Få fri adgang til alle lukkede artikler på ugebrev.dk hele sommerferien:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, der udkommer igen til august

Uddrag fra Goldman/ Spotgamma og Zerohedge

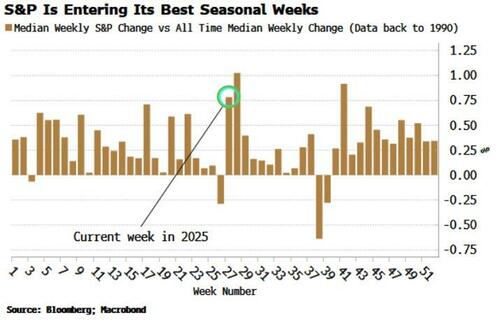

While the world and his pet rabbit is now aware of the current strong seasonals for stocks…

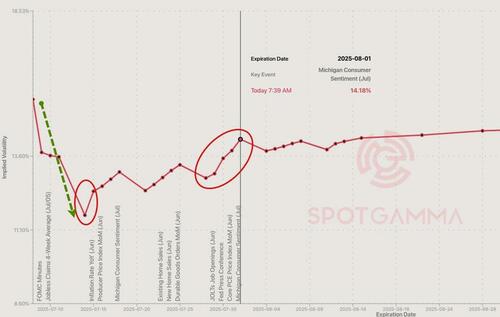

… next week could well be a turning point given the slew of data, OPEX, end-of-month FOMC, and then the 8/1 tariff deadline – which is where implied vols peak…

As SpotGamma notes, this doesn’t have to be point at which the market drops sharply, but the conditions will be ripe.

The argument is that these are all “second half of July” problems, and so 0DTE traders can come out and (attempt to) harvest vol until then.

In the short-term, Goldman’s Nelson Armbrust highlights something crucial for all traders, not just 0DTE maniacs.

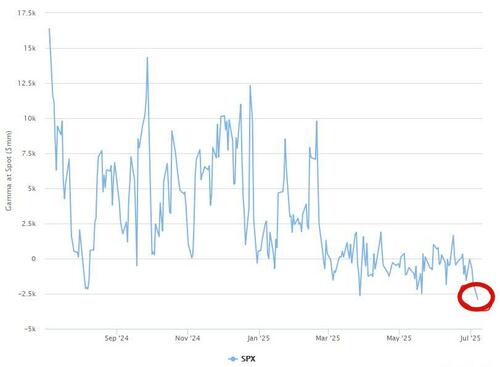

It;s been a while since I wrote about Gamma, because it has been flattish for a few months now, versus a historical long of $4-6bn.

Well, the market is now short -$3bn of Gamma…

… which means that for every 1% move in the S&P dealers have to trade $3bn of S&P futures in the same direction the market moves to adjust their gamma.

This large negative gamma profile exacerbates market moves and therefore increases intraday volatility.

On the bright side, liquidity (as proxied by S&P futures top of book depth) has been rising steadily and is now at $18.3mn versus a 3y average of $11.9mn, which means the impact of the short gamma will be smaller as liquidity is quite solid at the moment.

Frankly, this is quite surprising given we just entered into US summer and my emails are getting multiple OOO messages.

Finally, SpotGamma sees 6,300 as resistance and warns that if SPX breaks 6,200 at any time from now through the window to the end of the month, we will flip to risk-off (and negative gamma works both ways, remember).

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her