → follow the tape, not the story.”

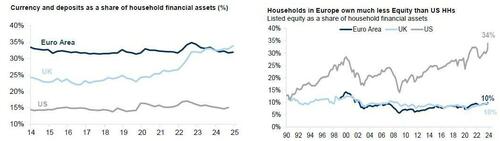

4. Europe – cash vs investments.

5. Europe – Retail

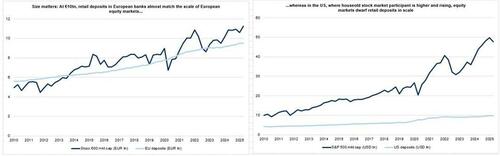

6. Small vs big: Russell vs Nasdaq. Is small beautiful again?

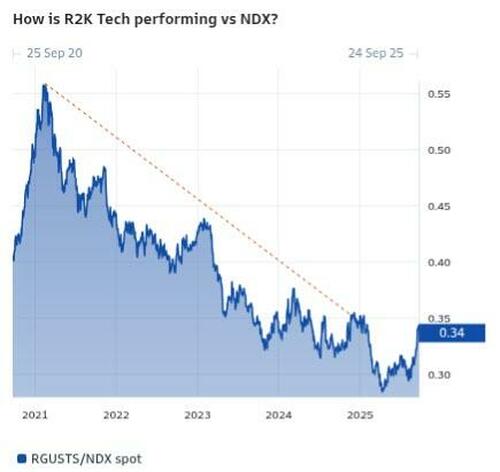

7. De-regulation: The story of Q1 coming back to life in Q3

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her