Uddrag fra Goldman/ Zerohedge

Goldman Sachs macro trader, Bobby Molavi notes that the narrowness of the market now too much of a feature to warrant mention as we edge closer to the big 7 accounting for 30% of the market…and a ham and eggs contribution from one of them to offset any momentary weakness elsewhere (this week Tesla’s 20% rally the kicker from a less likely source).

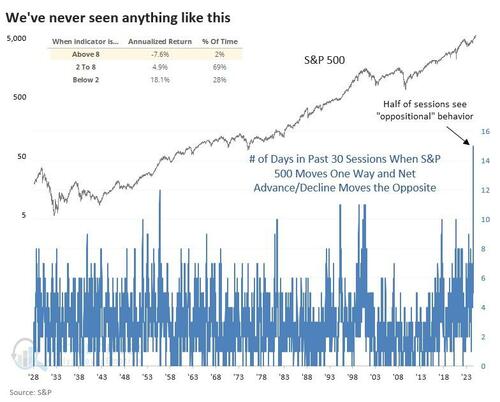

[ZH: As @SentimenTrader noted on X: we’re in a bizarro world:

The S&P 500 index has been doing one thing while its underlying stocks do another.

Anyone with a family member with Oppositional Defiant Disorder can relate to how maddening this can be.

To the greatest degree in history (by far), stocks within the S&P 500 are defiant against whatever the index is doing.]

Elsewhere, a dovish Powell and weaker macro data hardening views of a rate cut sooner rather than later – a 75-80% probability being priced in for a sept cut…

A minor fly in ointment that some are worrying about being the continued slow down in data and consumer trends.

Leading some to wonder… could bad news get really bad and cuts be late and lagging.

The guts of NFP showing weakening in the job market… and I think keeping an eye on that unemployment trend important…absolute levels still low (4.1%) but the trend is steady…and it seems to be ticking worryingly higher.

For me…that means something gives…

- either a proxy releveraging of the consumer (which tends to auger problems later)

- or a shift in consumer behaviour (judging from retail guidance starting to see some of this).

So American exceptionalism and US equities (S&P now up nearly 17%) the trade that keeps working for now….and we climb every wall of worry we face…so far. From a European perspective….over the weekend, a twist no one saw coming. The left ‘won’ in France. An interesting shift from the (ex-UK) momentum the populist Right had been having across the global political framework. Impacts on markets so far muted…as the ‘surprise’ not a left tail…and the event was heavily hedged with over $1bn of gamma being run into the second round offsetting a fair bit of the ‘surprise’. A recent run of ‘tactical own goals’ in the form of political gambles by leaders/parties – early US presidential debate, UK election timing and France snap election. The guts of the result a win for the centre with the centre left and Macron’s party doing much better than forecast. More on this later.

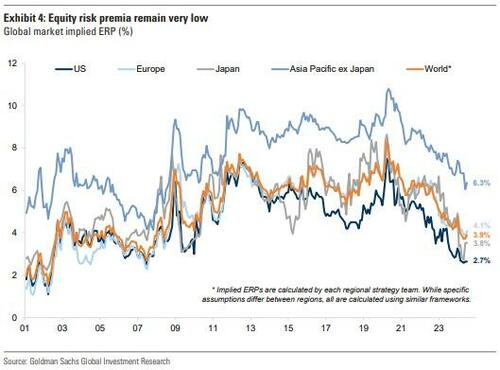

June was a confusing month. One where we’ve had a political shock in France, we’ve had the trajectory (and odds) of the US election upended by a weak debate showing, as well as a landslide victory for the Labour party. We’ve seen a moderate take power in the Iranian presidency, we’ve seen continued conflict in Middle east and Russia/Ukraine….as well as slow down in China. Yet…..Equity markets have shown no sign of weakness. In terms of conflicts, it is somewhat confusing to me that what arguably constitutes ‘escalation’ (Ukraine using US weapons on Russian soil, and Lebanon getting drawn more into a Proxy war) has resulted in no equity risk premia increase. M&A activity has picked up, capital markets activity has slowed (slightly due to some of the geo-political hiccups) and we approach summer and earnings windows and lower volumes/liquidity and possibly higher volatility.

