Uddrag fra Goldman/ Zerohedge

In any case, Goldman deriatives guru John Marshal’s theory that institutions were piling into stocks with leverage and at an unprecedented pace, pushing the S&P to new daily records, was correct… until Dec 18, the day of the hawkish FOMC when, as we all know, “political Powell” decided to make a dramatic U-turn on the Fed’s dovish pivot less than three months earlier, and to warn that the Fed will hike far less than previously expected.

And with that the party was over. That’s when the funding spreads cracked. In fact, see if you can spot on what day the front month S&P 500 TRF BTICs, i.e., funding spreads, peaked?

Don’t worry, it’s not a trick question: funding spreads peaked on Dec 18, when Powell took the punchbowl away, to the dot… and have absolutely imploded since, undoing six months of gains in two weeks!

But if funding spreads surging was a bullish sign – as per Marshall’s December note – wouldn’t plunging spreads be bearish, one may ask?

Well, that’s precisely what Marshall wrote in his latest note

According to a Jan 5 report by the Goldman derivatives strategist, the chart of continued signs of de-grossing across institutions is “a significant warning sign for equity investors.” Marshall elaborates that “selling through the futures channel continued this week as evidenced by the decline in the cost of funding levered longs” and cautions that “weakness in funding spreads on Thursday was a significant occurrence because it demonstrated the December move was not just year-end related. Further, funding spreads held flat on Friday even in the context of the +1.3% in the SPX (normal correlation would have suggested a significant increase).

Ominously, to Marshall “this episode continues to look like the Dec-2021 move in positioning when worries about monetary policy triggered professional investor selling ahead of a 10-month decline in the SPX.”

And speaking of which, the selling has already begun.

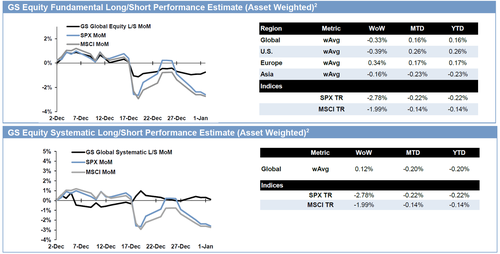

Another Goldman trader, Vincent Lin, highlighted in his Jan 3 publication that “Hedge funds net sold US equities in each of the past 5 sessions and at the fastest pace in more than 7 months.” Some more detailed from the full report

- Global equities saw the largest net selling in over 7 months, driven by short sales and to a much lesser extent long sales (4.8 to 1).

- All regions were net sold and saw increased short selling on the week, led by North America and to a much lesser extent EM Asia.

- Both Macro Products and Single Stocks were net sold and made up 77% and 23% of the total notional net selling, respectively.

- 8 of 11 global sectors were net sold, led by Health Care, Financials, and Industrials, while Info Tech, Materials, and Energy were the only net bought.

The punchline, to Marshall, is that “while equity valuations have been historically high for many months, this is the first time we are seeing significant selling in both of these positioning measures in years.”

Then again, one can counter that unless there is some macro factor to trigger wholesale sales, this entire episode will culminate in merely yet another massive hedge fund short squeeze, sending the S&P to new all time highs.