Uddrag fra Goldman Sachs/ Zerohedge

With 2 of the Mag7 in the books, and the bulk of the group set to report Q2 earnings this week, Goldman tech specialist Peter Bartlett has compiled a list of the 7 top observations from atop his perch at the Goldman TMT desk.

- Negative asymmetry around earnings (particularly in Semis / Internet)

- Despite low implied moves into prints, getting some big moves

- Retail / Speculative trading is BACK

- Stalling momentum in “tariff immune compounders” in July (see NFLX, SPOT, TTWO, TKO)

- Capex Datapoints another confirmation of the AI trade

- Most talked about Singles this week (TXN, IBM, GOOGL, MDB)

- Sharpen pencils for a big week ahead (earnings from MSFT, META, AMZN, AAPL)

The above points flushed out + charts:

1. Downside earnings asymmetry

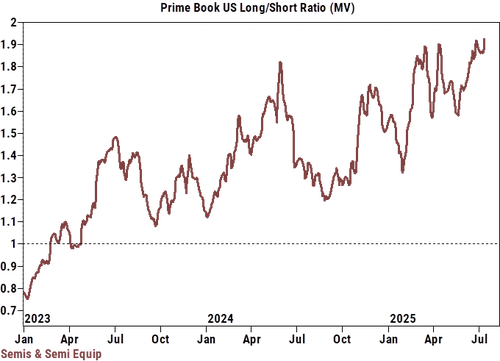

- Into this earnings season, we highlighted Semis, and to a lesser extent, Internet as being the most crowded pockets of TMT.

- So far this earnings seasons, we’ve seen notable negative asymmetry around earnings reactions across Semis / Internet … which seems to confirm the tougher setups / higher positioning bars.

- Good prints have traded modestly higher, and in some cases, lower (NFLX -5%, GOOGL +2%, FLEX -8%, NXPI flat) while bad prints have seen big downside moves (TXN -13%, ASML -8%, STM -17%)

- Recirculating GS Prime L/S ratio across Semis. In my view, crowded positioning does NOT represent a performance headwind in most environments… however crowding can create short-term headwinds, specifically around earnings.

2. Implied moves are low, actual moves have been big

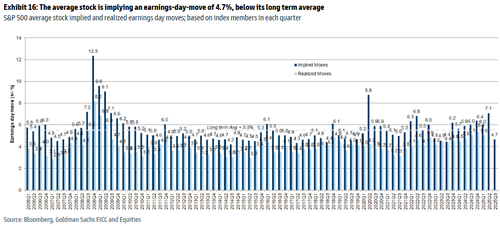

- Into earnings, John Marshall and team highlighted that the options market was implying an average earnings move of +/- 4.7% … which was a multi-year low and well-below last quarters implied move of +/- 7.1%. Lee Coppersmith astutely pointed out that the proliferation of systematic Vol selling strategies across the market has contributed to compressing Index vol, which bleeds into lower Single stock vol.

- So far this quarter, realized earnings day moves in Tech, in many cases, have far exceeded what options have implied (see TXN -13% …. nearly 2x any earnings move we’ve seen over the last 10 years in the name).

- Given the backdrop, and where vol is currently trading … could be an interesting quarter to amplify high conviction ideas (or hedge lower conviction trades) through the options market.

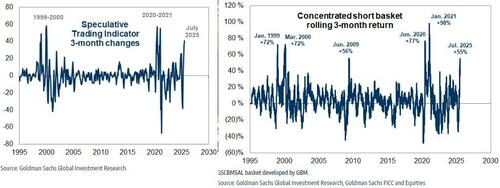

3. Retail / Speculative trading fervor is clearly back

Ben Snider and team out with a great note (available to pro subs) highlighting a big uptick in speculative trading activity, which has fueled a narrow breadth short squeeze. Our new Speculative Trading Indicator now sits at its highest level on record outside of 1998-2001 and 2020-2021, although it remains well below the highs reached in those episodes. The rise in the indicator reflects the elevated recent share of trading volumes in unprofitable stocks, penny stocks, and stocks with elevated EV/sales multiples.

