Uddrag fra Goldman:

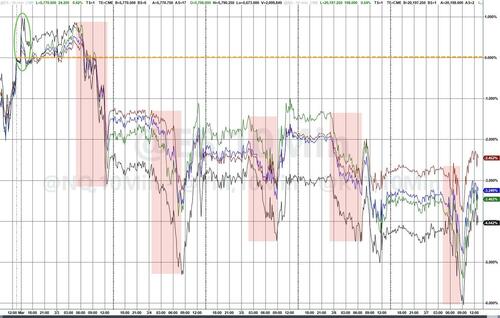

Stocks suffered their worst week in six months as an avalanche of geopolitical and macro-economic headlines crossed paths with an ugly technical situation.

Here are Goldman’s Top 10 reasons to be fearful…

1) Growth Concerns (payrolls + ISM manuf.. follows weak confidence readings)

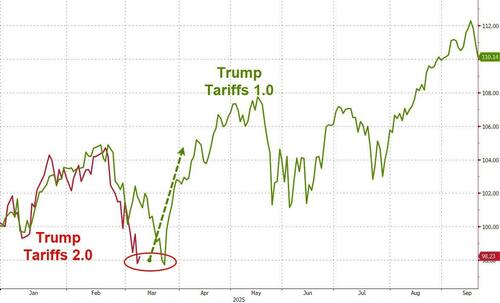

2) Tariff Fatigue magnified by thematic re-pricing in AI

3) Global Complexity (Ger & Fra Yields breaking out + China higher again on JD, BABA QwQ-32B AI Model)

4) Technicals Weak (SPX flirting with 200dma 5732, counterbalanced by most major indices & single stock bellwethers approaching technically “oversold” levels)

5) Systematic Supply (CTAs have sold almost $60bn of US equity delta in the last week, ~30bn SPX)

6) Positioning Elevated (HF Gross Leverage rose +1.1 pts this week and sitting in 100th percentile vs past 1-year // Nets remained ~flat and in 47th percentile vs past 1-year)

7) Liquidity very challenged making new lows

8) LO Risk Reduction (seen in relative out-performers such as HCare, Utilities, & Semis)

9) Consumer Woes (think: ANF, FL, ROST, VSCO, Cruise lines, etc.)

10) Poor Seasonality (bounce set up for 3/14)

From a flow perspective:

- Asset managers were steadily reducing risk in relative out-performers and started rotating into defensives late in the week (staples, telcos, and insurers).

- LOs finished -$5b net sellers while

- HFs finished +$1.5b net buyers, consistent with the flavor of last week’s activity.

From a sector perspective, only Healthcare was green on the week with Financials proper fucked…

- Largest Sell Skews: Tech, Financials, & Discretionary

- Largest Buy Skews: Comm Services.

However, as we detailed earlier, there is some potential silver lining for the bulls.

…as the Goldman trading desk writes overnight, “CTAs have sold 47bn global in the last week. Our calculations show 1w flat tape = 40bn to sell // 1m flat tape = 43bn to sell. The fact that the “flat tape” sell expectations over a month and over a week are almost the same, means that with spot here – this technical supply will be largely finished by next week.”

Which means that the avalanche of selling from the CTAs, which as we explained previously was the key trigger for the current market rout, is almost over. The question then will be whether corporate buybacks – which are currently running in full force at about $5BN per day – will have sufficient impact to turn the meltdown around.

But we do note as an aside that the S&P and Nasdaq bounced back up to their 200DMAs today after breaking below with some claiming comments from Fed Chair Powell prompted it – which is somewhat ridiculous since he said nothing new, affirming no rush to cut rates (which implies this is not The Great Depression maybe?)…

“Despite elevated levels of uncertainty, the US economy continues to be in a good place,” Powell said at an event Friday in New York hosted by the University of Chicago Booth School of Business.

“We do not need to be in a hurry, and are well positioned to wait for greater clarity.”

“The costs of being cautious are very, very low,” he said.

“The economy’s fine. It doesn’t need us to do anything, really, and so we can wait and we should wait.”

Momentum’s meltdown continued to accelerate this week – now down almost 20% from its highs…

Source: Bloomberg

AAPL remains the lone company with a market cap above $3 trillion as NVDA has lost $1 trillion in market cap this year and TSLA has tumbled almost $700BN…

Source: Bloomberg

Hedge funds continue to feel the pain with huge drawdowns in their most-held stocks…

Source: Bloomberg

Tariff-on, tariff-off… but we note that while stocks were pummeled, the peso ended the week higher…

Source: Bloomberg

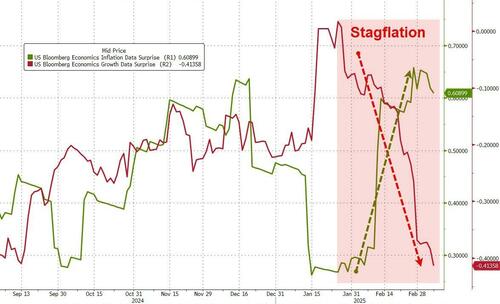

…suggesting the equity market is fearful of far more than some marginal tariff tensions. Macro data this week broadly speaking reinforced the growth scare (red line below) but worse still for the more PhDs in The Eccles Building is that inflation anxiety is back way up – stagflation is back bitches…

Source: Bloomberg

Treasury Secretary Bessent echoed the sentiment of President Trump and Elon Musk who have both recently warned of some short-term pain…

“The market and the economy have just become hooked, and we’ve become addicted to this government spending,” Bessent said.

