Resume på dansk:

En af Goldmans ledende tradere skruer nu ned for risikoen. Selvom økonomien stadig ser fornuftig ud, er der flere faresignaler i markedet.

1. Regnskaberne fejler ikke – men investorerne tvivler

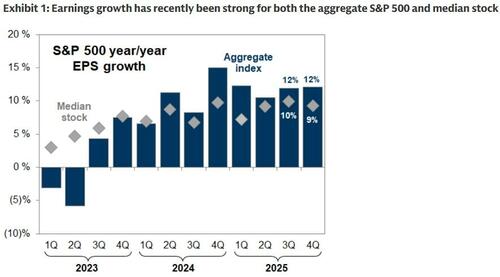

75 % af S&P 500 har afleveret regnskab.

Indtjeningen vokser ca. 12 % i forhold til sidste år.

Margenerne holder bedre end frygtet.

Forventningerne til 2026 er flere steder hævet.

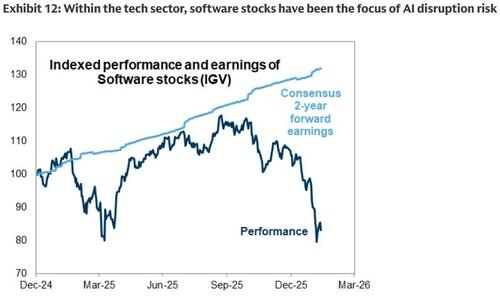

Men: Aktierne falder alligevel – især software, som er ned ca. 24 % på tre måneder.

Investorerne er begyndt at tvivle på, om AI-gevinsterne holder på længere sigt.

👉 Fokus er flyttet fra “god indtjening nu” til “holder det om to år?”

2. AI-feberen er blevet mere usikker

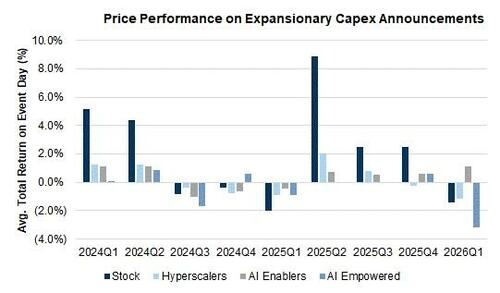

Markedet reagerer pludselig negativt på AI-nyheder.

Selskaber med direkte AI-eksponering er meget volatile.

Investorer kræver nu bevis for reel indtjening – ikke bare store investeringer.

Samtidig:

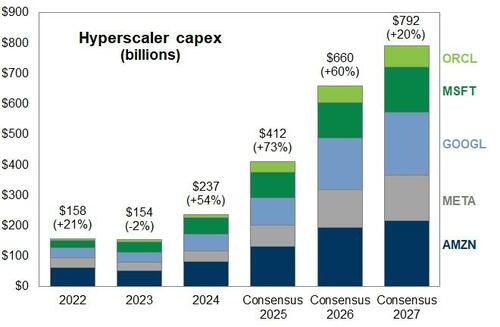

Amerikanske tech-giganter ventes at investere ca. 660 mia. dollar i 2026.

Det er 120 mia. mere end ventet.

Pengene tages bl.a. fra aktietilbagekøb.

Det gør markedet mere følsomt over for skuffelser.

3. Vækstforventningerne falder

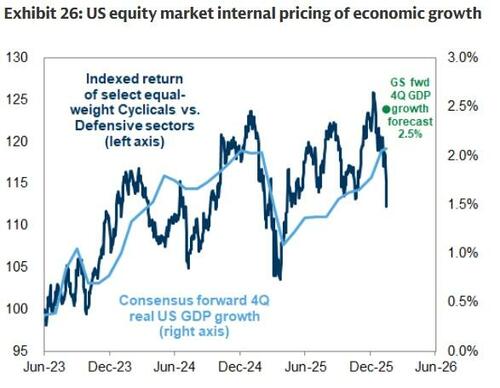

Markedet priser nu kun ca. 1,5 % fremtidig amerikansk vækst ind – mod 2,5 % tidligere.

Det er et klart tegn på, at optimismen er dæmpet.