MTD moves that stand out: OPEN +354% … KSS +61% … DNUT +48% … LCID +41% … CHGG +40% … AEO +17%

4. Stalling Momentum in “tariff-immune-compounders” is starting to stand out

- One the biggest thematic trades we observed in our flows (and price action) over the 1H was capital concentration into “tariff immune compounders”

- As market tariff concerns continue to fade and as valuations have stretched across this group, we’ve noted a material flow inflection across this group in July (skewed better for sale after consistent thematic inflows for much of the 1H)

- Stocks like NFLX (-11% mtd), SPOT (-11% mtd), TTWO (-7% mtd), TKO (-7%) have all seen stalling momentum … although we would note these stocks are all still huge YTD winners and long-term bulls still feel very much committed to the stories.

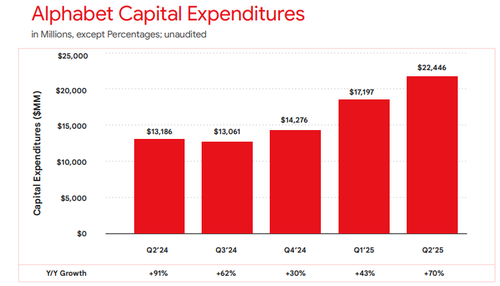

5. Capex datapoints another confirmation of the AI trade

- Enthusiasm for the AI trade feels like it has never been higher… and it seems like for good reason, as recent price action & industry datapoints all seem to be confirmatory of the trade

- This week, GOOGL reported Y/Y capex growth of 70% in the quarter (up from +43%), raised its FY25 CapEx guidance by $10bn, and said they expect a further increase in CapEx in 2026. The next datapoints to watch are CapEx trends at MSFT, META, and AMZN next week.

6. Most talked above Singles this week – Quick hits:

- TXN: Why down this much? TXN registered 2nd worst day in 25 years on 2H / pull-fwd concerns. Most understood the direction of move, but lots of complaints around the magnitude.

- IBM: Clear & wide schism between how many in the LO community feel about this stock (mostly constructive) vs. Hedge Fund views (where we heard from several vocal and passionate bears). Desk flows mostly skewed heavily towards HFs trading around Short books w/ not much movement from LO community.

- GOOGL: Consensus trading view into the print was for a pop on strength of numbers, followed by a fade as DOJ ruling (expected mid Aug) looms. That view more-or-less played out, and we did observe trimming into & out of #s.

- MDB: Continues to come up with differentiated long pitch / turnaround story. Stock now 9 up sessions in a row (+20% over that period) as excitement builds around this story.

7. Big Week ahead … Refreshing on megacap positioning / expectations

- MSFT reports Wed… Microsoft has firmly broken out of its ~18month holding pattern, adding $650bn to its cap (which now stands just shy of $4T) this year. Well positioned to capture a number of major secular trends (gen AI, public cloud consumption, SaaS adoption etc) + relatively insulated from tariff considerations, MSFT has become an “easy” core long for most Growth, TMT, & Generalist portfolios. We have as a 9 on 1-10 positioning scale. For the quarter, Bulls are playing for mid-30s+ Azure Growth.

- META reports Wed… While still well-owned by most measures & sentiment still largely positive, we’ve noted a slight uptick in caution in recent weeks. We have as an 8.5 on 1-10 positioning scale. Strength still expected in the quarter & guide as the Ad environment remains strong (and benefiting from AI efficiency), but some longer term uncertainties are emerging given recent moves (hiring spree / off-balance sheet datacenter investments are bringing the ROI discussion back into the fold). For the print, bulls are looking for robust top line performance in the quarter & guide to support growing spending trends.

- AMZN reports Thu… A relative laggard on the year (“only” +5% ytd), AMZN has had to contend with tariff uncertainties (which have abated in recent weeks) + some technical/flow headwinds (Bezos Form 4s) + debates on AWS growth into the second half. Still a Long for most, but we sense some 2-way tactical positioning. We have as a 7 on 1-10 positioning scale.

- AAPL Reports Thu… AAPL a very clear outlier from a sentiment, flow, and positioning perspective relative to Supercap Tech peers. As the largest MF Underweight in the market (per latest GIR “Mutual Fundamentals) and a popular HF relative short, AAPL has represented a significant source of “performance Alpha” for most this year (stock -17% vs. NDX +9%). We have as a 4 on 1-10 positioning scale. A beat is expected in the quarter (and most are “respectful” of that dynamic), but long term uncertainties around AAPL’s competitive positioning feel like they remain as high as ever.

