Uddrag Goldman/Zerohedge:

As Goldman tech trader Peter Callahan writes in his daily market post-mortem, today was a “very tough session, that saw: 1) extreme pressure across the software space (largest 1d move lower in ~2 years), 2) a big reversal in recent Momentum winners (NVDA / FICO / IT / DELL / MU types down -4%), and 3) sneaky outperformance of defensives, specifically (names like VZ, T, AMAT, SBAC, CMCSA up +2-4%).”

Here are some more details from Callahan’s note:

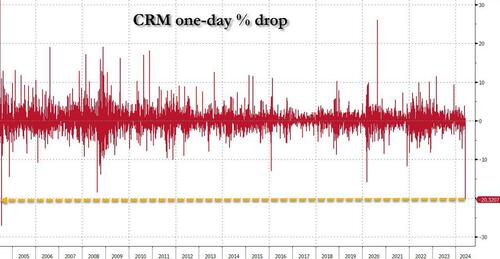

- Software was clearly the focus today with CRM -20% on the day (worst day in 20+ years), which set the tone early and appeared to trigger what felt like capitulation across the group – albeit evidenced more by price action, volumes & investor feedback than by our high touch flows. Directional moves made sense to most, but several of the move magnitudes seemed to surprise (e.g. I have never seen a name like name like NOW or CRM trade down 10%+ on a “read-through”) – especially given local positioning (cleaner) and YTD price action (big laggard). Said another way, wasn’t some of this priced in?!

- To me, not a lot of room for ‘nuance’ today as it felt like Software price action was informed by mounting frustration around the group (has been building over last 3-4weeks) as CRM (& PATH) added to concerns that the (further) slowdown in 1H software spending may have moved out the goal-posts on the timing of any recovery / reversion in the group (makes 2H ‘recovery’ harder to underwrite). On this point, there remains a healthy debate and dialogue on how to explain these weakening software trends juxtaposed against accelerating public cloud trends and a broadly upbeat macro narrative (open to satisfying views / explanations); for reference, most oversold names in software (as measured by 14-day RSIs): WDAY 20, FIVN 22, BL 23, BILL 28, TEAM 29, ADSK 30.

Top inbounds today .. any ‘logical’ explanation for NOW -12% on a read-through? … HPQ up 17% today? (best day in 11yrs on a reit of guide) .. feedback on OKTA down -8%? Wasn’t that good enough? Weakness in memory today (esp WDC, MU)

CRM -20%: worst day in 20 years as name fell to ~$220/shr (or ~20x P/E on cons ~$11 of ’25 EPS — sandwiched between ORCL at ~18x an ADBE at ~22x) as the market worried about the potential for CRM to dip into ~HSDs topline growth band (FY guidance cut to “slightly below 10% y/y” on a reported basis). Debate today was about: 1) what is the right normalized growth rate for CRM (its not that long ago that this was a 2-handle topline grower), 2) how much of this is CRM specific versus just a macro issue ? .. 3) what is the next catalyst and when do you feel better about a topline recovery? .. 4) do you even ‘need’ topline to come back for the stock to work at this price?!

GS Semis Conference .. takeaways from GIR on today’s sessions ..

- ENTG .. discussed 1) the overall semiconductor unit and capex market outlook, 2) key technology inflections that are expected to support Entegris’ outperformance vis-a-vis the market, 3) primary focus areas following the integration of CMC, 4) margin outlook and 5) capital allocation priorities.

- Ampere Computing (private) .. Ms. James – highlighting Ampere’s power-advantage vis-a-vis traditional x86 CPUs and GPUs – noted that growing power constraints in the Data Center will play to the company’s advantage and that, within the context of AI, the company is well-positioned to play in the Inference and SLM Training markets in the medium to long term. From a demand perspective, while Ms. James believes the general-purpose server CPU market has bottomed following an unprecedented decline in 2023, she was reluctant to predict the timing and shape of the recovery.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her