While earnings season is now almost over, this will be a consequential week with a solid data set to accompany the evolving narrative.

As Goldman’s derivatives guru Brian Garrett writes in a Sunday note, Nvidia – the world’s largest company – is reporting earnings (with a $300BN market cap implied move); we also get the first US government employment report in two and a half months (Goldman is above consensus at +80k), and almost all brick/mortar bellwethers (a sector that has gotten crushed recently) will report (HD, WMT, LOW, TGT, etc).

Here is how to prepare for what is coming according to Garrett:

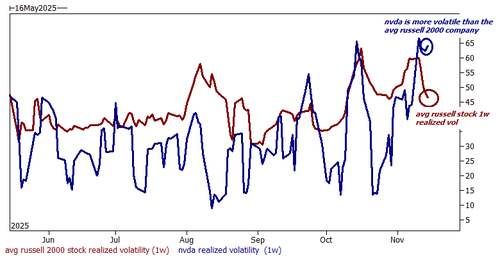

- Defensive flows remain: the VIX traded north of 23 intraday for only the fourth time since April, two out of three CTA levels broke this week (spx inflection @ 6725 very important); hedges are bought in tech; nvda is more volatile than the avg small cap; this week registered one of the worst sessions for momentum in a decade (beta next?)… desk anecdote: i was asked for a “CDS primer” more times this week than in 10 years.

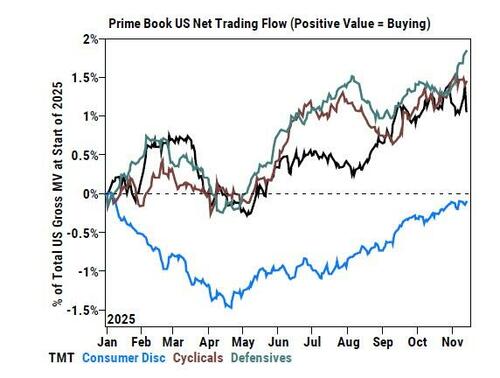

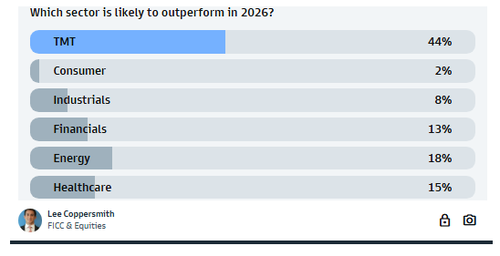

- The tone the week ahead prep is unintentionally bearish the technology sector: this flow comes in sharp contrast to a Goldman sentiment poll where almost 50% of respondents expect TMT to be the leading sector 12 months from now.

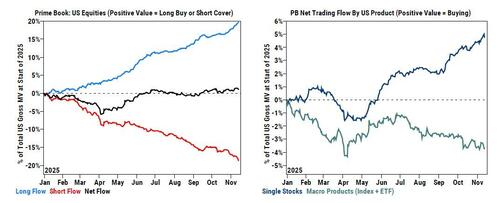

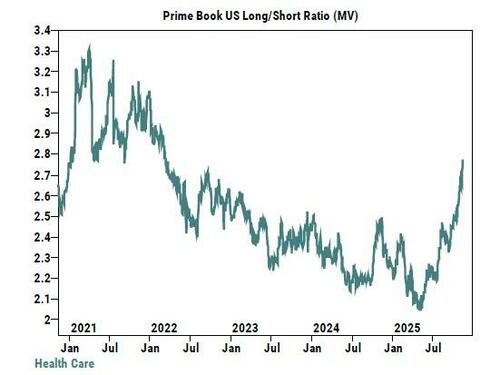

- Prime Brokerage (defensive): last week, Garret noted that the rotation from growth into defensive sectors had begun, and that continued this week in the face of a four year record in gross single stock trading activity … short sells outpaced long buys in TMT and long buys outpaced shorts in healthcare and staples (defensive tilt continues)…

- … as someone in the seat every day, i would have thought gross exposure would have decreased meaningfully (it has not)

- One-delta (defensive2): the Goldman cash desk echos the prime data: the large supply in tech (the Thursday afternoon was peak panic) with demand in healthcare (go so far as to suggest a “chase” from long onlys in this sector) the healthcare “prognosis for alpha” report could not have had better timing.

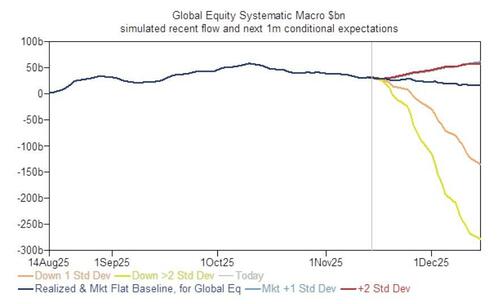

- Systematics (precarious): The S&P has now broken the short term threshold twice in as many weeks, only to be saved by the 4:00pm bell. The short term threshold in NDX and RTY were both broken this week, and Goldman’s work suggests CTAs are set to sell ~20% of their NDX and RTY holdings in the next week (assuming flat tape); keep SPX 6725 on your launchpad, at this level the S&P flips to negative trend for the first time since one session in oct, and only the second time since February

- The bext key level to watch is CTA medium term momentum threshold of 6442 – below this level market will have to absorb more than $32BN of supply in a 1 week period.

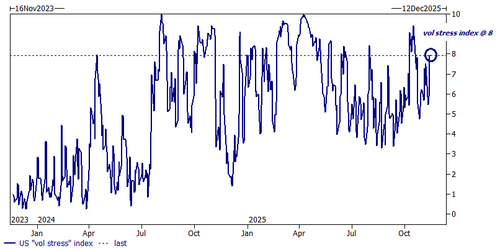

- Derivatives (tech hedges): the desk saw demand for downside hedges in megacap tech (this “rhymes” with the supply in TMT from both prime brokerage and one-delta); the spread of NDX vs SPX implieds is close to 1y highs; the downside in NDX avg stock trades at one of the largest multiples in 2y, and the “vol stress” index is an 8 out of 10.

- Derivatives (one stock): Garrett says that he found this interesting, albeit disconcerting: on zero idiosyncratic catalysts, NVDA has been exhibiting higher volatility than the avg stock in the Russell 2000 … reminder, nvda is about 2,500 times the size of the avg stock in Russell ($4.6tr vs $1.7bn) and infinitely more liquid.

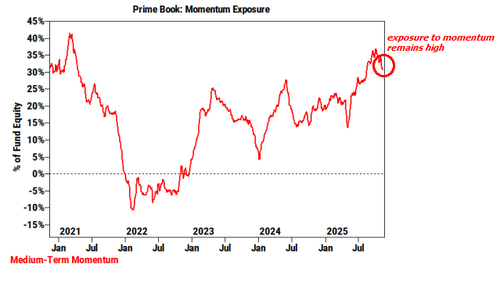

- Thematics (wow): three weeks ago, Goldman highlighted the fact that GS custom baskets have been significantly more volatile than the market itself … this spread culminated on Thursday with a 750bps one day sell off in the momentum index; here, the Goldman derivatives team worries this could spill into something more precarious (beta + momentum hedge ideas here); yet despite the anxiety (and negative performance) investor exposure to momentum remains very high.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her