Uddrag fra Goldman/zerohedge

Goldman Sachs is out with a comprehensive look at four scenarios for the new Covid-19 ‘Omicron’ strain, which at present appears to be less severe, yet possibly more virulent than previous strains.

On Friday, the World Health Organization declared Omicron as a ‘variant of concern’ after several confirmed cases in South Africa and elsewhere, causing markets to panic into the weekend. The new variant has approximately 30 mutations to the spike protein over the Alpha strain, making its effects, and spread, difficult to predict at this point.

As Goldman notes, “The transmissibility, degree of protection from vaccines and prior infections, and disease severity of Omicron will shape its potential economic impact…”

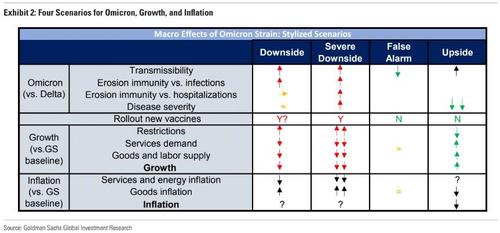

To that end, analyst Daan Syruyven and team have come up with four scenarios for OMicron and the global economy.

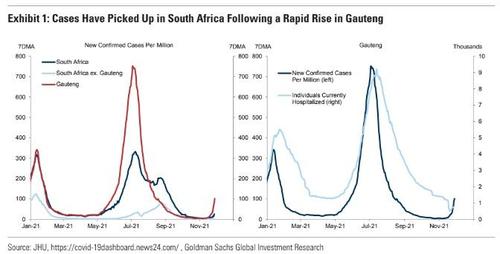

1. Downside scenario: Omicron transmits more quickly than Delta, and evades immunity from vaccines and prior infections. In this case, Omicron unseats Delta as the dominant strain, as well as “evades immunity against hospitalizations only slightly more than Delta, and causes similarly severe disease.” As far as economic impact, it would result in another large Q1 infection wave across various economies, resulting in a global growth slowdown to a 2% q/q annual rate – 2.5pp below Goldman’s current forecast.

2. ‘Severe downside’ scenario: This less likely scenario would see both disease severity and immunity against hospitalizations substantially worse than with Delta, and would have a worse economic impact than the 1st scenario. The economic impact would of course be worse, while “The net overall inflation impact is again ambiguous although the moves in energy and services inflation(down) and in goods inflation (up) are larger.”

3. False alarm scenario: Omicron is a nothingburger – and spreads more slowly than Delta. It has no significant effects on global growth and inflation.

In this scenario, the sharp rise in reported Omicron cases in Gauteng may reflect skewed sequencing, other data issues, or superspreading events. Finally, any ability of Omicron to outcompete Delta in South Africa does not necessarily carry over to other geographies with higher vaccination/lower prior infection rates

4. Upside scenario: Here, Omicron is slightly more transmissible than Delta but causes much less severe disease. This speculative ‘normalization’ scenario would result in a net reduction in disease burden on various systems, leaving growth higher than in Goldman’s baseline. In this scenario, inflation is likely to decline more quickly than the baseline scenario because of a rebalancing of demand from goods to services, along with an accelerated recovery in goods and labor supply.

In Conclusion, Goldman notes that Omicron ‘could have sizeable growth effects,’ however the range of medical and economic outcomes remains unusually wide. Because of this, “we are not making Omicron-related changes to our growth,inflation, and monetary policy forecasts until the likelihood of these scenarios has become somewhat clearer.”