“There’s going to be a detox period.”

As Bloomberg’s Ed Harrison noted, that’s good news for bond investors, but bad news for stock investors because it suggests a calibrated risk strategy to get the “bad stuff” out of the way first via tariffs and government spending cuts before any deregulation or tax cuts kick in.

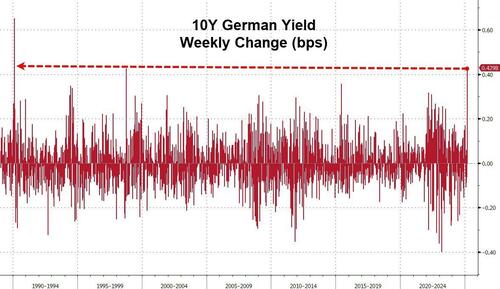

But, the timing is tricky and not helped by the fact that the German bond market blew up this week…

Source: Bloomberg

…and likely trigger VaR shocks around the rest of the world…

Source: Bloomberg

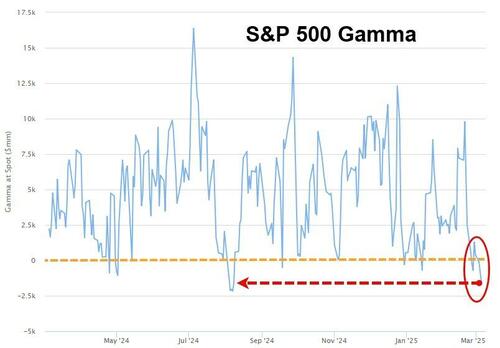

And if you really want to rub the salt in the wounds of levered longs, market gamma swung negative, implicitly exacerbating any move (up or down)…

Source: Goldman Sachs

And despite Fed Chair Powell playing down any need for speed to move on rates anytime soon, markets moved expectations significantly more dovish this week (now pricing in 3 full 25bps cuts by year-end)…

Source: Bloomberg

Quite a disconnect between bonds and stocks this week (both clubbed like a baby seal)…

Source: Bloomberg

Treasury yields were all higher on the week (contagion from Bunds blowing out overwhelming any growth scare), with the long-end underperforming (not what Trump or Bessent want to see)…

Source: Bloomberg

…which steepened the yield curve, dis-inverting the all-important 3m10Y spread…

Source: Bloomberg

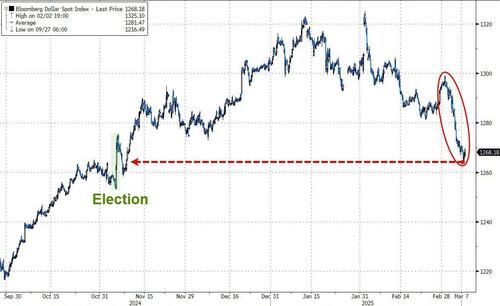

On a relative VaR basis, excluding bunds, the dollar was the worst performing asset on the week, smashed down over 2% – its worst week since Nov 2022…

Source: Bloomberg

Bitcoin managed modest gains on the week (Friday equity close to Friday equity close) even as Trump’s Strategic Bitcoin Reserve disappointed some with its lack of ‘new buying’…

Source: Bloomberg

Is bitcoin ready for its next leg to record highs? Or do we dip more first?

Source: Bloomberg

Gold was the best performing asset on the week (up 9 of the last 10 weeks), but we note that gold’s strength was all on Monday and Tuesday after which it trod water around $2910…

Source: Bloomberg

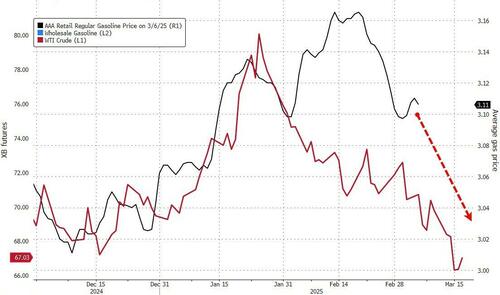

Oil prices fell for the – drum roll please – 7th week in a row with WTI solidly below $70 (testing their lowest since May 2023 intraday)…

Source: Bloomberg

That’s good news for Americans who should see gas prices tumble further…

Source: Bloomberg

Finally, is it time to BTFD?

Source: Bloomberg

Well it was in the peso… but maybe this time is different and stocks are falling for non-tariff-anxiety reasons. Are more traders starting to realize that Bessent’s desire to bring the long-end yields down necessitates a rapid and sharp recession?

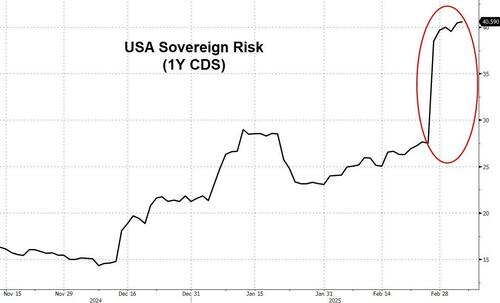

Or are they worried that the US Govt shutdown is imminent…

Source: Bloomberg

…and this time may not be resolved so fast!

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her