By Mark Wilson, Goldman trader and managing director

In a week that contained an abundance of new micro info (from robust US large cap bank results, to an inflection in luxury consumer spend with standout results from both Richemont & Brunello, to confirmation of semi & AI demand trends with TSMC talking up 5yr revenue CAGR of ~20% and AI revenues to double again this year), two larger macro themes dominated markets :

- A break in inflation fears post CPI

- renewed focus on Trump’s imminent 2nd Inauguration and the executive order & policy activity that may follow.

Weaker than feared inflation readings in both the US & UK brought some welcome stability to yields, allowing equities & risk assets to perform and post their best week since Trump’s election victory. As flagged last week, the theme of higher yields isn’t going to go away – it’ll be a perpetual feature this year, partly as the market continues to stress test the inflationary impulse of Trump’s pro-growth agenda, partly because the buyer of sizeable supply is not as obvious as it was before now that CBs have stepped away, Chinese demand wanes (see chart below: white line = China UST holdings, orange = China CB gold holdings, blue = 10yr UST yields), and higher rates drive inevitable discussion of fiscal sustainability.

Nevertheless, with higher yields comes the forcing mechanism of markets which will compel & necessitate greater fiscal discipline, something that has arguably already become apparent in very recent UK political discourse, but which is increasingly apparent in the Trump narrative. The popular post-election narrative of sizeable fiscal expansion under Trump 2.0 (as was seen in Trump v1.0) seems to be quite inconsistent with what we’ve heard from Bessent (& others) of late.

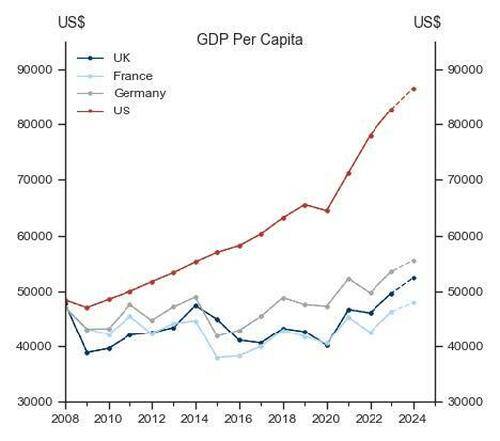

The reason I bring up this point of higher yields and market pricing as a clear forcing mechanism to behavioral change, is that this isn’t just true in fiscal policy. In fact, when we look at European GDP per capita vs the US since the financial crisis, its perhaps unsurprising that traditional Western European mainstream political parties are coming under pressure (judging by current polling data for AfD, National Rally, or Reform).

From this, the obvious question I keep asking – especially in light of early-year European outperformance, and an accompanying clear breakout in European banks post an 8-month consolidation – is can economic pressure, combined with the fallout from renewed US hopium, operate as a sufficient forcing mechanism to drive substantive change in Europe & the UK, and catalyze action outside the US as the global economy seeks to compete & keep-up with the new Trump Administration’s pro-growth agenda?

The weight of evidence increasingly suggests it can; consider that:

- The UK this week followed the US lead, delaying Basel 3.1/4 implementation to 2027;

- Labour government Chancellor of the Exchequer, Rachel Reeves, is widely reported to have shifted stance this week with a message to regulators to shift their focus from risk mitigation to growth promotion (link and link)

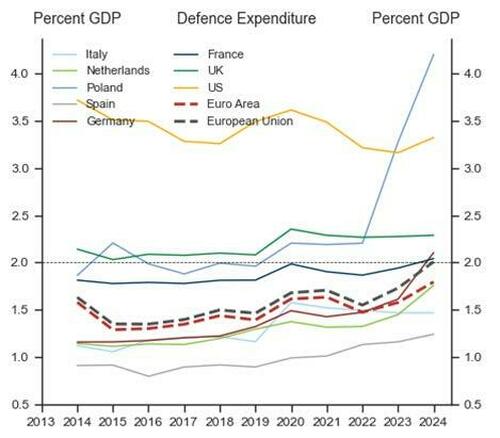

- In defense expenditure, only Poland has yet set targets as ambitious as Trump’s suggested “5% of GDP”, but EU spend is already up 50% from recent lows and will continue higher:

- London listed multi-industry Smiths Group broke-out Friday to new all-time highs following news of a rare US activist shareholder ownership with demands for more aggressive & proactive approach to shareholder value creation.

- This follows press reports (here) that Glencore & Rio Tinto have held merger talks around what would be the world’s largest ever mining merger. With BHP/Anglo’s block on ongoing negotiations now expired, the noise around much-needed consolidation across resource sectors – that have outsized weight in European indices – will only increase.

- Benefittng from US economic strength, as well as unexpected stability in Asia sales trends, Richemont led European luxury higher – with Richemont trading to new al-time highs:

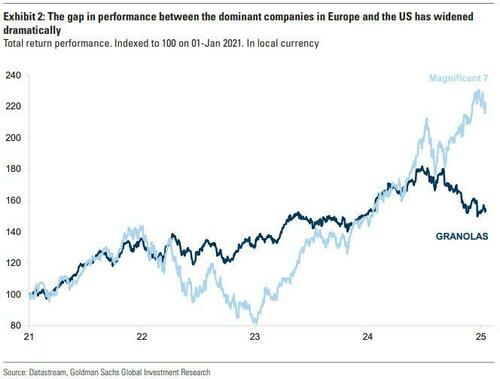

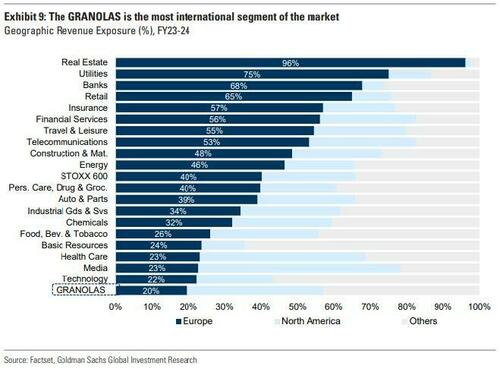

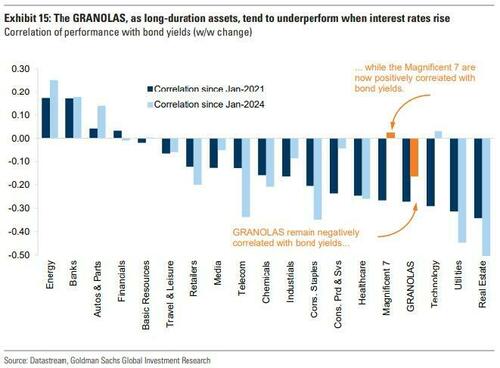

And – helpfully for European indices – after a period of the largest index constituents (GRANOLAS) underperforming the index (chart 1), their de-minimus domestic European sales exposure (chart 2) and negative correlation to bond yields (chart 3) is likely to prove advantageous in the current economic & rates set-up: