Uddrag fra Goldman

Goldman’s Prime Broker data suggests that hedge funds bought the dip in North America yesterday (driven by single stocks purchases, largest 1day buying in 5 months).

By sectors we saw buying in tech + defensives (hcare, staples, utilities)

But, as top Goldman trader Brian Garrett warns in a brief note to clients this morning, “we are still very much in adult swim territory.”

He goes on to note that, as someone mentioned to him yesterday, this doesn’t feel like merely a “12 hour correction.”

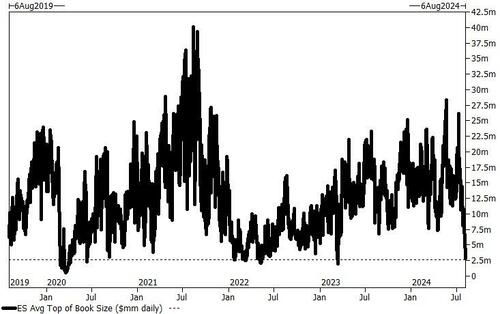

Liquidity is very low…

Market liquidity as measured by top of book es1 is at one of the lowest levels in years

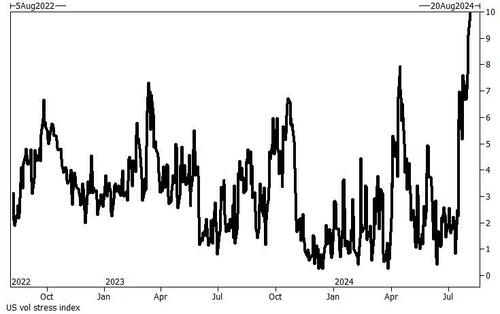

Stress is very high…

The “US stress index” aka panic, registered 10 out of 10 going home last night

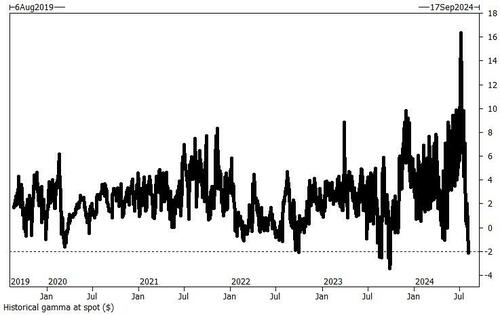

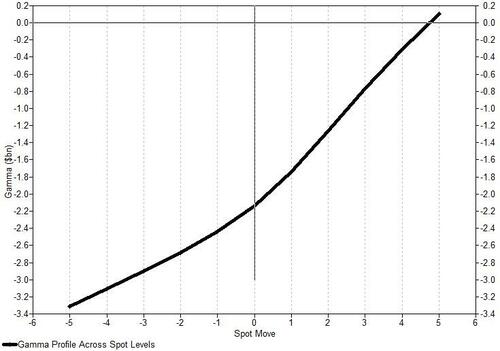

Street gamma is short (with no respite in sight)…

Short $2BN…

…there is no respite in sight… even on a 10% rally, the modeled gamma goes from -2bn to only marginally positive … dealer long strikes are too far OTM down here

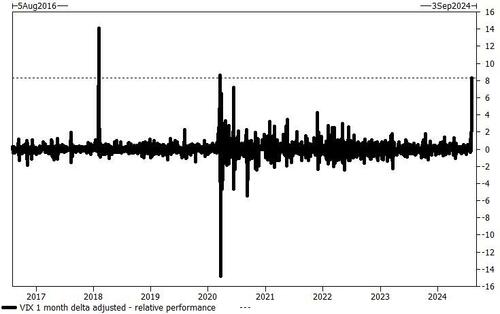

The changes in implied vol relative to history is extreme…

The delta adjusted move in VIX yesterday was third largest in our data set … if this were struck intraday, it would have been much higher

