By Mark Wilson, Goldman trader and managing director

1. Its been a volatile start to the year with limited directional clarity, but plenty of trading activity: Tuesday was Nasdaq’s largest volume day in history, 13.4BN shares traded; Tuesday also was a record trading in US stocks with prices <$1 (typically associated with speculative retail activity) as a %age of total volume.

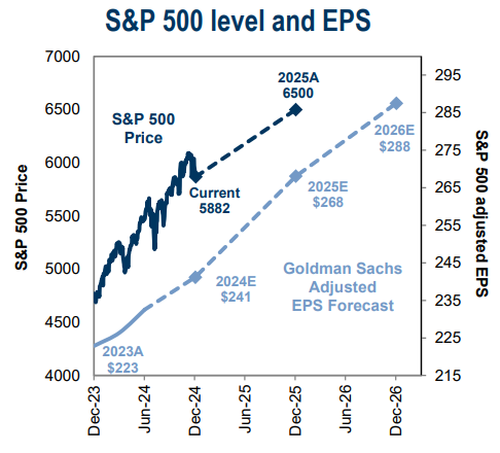

Our central macro views for 2025 hinge on our forecasts for above consensus US GDP, below consensus inflation, ongoing Fed cuts (albeit now 1 less this year than pre-NFP forecast, in June & Dec), alongside a weaker than consensus GDP outcome in Europe, but weaker than forecast inflation & more ECB cuts than priced. Against that forecast backdrop, I’d suggest it’s tough to be overly bearish equities. Nevertheless, year-to-date (and really since Powell’s December meeting pivot to an explicit inflation focus), the move higher in yields is threatening to derail the equity narrative with US 10yr yields now well above the top of the 18mth down channel, through 2024 highs and approaching the cycle high of 5% from November 2023.

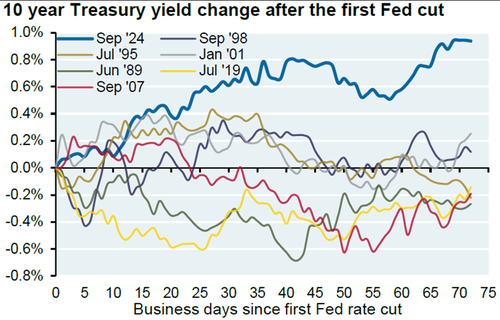

This is also now the biggest ever move higher in yields post the first Fed cut…

… and we are seeing the beginnings of a tightening in financial conditions;

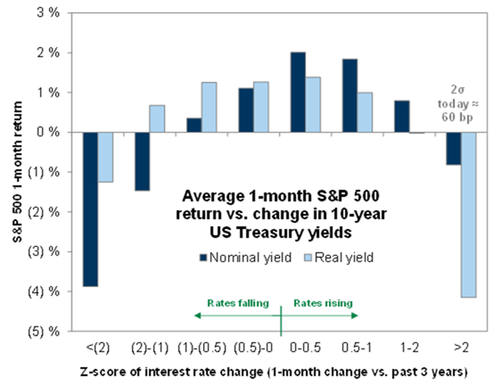

But as equity investors are all too well aware, it’s the speed of the rates re-pricing that matters (as per chart 4). Reflecting back on that November 2023 cycle-high in yields, equities completed their 11% drawdown within 10 days of that high-print in yields.

Financial conditions have been tightening since the Fed’s first cut, but not unduly :

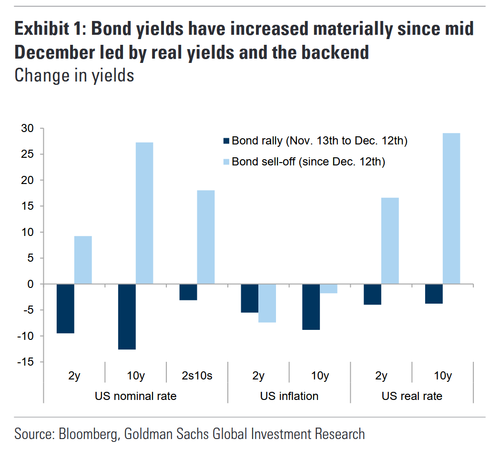

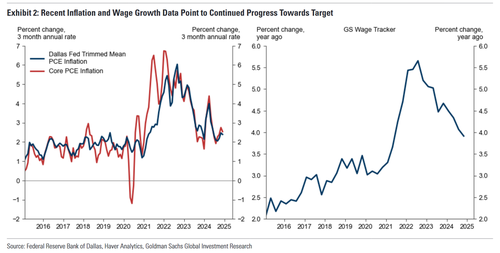

2. The composition of the rate move is notable, mostly driven by real yield & term premium, not inflation (chart 1) – and, although, I’m not wholly dismissive of the inflation risk (especially after yesterday’s University of Michigan expectations coming in higher, and the counter trend move off what now looks like a pretty well established floor in oil price and the decent early-year 8% jump in copper, 2nd & 3rd charts), its staggering to see the scale of the implosion in China yields (& the divergence in DM yields vs China, (chart 4), plus the major trend of deflating labor/wage costs in the US continues unabated (chart 5) :

Crude:

Copper:

US 10yr yields vs China !

