Uddrag fra Goldman Tech S&T

Sentiment check: the Nasdaq eked out a small gain last week (+25 bps), breaking a 4 week losing streak that had featured consistent 2-3% weekly sell-offs. While risk sentiment remains stuck in a holding pattern given near-term unknowns – quarter-end / preview season, tariffs on 4/2, NFPs on 4/4 – it was healthy to see signs of ‘stabilization’ as positioning (see GS PB data re: cleaner TMT exposures) & valuations (NDX trading at ~10% discount to 5yr avg P/E multiple) are no longer the headwinds they once were.

That’s the ‘good’ news. The ‘bad’ news is that conviction levels feel very low right now – not because of price or positioning – but because of geopolitical & macro uncertainty (and, in turn, thematic uncertainty), which has translated into a lack of conviction to add to longs in recent days [e.g. last Thursday = lowest volume day of the year].

Putting it together, while there is some comfort in cleaner positioning and better prices, it feels like investors will be inclined to keep risk on a short leash until some level of Policy Put is found, an important stepping-stone in catalyzing potential ‘buy the cut’ conviction for investors as we digest a potential choppier Q1 (for more see “Goldman Trading Desk: Sentiment Will Swing Day-To-Day Until Investors Clear The April 2 Tariff Hurdle“)

Top client inbounds last week:

- why was MU down 8% on that print??

- whats up with META lately?

- feedback on ACN? read-throughs?

- anyone have any conviction in any Software stocks?

- whats up w/ TSM? can this work, please?

- shopping lists? Quality defensives? ..

Callahan next breaks down the key market themes in the following 8 points:

1. Two down, one to go? When tasked with trying to level-set on the moving parts this year, I tend to highlight 3-dynamics:

- The re-pricing (lower) of the GenAI theme in the face of growing thematic complexity (good news here is that positioning & valuations have reset, whilst, near-term / 2025 datapoints remain strong – see JBL last week),

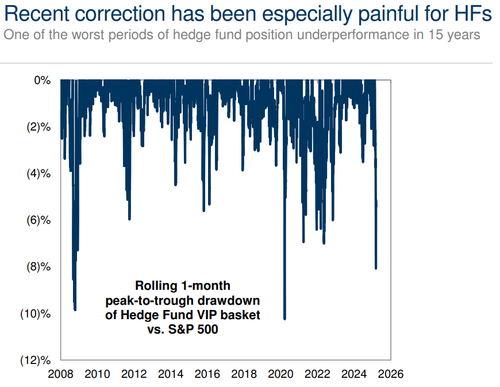

- A swift unwind in Momentum & de-risking amongst market participants (as Tony P puts it: “the fiercest risk transfer from the levered community is behind us… [now] the spotlight remains on the structural holders of US equities – both households and institutions” and

- A weaker US economic growth backdrop (the US economy has clearly slowed, but as this week’s data set demonstrated, growth is not collapsing… yet);

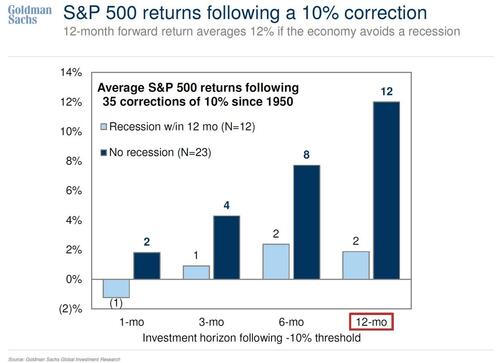

From my seat, at this point, the biggest obstacle of the 3 is the ongoing ‘growth concerns’ issue, which is likely going to remain data dependent [historic returns following 10% market drawdowns have been highly dependent on a recession outcomes – up 8% over next 6-mo no recession, only up 2% if there is one] — leaves investors with the playbook of upgrading the quality of the portfolio, but likely stopping short of a full ‘recession’ playbook.