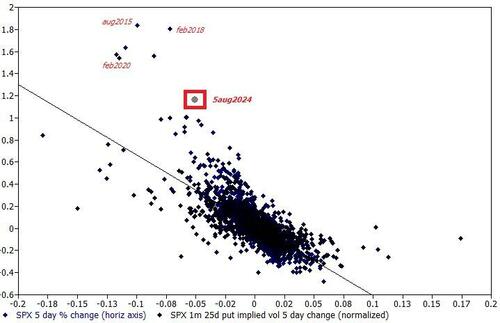

…percent change in spx (5day) vs percent change in 1m put vols (normalized)

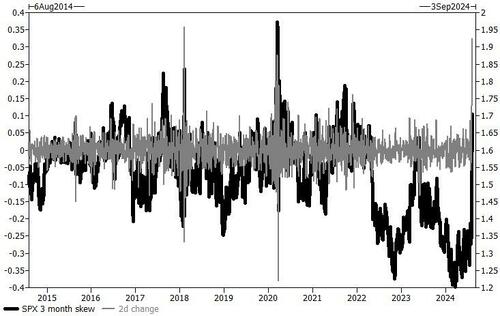

…change in 3 month spx put vol skew – absolute and 5d change

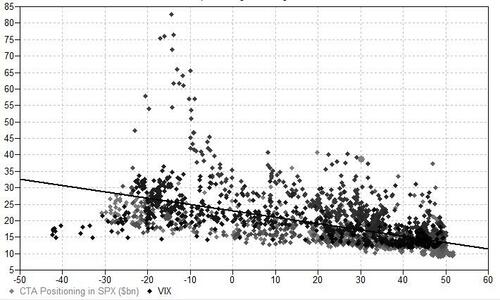

Systematics are still very full relative to volatility levels…

cta positioning in SPX vs VIX spot … with VIX here, CTAs have tended to be net short SPX vs currently long $30bn

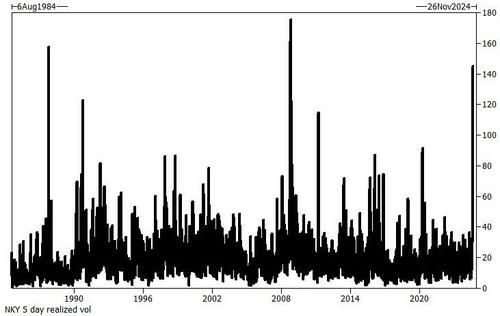

And, last but not least, NKY realized vol ~150 (!)

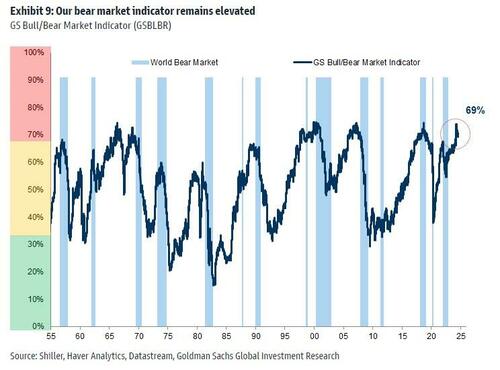

While the correction over the past week has tipped our fundamental Bull/Bear indicator over from its highest levels at the start of July, it remains elevated.

This index comprises six fundamental factors that, when all are at extremes together, tend to flag heighten risks of a bear market or period of low returns. High valuation and rising US unemployment from a low level are two of the components that are most stretched, and suggest that we are not out of the woods yet.

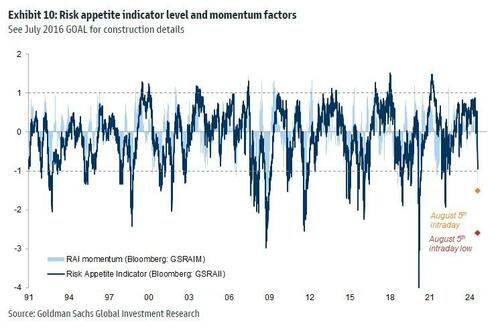

Goldman’s tactical indicator, the Risk Appetite Indicator, RAII, tells us more about positioning, with sentiment having adjusted more quickly.

At this stage, however, it seems likely that the unwind has further to go in the short term.