GS wage tracker :

3) Within the overall benign inflation narrative we’re subscribed to, the UK is the outlier … Generous public sector wage increases & weaker GBP haven’t helped the UK situation stagflation risk, and the move to new cycle highs (above the Liz Truss moment) has happened in an illiquid tape where numerous questions have been asked as to who will buy the supply of UK paper. Inflation fears weren’t helped by German headline inflation at 2.9% yoy in Dec, taking our Euro area Dec core inflation tracker to 2.75% yoy; but, for the UK the worry is that the 2 off-ramps that were evident in 2022 at the Truss/Kwasi moment (ie an exhaustion of technical LDI supply, and a change in people & policy) are not apparent today. Yesterday’s price action felt much healthier, despite the continued US sell-off, but a more forceful message around the imperative growth agenda can’t come soon enough (especially with UK 30yr yields now at the highest since 1998) :

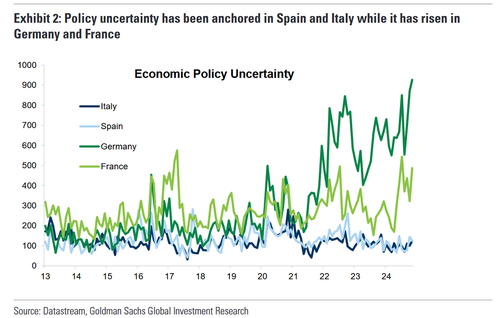

4) Although 2024 was supposed to be the year of peak political market drag given how just how much of the world was going to the polls, 2025 is going to be similarly important – especially as it relates to German elections (given the possibility of a stark shift in fiscal policy), but then Canada & France have similarly important votes ahead. As such, country risk is going to matter – and market friendly political outcomes can be handsomely rewarded given the starting point & elevated level of uncertainty :

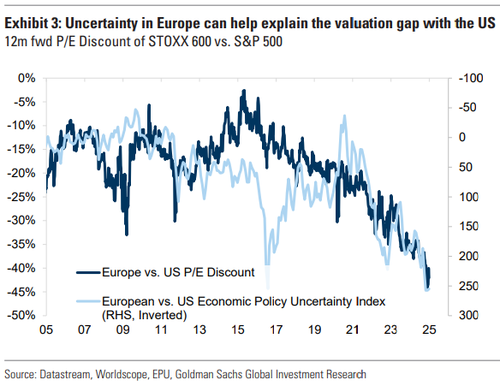

5) I’ll bite my tongue and stay well clear of the dreaded “European outperformance” prediction, but just to borrow from our Europe strategy teams 3rd Jan report, they identify 5 key themes that weighed on European markets in 2024: “trade & tariffs, China weakness, uncertainty in Europe, interest rates, concentration risk”. As per the tone of prior points, I’d be inclined to argue all of these are either “in the price” or set to trough in q1/q2, with German political clarity and a floor around a tariff worst-case being most important. Uncertainty in-and-of-itself is terrible for equity performance (as per chart), but Germany taught us the powerful lesson last year that global winners can re-rate meaningfully irrespective of where they’re listed (SAP +>70% last year; and remember only 15% of CAC40 revenues come from France, and only 22% of FTSE100 revs come form the UK) :

6) So far this year, aside from rates, one thing hasn’t changed: as Nvidia has gone – so has the market (white = Nvidia, blue = MSCI World).

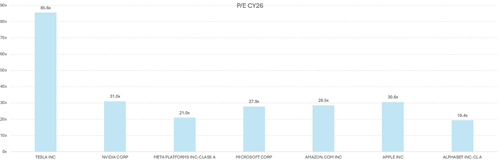

But for the year ahead, I can’t help but revisit the conclusions from Peter Oppenheimer & team’s Nov 18th strategy note: “…focus on diversification to improve risk adjusted returns.” I’d also contend that’s a core theme for portfolios at a macro & micro level; on the latter point – and given how much airtime & investor attention the Mag-7 garner – its worth re head-checking where valuations stand for those behemoth core index-component stocks (fwd P/E using Bloomberg consensus) :

7) Q4 earnings season starts next week – it’ll be fascinating to hear corporate commentary on the outlook, especially on the eve of a new US administration. Despite a likely upbeat earnings outlook (we have 2025 SPX EPS growth accelerating from 8% to 11%), Inauguration events & early Trump policy action are likely to be all important, but even then – I suspect where rates end up stabilizing will remain the key variable for now.