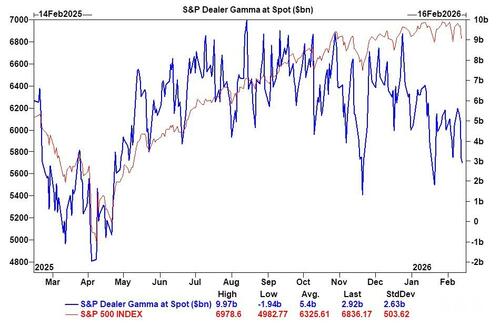

4. Teknisk advarsel: “Gamma arbejder imod markedet”

Ifølge Goldman er optionsmarkedet sat op på en måde, der kan forstærke udsving:

Fald kan accelerere.

Opture møder modstand.

Der er mindre “støtte” fra markedets store aktører.

Kort sagt: Bevægelser kan blive større – især nedad.

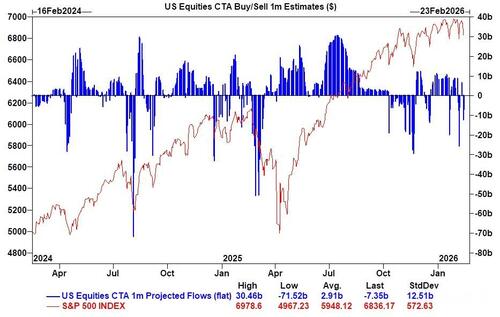

5. Pengestrømmene vender

Kortsigtede trendsignaler peger nu på salg i USA.

Tech er faldet tre uger i træk.

Investorer søger mod mere defensive sektorer som:

Forsyning

Stabilt forbrug

Energi

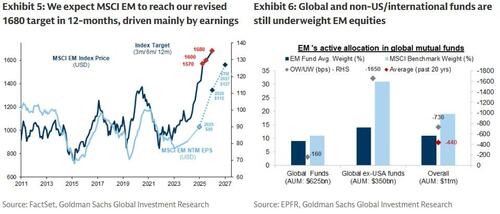

Samtidig flyder der rekordmange penge til Asien og emerging markets, hvor Goldman netop har hævet vækstforventningerne markant.

Bundlinjen

Økonomien ser ikke katastrofal ud. Indtjeningen er solid.

Men:

Vækstforventningerne falder

AI-entusiasmen køler af

Optionsmarkedet forstærker risikoen

Systematiske investorer er ikke længere en støtte

Goldmans konklusion:

Det er tid til at være mere defensiv og selektiv – og undgå at tage for store risici.**

Kilde: Stay Defensive, Selective: Top Goldman Trader Warns “Gamma Is Working Against The Market”

Original tekst her:

Flows on Goldman Sachs trading desk began to tilt more defensively on Friday.

Top trader, Lee Coppersmith, notes that while the macro backdrop remains broadly supportive, the technical setup has deteriorated and the AI landscape continues to get more complicated.

On earnings, the message has been pretty straightforward: results are solid and broadly in line. With roughly 75% of the S&P reported, EPS is tracking around +12% y/y, with the median company closer to high-single-digit growth. Revenues benefited from nominal activity and a weaker dollar, margins held in better than feared, and 2026 estimates have edged higher in parts of the market. None of that has been especially controversial – and it’s not what’s driving recent price action.

The pressure is coming from the forward debate. Software is down roughly 24% over the past three months, yet two-year forward earnings estimates are actually higher by about 5%. We’re seeing a similar dynamic across a number of AI-exposed industries – decent prints, positive revisions, but meaningful multiple compression. Investors are increasingly focused on the durability of profits rather than near-term earnings strength.

What’s changed more recently is how the market is reacting to AI news. After several quarters of generally constructive earnings reactions, Q1 2026 has seen post-event reactions turn negative across most AI stocks, reflecting a shift in how investors are thinking about AI spend longer-term. AI-Empowered names have been the most volatile, while AI Enablers have held up better on average given their more direct linkage to hyperscaler capex growth.

Hyperscaler capex is adding another layer. Updated guidance now points to roughly $660bn of US hyperscaler capex in 2026 – about $120bn higher than estimates just weeks ago. That increase is coming at the expense of buybacks. S&P 500 repurchases fell ~7% y/y in 4Q, and hyperscaler capex is now on pace to absorb more than 90% of operating cash flows this year. As a result, markets have become far more sensitive to revenue growth as proof of AI monetization – driving sharp dispersion in post-earnings reactions across mega-cap tech.