———————–

tekst bearbejdet til dansk

Med 2 af Mag7-aktierne i regnskabet, og størstedelen af gruppen klar til at rapportere regnskab for 2. kvartal i denne uge, har Goldmans teknologispecialist Peter Bartlett samlet en liste over de 7 vigtigste observationer fra sin plads ved Goldmans TMT-skrivebord.

- Negativ asymmetri omkring indtjening (især i Semis/Internet)

- Trods lave implicitte træk til print, får man nogle store træk

- Detailhandel/spekulativ handel er TILBAGE

- Aftagende momentum hos “toldimmune blandingsproducenter” i juli (se NFLX, SPOT, TTWO, TKO)

- Capex Datapoints endnu en bekræftelse af AI-handelen

- Mest omtalte singler denne uge (TXN, IBM, GOOGL, MDB)

- Spids blyanterne til en stor uge forude (indtjening fra MSFT, META, AMZN, AAPL)

Ovenstående punkter skyllet frem + diagrammer:

1. Asymmetri i nedadgående indtjening

- I denne indtjeningssæson fremhævede vi semis, og i mindre grad, internettet som værende de områder med mest trafikerede TMT-markeder.

- Indtil videre i denne indtjeningssæson har vi set en bemærkelsesværdig negativ asymmetri omkring indtjeningsreaktioner på tværs af semifinaler/internet … hvilket synes at bekræfte de sværere opsætninger/højere positioneringssøjler.

- Gode print er handlet moderat højere, og i nogle tilfælde lavere (NFLX -5%, GOOGL +2%, FLEX -8%, NXPI uændret), mens dårlige print har oplevet store nedadgående bevægelser (TXN -13%, ASML -8%, STM -17%)

- Recirkulerende GS Prime L/S-forhold på tværs af semifinaler. Efter min mening repræsenterer crowded positioning IKKE en præstationsmodvind i de fleste miljøer … men crowded positioning kan skabe kortsigtet modvind, især omkring indtjening.

2. Implicitte bevægelser er lave, faktiske bevægelser har været store

- I forbindelse med indtjeningen fremhævede John Marshall og teamet, at optionsmarkedet indebar en gennemsnitlig indtjeningsstigning på +/- 4,7% … hvilket var det laveste niveau i flere år og et godt stykke under den implicitte stigning på +/- 7,1% i sidste kvartal. Lee Coppersmith påpegede skarpsindigt, at udbredelsen af systematiske voluminøse salgsstrategier på tværs af markedet har bidraget til at komprimere indeksvolumen, hvilket afspejler sig i lavere enkeltaktievolumen.

- Indtil videre i dette kvartal har de realiserede bevægelser på indtjeningsdagen i tech i mange tilfælde langt oversteget, hvad optioner har antydet (se TXN -13% … næsten dobbelt så meget som enhver indtjeningsbevægelse, vi har set i løbet af de sidste 10 år i navnet).

- I betragtning af baggrunden, og hvor vol handles i øjeblikket … kunne det være et interessant kvartal til at forstærke ideer med høj overbevisning (eller afdække handler med lavere overbevisning) gennem optionsmarkedet.

3. Detailhandel/spekulativ handel er tydeligvis tilbage

Ben Snider and team highlighting a big uptick in speculative trading activity, which has fueled a narrow breadth short squeeze. Our new Speculative Trading Indicator now sits at its highest level on record outside of 1998-2001 and 2020-2021, although it remains well below the highs reached in those episodes. The rise in the indicator reflects the elevated recent share of trading volumes in unprofitable stocks, penny stocks, and stocks with elevated EV/sales multiples.

MTD moves that stand out: OPEN +354% … KSS +61% … DNUT +48% … LCID +41% … CHGG +40% … AEO +17%

4. Stalling Momentum in “tariff-immune-compounders” is starting to stand out

- One the biggest thematic trades we observed in our flows (and price action) over the 1H was capital concentration into “tariff immune compounders”

- As market tariff concerns continue to fade and as valuations have stretched across this group, we’ve noted a material flow inflection across this group in July (skewed better for sale after consistent thematic inflows for much of the 1H)

- Stocks like NFLX (-11% mtd), SPOT (-11% mtd), TTWO (-7% mtd), TKO (-7%) have all seen stalling momentum … although we would note these stocks are all still huge YTD winners and long-term bulls still feel very much committed to the stories.

