uddrag from Goldman’s head TMT specialist, Peter Callahan,

As Callahan writes, the Nasdaq is now up 4 days in a row, registering new ATHs (again) amidst a relentless underlying bid across markets (the NDX has had only three >1% daily declines in the last 2+ months) with the core tenets of the recent rally still intact:

- Rapidly improving Macro sentiment (geopolitical conflicts easing + a full rate cut now priced in for Sept + tariff angst on the back-burner) = Goldman’s Financial Conditions Index at YTD lows (easiest all year)

- Continued enthusiasm around the AI trade with visibility extending out to 2026 (NVDA break-out trade fueling the group higher)

- Underweight positioning into quarter-end (L/S ratio still low-ish)

- Favorable technicals (vol continues to compress, retail on bid, etc)

The velocity of this move has left investors in a bit of a just “make it to quarter end/the long-July 4th weekend” feel out there as most investors acknowledge that things feel “stretched” (and R/Rs have thinned out in places), yet, there doesn’t appear to be an apparent catalyst to reverse the AI > ‘the rest’ thematic that has taken over the market the last few weeks.

With plenty to debate on the velocity of the rally, two questions I am asking myself

- how long does this AI run last (esp as it increasingly appears to be driving sentiment in non-AI infra sectors like Software)? MU lower on a big/beat raise feels like the only sign of fatigue out there with evidence of investors chasing laggards the last few days – think: COHR, ANET, DELL, FN, ALAB, AMD types on a run lately

- does anyone have price-targets in Internet anymore ?? (half joking… but yes, some stretching of multiples and/or ‘realistic’ upside to consensus estimates)

Top inbounds today:

- Weakness in e-comm (ETSY, EBAY, Adyen)

- Why the fade in MU? Feedback?

- Weakness in SNOW yday/today?

- Strength in ALAB today? (up 9%)

- Feedback on EQIX? Any cares?

- Break-out in big tech? anyone tapping the breaks?

Stocks that stand out: Mag 7 dispersion (MSFT up 16 of 20 days vs. AAPL lagging NDX by 20pts over last 2-mo); GWRE down 6 of 7 days (many software stocks fit this trend); PAYX has u/p the market by 15pts in June (worst month in 15+ years); RBLX stock chart. Up 110% in a straight line over the last ~55 days; OKTA down 10 of 13 days ..

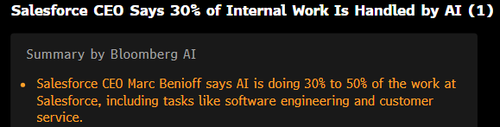

Headline of the day via Bloomberg (and yes, appropriately summarized, by Bloomberg AI)

Charts in Focus

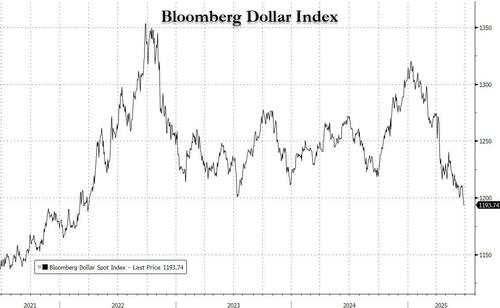

Not breaking any news here but the weakness in the USD continues to stand-out, now at 3+ year lows..

Big tech now breaking out above levels we stalled at in Dec-Feb range (yes, in part, thanks to USD tailwinds)…

… Leaving the NDX trading at a NTM P/E multiple ~28x E .. which is 20% rich to its 10yr history (10yr avg = ~22.5x), but more-or-less inline with its 5yr avg and solidly below recent peaks (3-handle range), with BULLS able to argue Rate Cuts, GenAI “efficiencies” and de-regulation are still to come.