Uddrag fra Goldman Sachs:

Goldman Sachs chefanalytiker Hatzius and his team of analysts assert that their note, titled “US Economics Analyst: 10 Questions for 2025,” addresses the most critical questions—with answers—clients need to prepare for the new year, especially in an era under Trump, with policies that diverge significantly from those of the Biden-Harris administration.

Here are ten key questions the analysts asked, along with our summarization of each for the sake of time. The full note is available to Pro Sub…

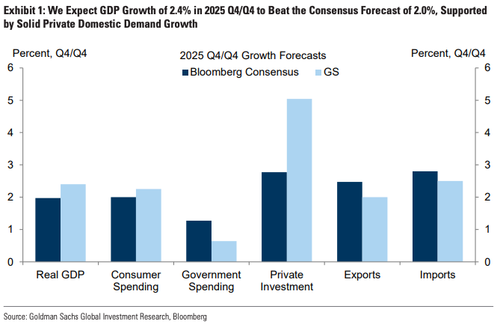

1. Will GDP grow faster than consensus expects?

Yes. The analysts expect 2.4% Q4/Q4 GDP growth for 2025, above the consensus of 2%, driven mostly by robust consumer spending, strong real income gains, and healthy business investment.

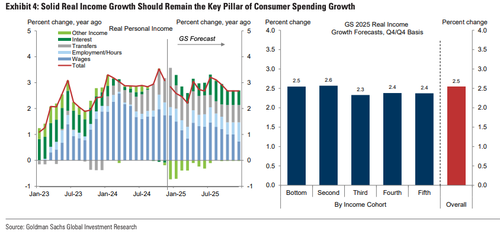

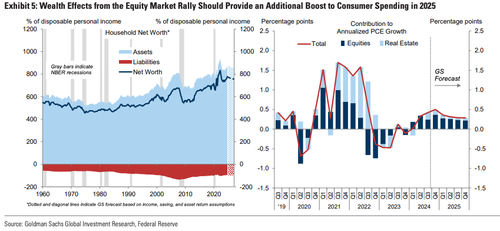

2. Will consumer spending growth beat consensus expectations?

Yes. The analysts expect consumer spending growth of 2.3% in 2025, consistent with trends from prior years. A couple of key drivers include a healthy labor market and wealth effects. These factors are expected to remain solid in 2025.

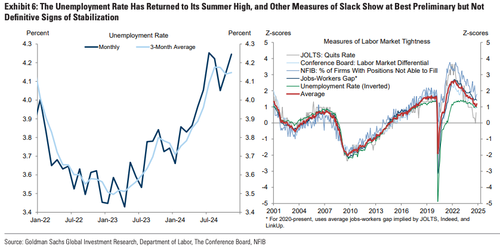

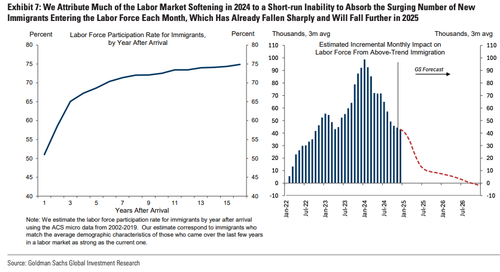

3. Will the labor market continue to soften?

No. The analysts highlight a labor market that, while slightly softer than in previous years, remains strong by historical and international standards.

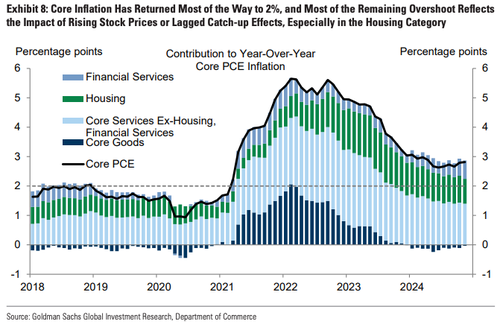

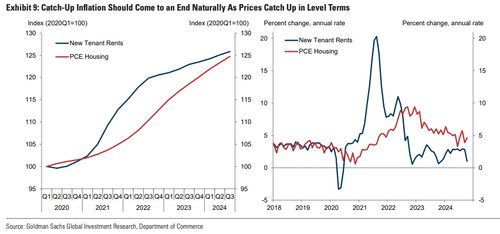

4. Will core PCE inflation net of tariff effects fall below 2.4% year-on-year?

Yes. The analysts forecast that inflation will continue to decline toward the Federal Reserve’s 2% target by the end of 2025, with the underlying core PCE inflation trend expected to reach 2.1%, excluding tariff effects. Including tariffs, inflation may rise slightly to 2.4%.

