Volatiliteten er blevet et voksende problem for investorerne, skriver Goldman Sachs. Eftervirkningen af volatiliteten kommer hyppigere end før – nu er det to gange om året. Goldman kalder det “left-tail risk events”. Derfor bør investorerne ændre strategi, så de ikke bliver så udsatte for volatilitet.

Uddrag fra Goldman Sachs:

Volatility erupting.

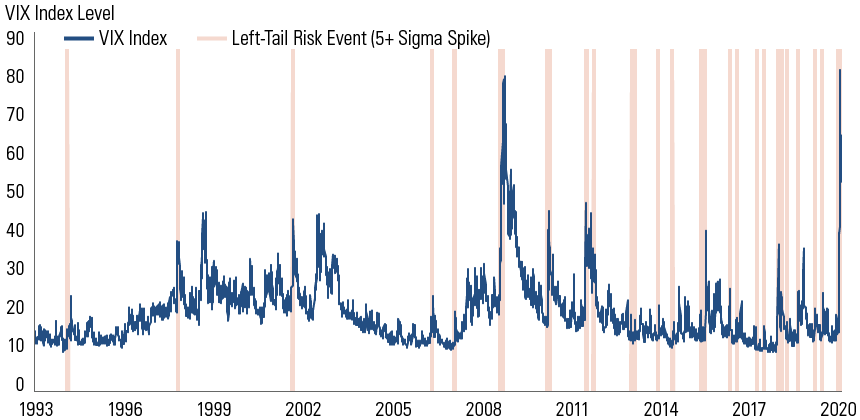

Tail risk has increased over the last ten years, even as average volatility has been subdued.

Volatility has recently been elevated as markets digest the COVID-19 downturn. Yet since the financial crisis, the odds of seeing left-tail risk events—defined as where the VIX closes up by five standard deviations or more in one day—has increased substantially. From 1993–2007, there were left-tail risk events approximately once every two years. From 2008 onwards, left-tail risk events occurred twice every year, amounting to a four-fold increase. In light of this trend, we believe investors should focus on reducing left-tail risk.

Source: Bloomberg and GSAM.