2. Lower Prices ≠ Lower Expectations: one dynamic that is topical into earnings has been the debate if “lower stock prices” = “lower expectations”; while there are obvious ‘benefits’ to having a stock enter earnings at a lower price (more valuation support, cleaner positioning), I don’t necessarily think that this means the “bar is low” for TMT names (which is supported by recent action / results: Airlines, Nike, ACN, Lennar, PATH, TER, ADBE). Why not? Well, I think investors’ appetite to buy cuts in this market would perhaps necessitate line of sight for things to ‘get better’ on the back side of any cut (e.g. Trump / Powell ‘put’ or policy visibility).

3. Linearity: at risk of stating the obvious, one of the big hang-ups in the market right now has been concerns around the “linearity” of activity down the stretch of 1Q and into the early days of 2Q – a comment on the Consumer (see GIR/GS Econ consumer dashboard, which Points to Solid Fundamentals, but the Outlook Looks Somewhat More Challenging – which, translating to TMT has potential bank-shots into payments / advertising / internet), as well as a comment on IT Spending (similar to PATH verbiage, ACN made the “recent weeks” comment on it’s earnings call, noting: “in recent weeks, we are seeing an elevated level of what was already significant uncertainty in the global economic and geopolitical environment”). Again, tied to point #4 above, it feels like investors will be patient over the next few weeks as we navigate 1Q earnings (esp given 2H ‘accelerations’ that are being modeled across the market) and near-term macro hurdles (tariffs, NFPs).

4. Datapoint round-up: what we heard last week

- JBL delivered (+) GenAI datapoints (raised AI Revs to +40% y/y in FY25, up ~$1bn from last qtr’s guide) vs. lowering Auto Transport revs outlook

- ACN noted elevated uncertainty among clients given current macro and geopolitical challenges – but does not yet see an impact to clients’ spending patterns

- MU upbeat results (PC / Smartphone inventories clearing up + robust HBM / datacenter demand), albeit balanced by ongoing pull forward / linearity concerns (Jan. 2025 China foreign-branded phone shipments down 21% y/y)

- MPWR guided up F1Q at its analyst day

- Carnival (CLL) beat and raised noting “we took price and we’re well set up for the rest of the year. Hence, not only do we pretty much smash Q1 on the yields, but we maintain yield guidance for the rest of the year over 4%”

- and then some less good results from FDX miss and cut, Lennar Q2 gross margin issues, General Mills cut its FY guide due in part to a slowdown in its snacking business (consumers remain value-seeking) and Nike a materially weaker F4Q outlook (partially due to timing), a muted and incrementally cautious tone on China

5. Notes from the road: ST, Tower & Fiber fieldtrip (SBAC, DY), Wistron, FLYW, Compal, Gigabyte, IET (4971.TW), WNC (6285.TW), Wiwynn, MiTAC (3706.TW), AVC (3017.TW), Murata – reach out for notes

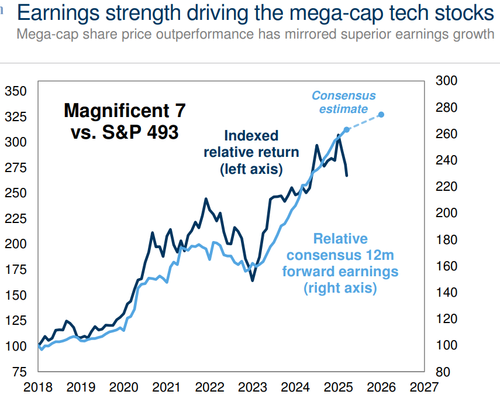

6. Mag 7 – where are we now? Similar to discussions above, positioning and valuations are less demanding, but there remains some apprehension about catalyst & event path (especially as the Mag 7 stopped acting defensively!) .. desk read on sentiment & debates (most to least ‘loved’): AMZN (some nt debate on 1Q AWS growth + ‘health of the consumer’ – but both of these are more around the edges), META (noisy week in the stock, but path to mid-teens+ topline & a ‘real’ AI portfolio is still in scope for Bulls), MSFT (sentiment starting to thaw (?) with focus on valuation, capex visibility, lowered Azure expects & durable M365 trends), NVDA (still a “believer or not” type of debate – not many in the middle), GOOGL (while sentiment (again) tilts more cautious – there’s at least a two-sided acknowledgement about valuation support in this mid-teens fwd P/E range), AAPL (.. (very) hard to find convicted ‘bulls’ out there .. ) and TSLA (stock down 9-wks in a row says it all); as always, check out GIR / Kostin’s “where to invest now” (link), which features a number of terrific Mag 7 related charts.