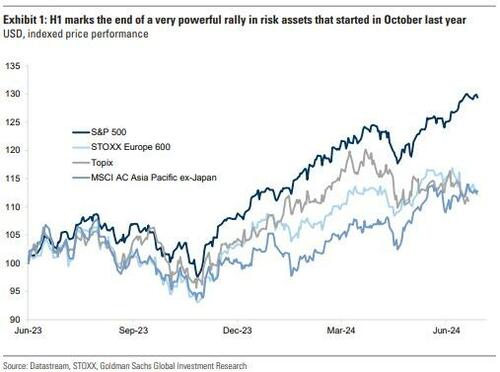

H1 performance.

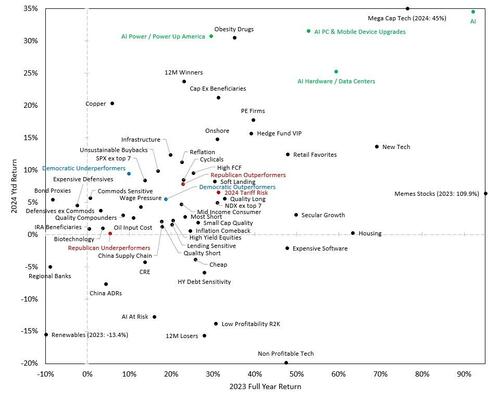

So the first 6 months of the year flew by. A strong performance for most strategies and risk assets. Equity risk premia remains v low and all global Equity indexes performed (in spite of the occasional blips – eg France). The themes of the year have been obvious and extreme – Ai, Ai capex, GLp1, Defence, Power, Copper, Capex beneficiaries, 12 month winners, Momentum, Mega cap tech, Onshoring, Retail favorites, Infra etc with the losers also very clear – Renewables, Low profitability, Ai at risk, Non profitable tech, HY debt sensitivity, China etc. The factor above all others has been momentum….with Size (large over small) not far behind. All of which has resulted in the ‘winners being (Mag 7, Europe banks (in spite of France drawdown), S&P 500, Granolas, US utils, Strang balance sheet over weak , Japan/India, Cyclicals over defensives etc. On the strategy front…it’s rare that everyone makes money at the same time…but H1 2024 is one of those windows – whether it be Long, Passive, Systematic quant, Multo asset, Fundamental L/S….we’ve seen positive scores on doors….a far cry from where we were after H1 2023 post a harrowing Q1 back then. It does feel like Q2 was harder than Q1 but overall….

France.

Too soon to say anything overly insightful here…but already the markets digesting the surprise. The left coalition (far-left + communists + “regular left” + ecologists) came in as the ‘winning party’ with 182-193 seats, followed by Macro’s centrist alliance which arrived with 157-163 with the Le Pen’s RN coming in a surprising 3rd with ~140. No party winning a majority and so now France has to try and figure out a solution without a history of coalitions. OATs marginally wider and French banks indicating down first thing this morning. The Left winning most seats viewed as a negative for the sector…but the key will be how things play out from here (will the left alliance hold up or when tested will we see infighting). In relation to defence, expect a relief rally as the NR majority pull back from Ukraine support now a lower probability. Whatever the forward, it feels more geared to Macron’s stance on Ukraine and defence spending. Our economists also reached the conclusion last week that a hung parliament in France would make the EU Council more likely to be able to mobilize additional support for Ukraine ; “European policymakers are considering how to mobilize additional fiscal support for common defense spending and investment, beginning with EUR 94bn still available within the European Recovery Fund…. Since repurposing the additional resources requires a vote by the EU Council, this option would be more likely if a hung parliament delivered a government more in line with the agenda of President Macron”. Elsewhere…how this impacts the EU council goals on Fiscal centralisation or co-ordination

Relative safe haven.