They noted that cooling wage pressure, easing catch-up inflation, and stabilizing financial services are some of the key drivers of this outlook.

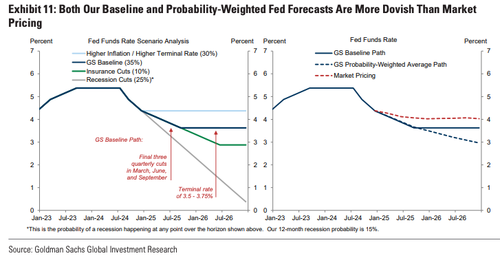

5. Will the Fed cut at least another 50 bps?

Yes. The analysts expect the Federal Reserve to push through three additional rate cuts in 2025, likely in March, June, and September…

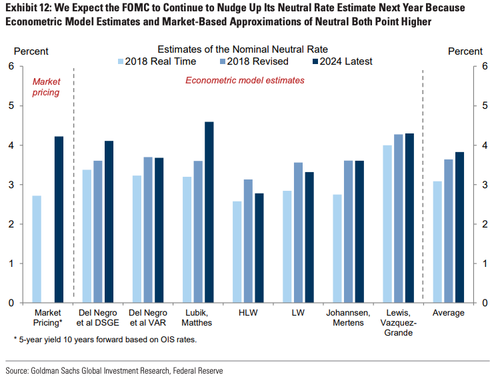

6. Will the FOMC’s median neutral rate estimate rise from 3% to at least 3.25%?

Yes. The analysts expect the Federal Open Market Committee to continue raising its estimates of the neutral interest rate in 2025.

7. Will President-elect Trump try to fire or demote Fed Chair Powell?

No. The analysts do not expect President-elect Trump to attempt to remove Fed Chair Powell despite potential tensions between Trump and the Fed.

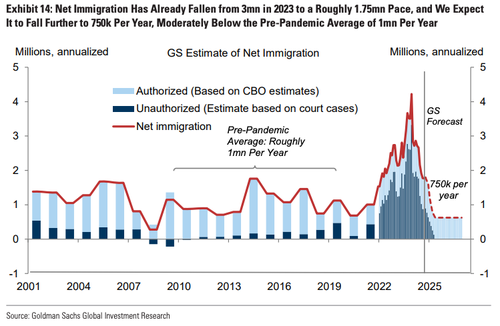

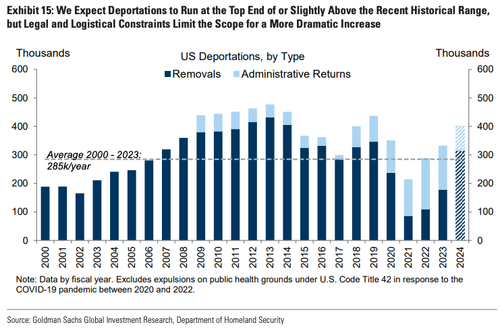

8. Will net immigration turn negative?

No. However, the analysts expect net migration will slide to about 750,000 annually, consisting entirely of authorized immigrants, while the unauthorized immigrant population remains flat due to deportations offsetting inflows.

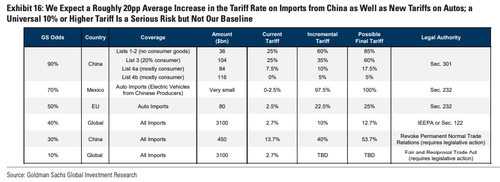

9. Will the White House impose a universal tariff?

No. Analysts expect President-elect Trump to raise tariffs on imports from China and autos but view a universal tariff on all imports as an unlikely baseline scenario.

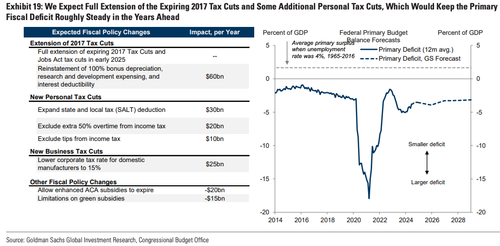

10. Will Congress meaningfully reduce the primary deficit?

No. The analysts do not expect a meaningful deficit reduction in the near term…

The note from Hatzius and his team offers clients a complete framework to navigate the economic landscape as Trump prepares to take office in the coming weeks and implement major policy shifts that could reshape economic outlooks.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her