From a growth perspective, our US equity market-based measures have cooled meaningfully – moving from pricing closer to ~2.5% forward US growth to ~1.5%. That deceleration lines up with what we’re seeing in factor leadership, dispersion, and the bid for cash-flow certainty.

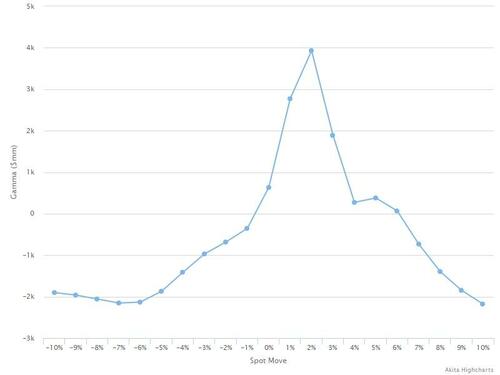

Technicals are also becoming less forgiving. The S&P gamma setup is as unfriendly as it’s been in some time. At current levels, there’s limited dealer support to dampen index moves. Rallies tend to encounter fresh gamma supply, while on sell-offs dealers move shorter gamma on the downside. All else equal, that creates an overhang where moves can extend more easily – with downside skew.

Looking only at CBOE-listed options data, the slope of the SPX gamma profile across spot levels is quite clear (shorter on the way down / longer on the way up):

SPX Gamma Profile Across Spot Levels ($mm):

Systematic flows add to that risk. While global equity CTA supply/demand estimates still point to net buying, the US is a different story. Short-term trend signals for both SPX and NDX have turned negative – implying some small-to-moderate selling over the next one to two weeks. Flows flatten beyond that, but additional downside would mechanically increase selling pressure as signals deepen.

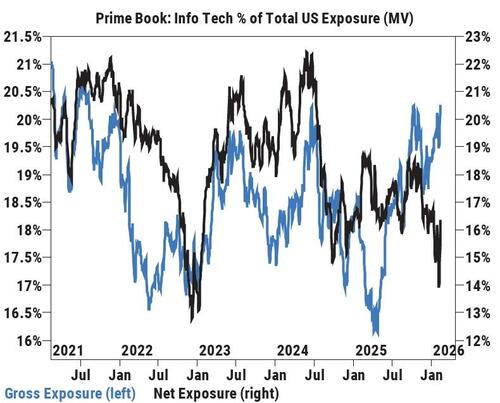

Under the surface, the rotation continues. Tech is lower for a third straight week, Mag 7 price action has stalled, and leadership has shifted toward more “physical” and AI-insulated parts of the market. Staples strength has accelerated, Utilities had a strong week, and Energy continues to benefit from hard-asset rotation. Positioning – rather than fundamentals – appears to be doing much of the work in several areas. Our flows reveal the same dynamic. Last week, Info Tech saw the largest $ net buying since Dec ’21 (+2.5 SDs, 1-year), driven by long buys and short covers (2.8:1). Semis & Semi Equip were by far the most net bought, followed by Tech Hardware, Software, and IT Services. At the same time, gross exposure to Info Tech is now near 5-year highs (95th percentile), while net exposure remains relatively low – reflecting extreme long positioning in Semis & Semi Equip alongside record short exposure in Software.

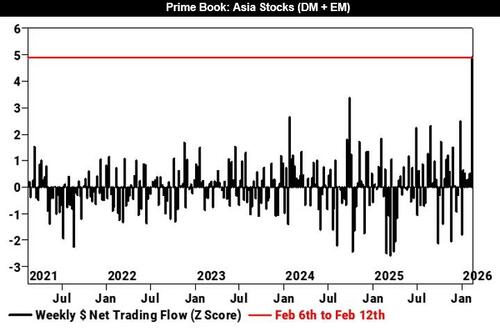

Outside the US is where we continue to see more positive attention. Notably, per our PB flows, Asia (DM + EM) saw the largest $ net buying on our record last week (since 2016), led by long buys. Gross and net allocations to Asia equities now sit at the highest levels on record.

We also raised our MSCI EM 2026 EPS growth forecast by 6pp from 19% to 25% last week.

Netting it out – US earnings remain solid, the capex trends remain real, and there’s no obvious macro air pocket. But growth expectations are rolling, the gamma setup is working against the market, systematic flows are no longer a tailwind, and the market is reacting very differently to AI signals than it has over the past year. In that environment, a more defensive, selective, and RV-oriented stance still feels appropriate.