Who would have thought that a post Brexit UK….fresh of the heels of the ‘Truss budget’ and a huge Conservative defeat and shift to the left with a Labour victory…could now be viewed as one of the more stable regions of Europe?! We have seen fragmentation and/or populism in Netherlands, Italy….we see gridlock/confusion in France…..and we will likely see political shifts in Germany heading into next year. All of this at a time when we see signs of debt to gdp stress and potential fiscal/deficit problems everywhere. All in all…perhaps fragmentations, rolling and breaking coalitions and more regular elections will be the new norm. unfortunately….once again diminishing the EU agenda of trying to coalesce and create a ‘union’ that can compete on a global stage without consistent own goals.

Market structure.

At the heart of what will come, is what has changed. In 2021 $1 trillion was the benchmark for the market ‘leaders’….now we have several at or around $3 trillion. That narrowness means meant that as long as the generals are strong…the rest of the playing field matter little for headline index strength. When you add to that the safe haven aspects of these leaders….plus the buyback support….plus the indexation/correlation momentum chase…you can in part explain how the big…continue to get bigger. As a result we see a growing divergence between what data and the consumers are telling us…and what the market is doing. The market ceasing to be an effective totemic instrument for gauging economy/investor trend/sentiment…as it gravitates towards being the amalgam of 5 to 7 stocks performance more than anything else.

Winner takes all world.

Starting to see the benefits of scale playing out everywhere in a winner takes all fashion. We see it in relation to the US economy. We see it in relation the US stock market. We see it in the biggest companies in the US with their greater than $1 trillion, $2 trillion or $3 trillion market caps. We see it in relation to the biggest banks with more and consolidation and concentration. We see this with asset managers and those that manage $1 trillion aum’s plus. We see it in private equity. Long story short…we are seeing the benefits of scale results in an uneven playing field with greater dispersion between the have…and have nots…and more value accreting to few people, places and/or firms.

Earnings.

We approach the 6 week window where we will see 90% of globally relevant countries report…with the last 2 weeks of July being the focal points with around 30% of Stoxx 600 and S&P companies reporting each week. In terms of Q2 earnings, the consensus is expecting 9% y/y growth for the S&P500, which would be the strongest quarter since 4Q 2021. The biggest six tech companies (AMZN, AAPL, GOOGL, META, MSFT, and NVDA) are expected to see earnings grow 30% y/y, compared with 5% for the rest of the market. A lot has been priced in….especially for the US Mega caps….any disappointments are likely to be heavily punished. Equally, a decent amount of focus going to be placed on signals relating to consumer strength…and segments of the market exposed to China.

PE.

A tale of two halves it seems. DPI remaining a focus and a ‘show me the money’ mindset from LP’s. The lack of a real resumption of exit consistency with certain avenues (for certain assets size/quality) still remaining impaired. To give one stat…US PE exits in the US year to date have hit $141bn…which is around flat year on year. That being said, the rise in backlog and mandates is clearly there. As is the narrowing of the bid/offer btwn buyers/sellers. It feels like the clock has been running and a mindset shift is taking place from protecting marks and hoping for a return to high watermarks towards a need to trade and get the wheels moving again. On the other hand, pro-active activity has definitely taken an uptick. If Q1 was more around CEO refocussing on growth and M&A with corporate strategic accounting for a lot of the activity…then the end of Q2 so a notable uptick of PE led trade sales and P2P activity. US/EMEA take private value hit $61bn in Q2 which is a 4x vs Q1

Womenomics.