5. Capex datapoints another confirmation of the AI trade

- Enthusiasm for the AI trade feels like it has never been higher… and it seems like for good reason, as recent price action & industry datapoints all seem to be confirmatory of the trade

- This week, GOOGL reported Y/Y capex growth of 70% in the quarter (up from +43%), raised its FY25 CapEx guidance by $10bn, and said they expect a further increase in CapEx in 2026. The next datapoints to watch are CapEx trends at MSFT, META, and AMZN next week.

6. Most talked above Singles this week – Quick hits:

- TXN: Why down this much? TXN registered 2nd worst day in 25 years on 2H / pull-fwd concerns. Most understood the direction of move, but lots of complaints around the magnitude.

- IBM: Clear & wide schism between how many in the LO community feel about this stock (mostly constructive) vs. Hedge Fund views (where we heard from several vocal and passionate bears). Desk flows mostly skewed heavily towards HFs trading around Short books w/ not much movement from LO community.

- GOOGL: Consensus trading view into the print was for a pop on strength of numbers, followed by a fade as DOJ ruling (expected mid Aug) looms. That view more-or-less played out, and we did observe trimming into & out of #s.

- MDB : Fortsætter med at komme med differentierede long pitch/turnaround-historier. Har nu 9 up-sessioner i træk (+20% i den periode), efterhånden som spændingen omkring denne historie stiger.

7. Stor uge forude … Forfriskende om megacap-positionering / forventninger

- MSFT rapporterer onsdag … Microsoft har brudt solidt ud af sit ~18 måneders holdingmønster og har tilføjet 650 mia. dollars til sin kapital (som nu ligger lige under 4 billioner dollars) i år. MSFT er godt positioneret til at fange en række større sekulære tendenser (generation AI, public cloud-forbrug, SaaS-adoption osv.) + relativt isoleret fra toldhensyn og er blevet en “nem” kernelong for de fleste Growth-, TMT- og generalistporteføljer. Vi har en positioneringsskala fra 9 ud af 1-10. For kvartalet spiller Bulls på Azure Growth i midten af 30’erne+.

- META rapporterer ons … Selvom de fleste målinger stadig er velansete, og stemningen stadig overvejende positiv, har vi bemærket en lille stigning i forsigtigheden i de seneste uger. Vi har en positioneringsskala på 8,5 på en 1-10-skala. Der forventes stadig styrke i kvartalet og vejledningen, da annoncemiljøet fortsat er stærkt (og drager fordel af AI-effektivitet), men der opstår nogle langsigtede usikkerheder i betragtning af de seneste bevægelser (ansættelsesbølge/investeringer i datacentre uden for balancen bringer diskussionen om ROI tilbage i fokus). Til tryk forventes der robuste toplinjeresultater i kvartalet og vejledningen vil understøtte voksende forbrugstendenser.

- AMZN rapporterer tors … AMZN har været relativt bagefter i forhold til året før (“kun” +5% hittil i år) og har måttet kæmpe med usikkerheder omkring toldsatser (som er aftaget i de seneste uger) + nogle tekniske/flowmæssige modvinde (Bezos Form 4s) + debatter om AWS’ vækst i andet halvår. Stadig en lang periode for de fleste, men vi fornemmer en vis 2-vejs taktisk positionering. Vi har en positioneringsskala fra 7 på 1-10.

- AAPL rapporterer torsdag … AAPL er en meget klar outlier fra et sentiment-, flow- og positioneringsperspektiv i forhold til Supercap Tech-kolleger. Som den største MF-undervægtede aktie på markedet (ifølge den seneste GIR “Mutual Fundamentals”) og en populær HF-relativ short, har AAPL repræsenteret en betydelig kilde til “performance Alpha” for de fleste i år (aktie -17% vs. NDX +9%). Vi har en positioneringsskala fra 4 på 1-10. Der forventes et overskud i kvartalet (og de fleste er “respektfulde” over for denne dynamik), men den langsigtede usikkerhed omkring AAPLs konkurrencepositionering føles som om, den forbliver lige så høj som nogensinde.