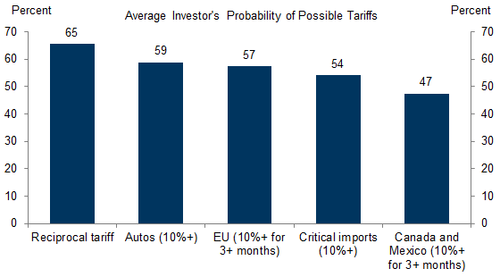

7. Tariffs: what’s the expectation from here? GIR/GS Econ recently carried out a timely investor survey – on the topic of Tariffs, investors see a high probability of a reciprocal tariff (65%), tariffs on autos (59%), imports from the EU (57%), and critical imports (54%), and larger tariffs on Canada and Mexico (47%). The average investor now expects a larger 8.6pp increase in the effective tariff rate from the start of 2025 to the end. Our own expectation has also risen from a 3pp to a 10pp increase.

8. Durables: chart caught my eye. Kostin/GIR built a list of “Stocks that are insulated from major thematic drivers of ongoing market volatility” (link) – names like DOX, SPGI, VEEV, MCO, MSCI, TYL, FDS, FIS, Visa all of which carry low correlation with drivers of recent volatility: US growth, trade policy risk, AI — a trend that’s inline with the ‘durables’ theme that I’ve been focused on this year [those are more the TKO, T, LYV types]

* * *

Charts in Focus

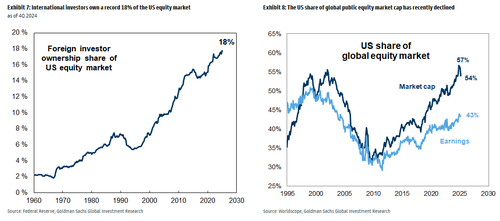

Kostin/GIR’s weekly is entitled: The role of foreign investors in the US equity market — Long-term data from the Fed show foreign ownership of US equities stands at an all-time high. Foreign investors owned just 2% of US equities in 1960 and 7% in 2000 but 18% of US equities at the start of 2025. 49% of foreign holdings are from investors in Europe.

Events in Focus

Mon 3/24:

- Earnings: BYD (1211 HK)

- TKO / DASH to join S&P500

- TD Securities Industrials & Infrastructure Services Conference

Tues 3/25: New Home Sales

- Earnings: Pre: Kuaishou, PONY, YQ; // Post: GME

- GS hosts: SE + JCDecaux

- CTSH analyst day @ 1pm ET – GIR preview (link) re ‘Medium-term growth outlook and strategic priorities in focus’

- PATH: UiPath Agentic AI Summit @ 11am ET

- Shoptalk: Reimagining Retail in Vegas

- HSBC – Global Investment Summit 2025

Weds 3/26: Durable Goods

- Earnings: Pre: CTAS, CHWY, PAYX, SAIL, VRNT; // Post: CNXC

- GS hosts: SE + JCDecaux

- Shoptalk: Reimagining Retail in Vegas

- PANW’s ‘Ignite on Tour’ in NY

- UBS Global Energy and Utilities Conference

- New Street BCG Connectivity Conference

Thurs 3/27: GDP Annualized q/q + core PCE q/q

- Earnings: Pre: SNX; // Post: BRZE

- GS hosts: JCDecaux + ACN + Worldpay

- Shoptalk: Reimagining Retail in Vegas

Fri 3/28: core PCE + Personal Income + UoM Sentiment

- GS hosts: JCDecaux + ZK

- Stifel Copenhagen Summit

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her