An interesting report from our own Sharon Bell looking through the ‘quiet revolution’. The impact of women to the total workforce in Italy, the doubling of female CEO’s in the S&P 500 in the last 5 years….the fact that female board representation is now at 40% in Europe. On the other hand…we are seeing weakness in growing regions like Japan and India across both participation and pay gaps….and a seeming under representation in Tech (and therefor Ai) and Finance. Either way….an interesting read in terms of where we’ve come from…where we are…and where we are aiming to go.

Some charts to finish…

1, Scores on the doors

The first half of 2024 has been one of the best since 1900 for the US market.

Global equities are up 30% from their low in October last year, and the Nasdaq has enjoyed a sharpe ratio of 2.3 over the past year.

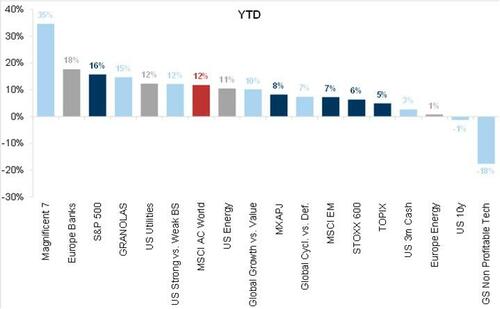

2, The themes of 2024

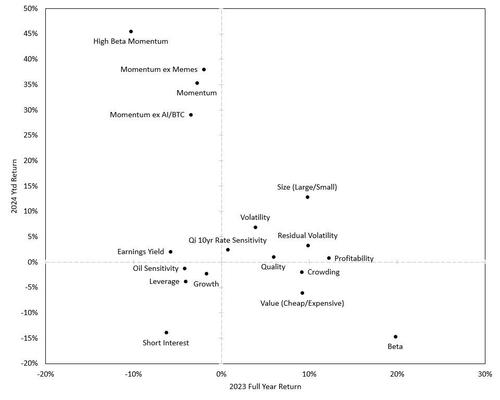

3, The Factor performances of H1 2024

4, The winners and losers beneath the surface

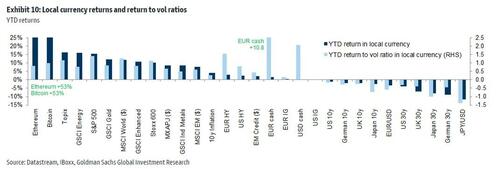

5, A broader view on performance.

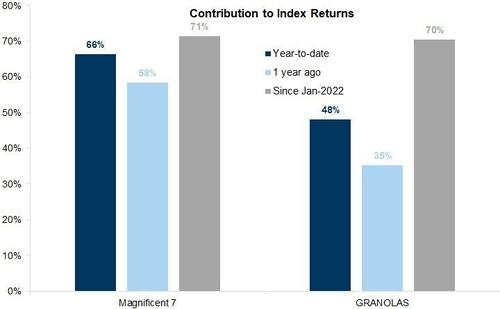

6, Concentration both sides of the pond

7, How important will earnings be.

In terms of Q2 earnings, the consensus is expecting 9% y/y growth for the S&P500, which would be the strongest quarter since 4Q 2021.

The biggest six tech companies (AMZN, AAPL, GOOGL, META, MSFT, and NVDA) are expected to see earnings grow 30% y/y, compared with 5% for the rest of the market.

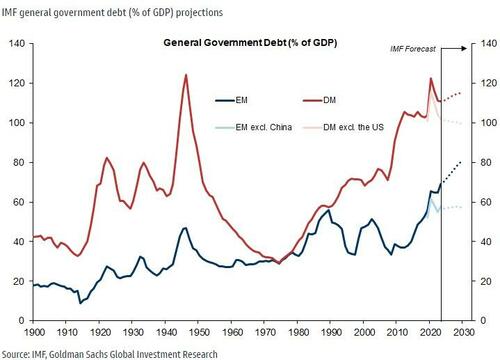

8, Fiscal

Just keep spending; both EM and DM debt ratios are expected to climb driven by the US and China.