Uddrag fra Goldman/ Zerohedge:

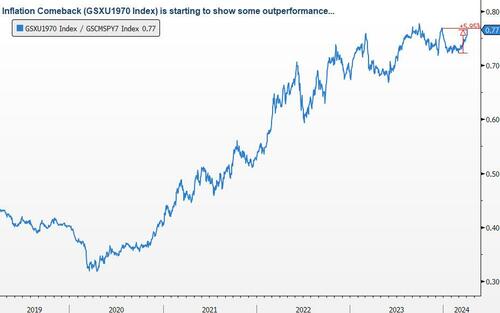

According to a new basket introduced last week by Goldman Sachs, called simply the GS1970 Inflation Comeback basket (GSXU1970), traders are now rewarding stocks that would benefit from a return of the inflationary tsunami of the 1970s. In other words, the market is confident that a second, far more dangerous wave of inflation is about to be unleashed.

Here is Goldman’s Thematic Trader Louis Miller introducing the 1970s basket, excerpted from the latest Goldman weekly rundown note

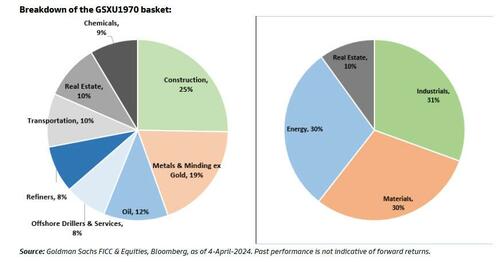

Introducing the GS 1970s Inflation Comeback basket (GSXU1970) which is composed of real economy industries that have outperformed the market when inflation resurged in the late 1970s: including oil, mining, fabricated products, transportation, construction, and real estate. The basket is liquid at $300mm at 10% ADV.

Despite falling inflation, the backdrop for these inflation oriented stocks is uniquely good. The lack of investment interest has led to disciplined management teams that are shareholder focused, and valuations, balance sheets and return of capital provide support while waiting for inflation or global growth to inflect, while US growth is above trend. If capacity or supply becomes a problem, suddenly these companies can over-earn, and the status quo of high free cash flow is pretty solid. Moreover, these companies tend to perform well when Mag7 underperforms, providing portfolio benefit, and also do well during geopolitical flare ups, which have occurred.

And an excerpt from Miller’s latest Movers and Trending analysis published over the weekend

A stream of pro-cyclical prints is supporting pro-reflation rotations. A high nominal growth and high inflation backdrop is good for commodity, and high return on capital cyclicals. Oil Majors GSXEBOIE and miners GSXEMINE broke the down trend in sympathy and our High Free Cash Flow basket GSPUFCFP & GSPEFCFP are starting to wake up, as a function of getting paid to wait for inflation or global growth to inflect.

In a sense you could argue that years of above growth trends and lack of investment interest has led to disciplined management teams focused on delivering shareholder capital. Besides, those companies are well positioned to over-earn and expand margins if capacity becomes a problem. High oil input costs stocks GSXEOILX, GSXULOIX and China reflation exposed cyclicals GSCBCNHY could be worth fading for beta neutral expressions.

The trading desk’s punchline: “The desk likes our reflation comeback basket GSXU1970 to express the extension of this trend.”

Which is hilarious, because if one listened to Goldman’s research desk, inflation will collapse under its own weight and by the end of 2024, it will barely be above 2%. It must not feel very nice for Jan Hatzius and his team to know that their own trading desk is taking the other side of their reco.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her