As the inauguration of Donald Trump looms, Goldman Sachs trader Lindsay Matcham asks (and answers) some key macro questions:

What Are We Expecting With Regards To Tariffs?

David Mericle:

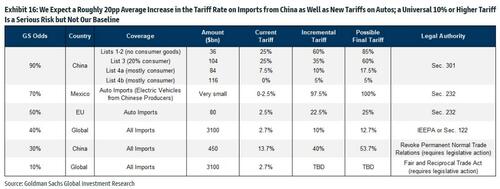

We expect President-elect Trump to increase tariff rates on imports from China by average of 20pp – less for consumer goods but by as much as 60pp for non-consumer goods – and to impose some additional tariffs on auto imports (Exhibit 16).

A universal 10-20% tariff on all imports is a serious risk – we give it a 40% probability – but is not our baseline.

We think the White House will prefer to avoid the potential economic costs and political risks associated with a universal tariff.

What Macro Regime Are We In Now?

Bullish + Risk Asset Friendly

The soft CPI print puts PCE YoY at 2.78% and the 6month annualized trend of core at 2.3% which is the lowest levels seen recently.

This should put Powell in a more comfortable spot of managing the labour market and the economy vs being focused on inflation = risk asset friendly

Source: Bloomberg

So back to inflation under control (for now), growth positive and an easing FED moving forward (data dependent of course) = risk asset friendly

How Is The Market Trading Going Into The Inauguration?

Soft CPI Moves

Played out largely as expected other than the US2S01S bull flattening (yields lower / lower in the back end) vs the bull steepening I was expecting (lower yields in the front).

Yields and the USD moved lower driving equities and gold higher.

Bull flattening vs SPX + gold higher post the soft CPI:

Source: Bloomberg

Strong Phily Fed Print = Rotation Out Of Tech & Into Cyclicals

The Phily Fed business print was very strong yesterday, and it’s a good pre-cursor to the ISM Manufacturing prints so it bodes well for the business cycle going forward.

As a result yesterday we saw a rotation out of Megacap which is less of a value play during a cycle, and into cyclical sectors including industrials, financials and materials.

Lots of interest in metals, financials and small caps in a reflationary environment and manufacturing pick up. US Nat gas sectors are also an improving ISM play which finished top of the pile yesterday.

Cyclical outperformance post the Phily FED yday:

Source: Bloomberg

Feels Complacent

As I type equities are rallying, credit spreads are tightening and vols and the cost of SPX protection are grinding lower which feels complacent going into an inauguration where there are a number of different outcomes. Having said that there has been some hedging and risk off going in.

Headlines hitting today *TRUMP: CALL WAS A VERY GOOD ONE FOR BOTH CHINA AND THE US bidding up risk and driving USDCNY lower.

Currency markets (USDMXN, USDCAD) look to be pricing tariffs as a negotiation tactic vs aggressive implementation imo (more below)

We think USDCNY goes to 7.5 over the next 6 months but keep an eye on the price action. If China decides to protect their currency and not de-value as much, the US consumer will feel the tariffs and add to inflationary pressures in the US.

USDMXN & USDCAD possibly pricing complacency?

Source: Bloomberg

Market Reactions?

Plays For An Aggressive Tariff Outcome = Equity Downside / Bid For Bonds / JPY Strength / USDMXN & USDCAD Higher / VIX Calls / EEM Puts

As above it does feel as though the market is underestimating an aggressive tariff outcome which would trigger the below moves imo:

Unsurprisingly will result in equity risk off. If you think Trump goes in aggressive short term downside makes sense with vols so low post CPI

Risk off will result in a bid for bonds (as it did in 2019), potentially bull flattening curves. This despite the tariffs = yields higher narrative

- JPY strength vs CAD and EUR look attractive

- Short EURUSD to parity

- Long USDCAD, USDMXN (making moves as I type)

- VIX Calls

- EEM Puts

Short USDJPY at 156 could be a good risk off play post an aggressive tariff outcome, especially with the BOJ expected to hike later this month:

Source: Bloomberg

Clearing Hurdle

Anything that isn’t aggressive will be a risk on event. Investors have been reluctant to deploy capital given the uncertainty so once out the way and not an aggressive outlier, I believe it’s a risk on event, especially given we are back in a bullish risk asset environment post CPI.

Look for longs in Trump trades that have unwound, EU USA Exposure, EU Luxury, and longs in copper and gold.

What Trades Do We like?

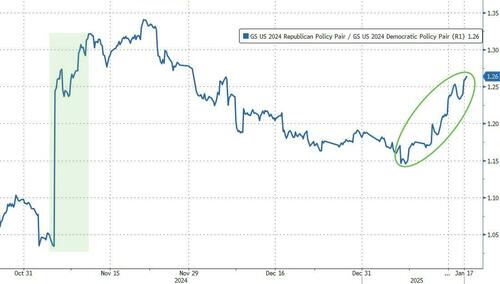

Go Long Our Republican Pair Basket

A number of election-related trades have unwound in December, some have given up to all gains since election day.

Our desk believes this presents a potential opportunity to position in our long/short Republican pair (GSP24REP Index) especially if we see more concrete action on policies floated throughout the campaign by the Trump administration shortly after the inauguration and thereafter.