Uddrag fra Goldman Tech/Media Specialist

Following a convincing technical ‘fail’ at the 200-dma last week (red line chart below), TMT looks set to close out 1Q’25 on a tough note – NDX down ~8% in March (worst month since Dec’22), and, down ~8% on the quarter (worst quarter since 2Q’22).

As we transition to April, macro issues (sentiment is somewhere between vibe-cession + recession) are set to become micro issues as several core Tech pillars are being impacted by linearity concerns into earning season – think:

- IT spending concerns (ACN + PATH commentary and GIR’s recent Security SW note: ‘demand conversations were stable to incrementally negative for the industry,’)

- DOGE unknowns (Elon recently reiterated plans for $1 trn in cuts by the end of May)

- Consumer angst across Internet (think Ads + commerce + travel on the back of stories like this re: declines in US/CAN x-border travel and/or recent Airline warnings)

- Tariff headwinds to cyclicals (and second derivative impacts)

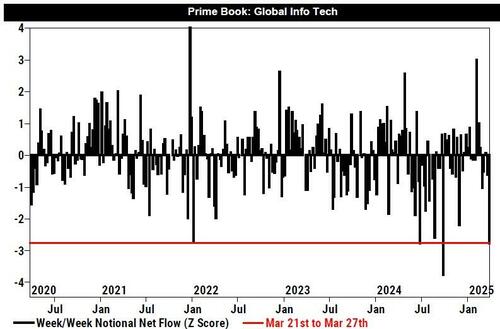

Needless to say, there is a fair bit of uncertainty out there. As such, not a big surprise to see Goldman Prime Broker data highlight outsized selling across Info Tech this past week, driving Info Tech exposures (both Net and Gross) towards multi-year lows.

While price has been anything but ‘static’, the story in Tech hasn’t changed all that much over the last week or two: no longer are we blaming positioning, nor valuations (at least among large-caps), rather, the action is more an output of;

- Lowered confidence in (+) near-term EPS revisions in TMT (will “inline, inline” be good enough?),

- Stalled momentum in the GenAI story, at least as measured by price action and

- Megacap Tech shedding its Defensive posture (e.g. Big Tech is the most negatively correlated to Defensives that it has been in years)

As such, even if one believes that we “land the plane” in Tech (e.g. eventually the policy induced slowdown is reversed & (AI) investments bear fruit), the lack of visibility on timing (as well as magnitude of the ‘disruption’ along the way) makes it harder to weather the storm in TMT (and, in turn, is driving a clear rotation outside of Tech to start the year – see chart at bottom of email)

****

Top client inbounds last week:

- Ad sentiment?

- What’s expected at this point (price): any ‘safe’ names in TMT?

- Feedback on SNX? Read-throughs?

- Feedback on Goldman’s PANW note?

- Security sentiment?

- How high can VZ and T go?? (VZ up 7 of 8-wks, T up 9 of 11-wks).

“Heads you win, tails I lose” feeling into 1Q earnings: While positioning and prices are no longer the headwinds they once were, linearity and timing are keeping buy tickets at bay as investors worry that quarter-end macro volatility could impact the set-ups into 1Q EPS season (2Q / 2H guides) – i.e., if companies miss or guide softer due to macro, that’s not great as “bad is bad” at the moment (see Jefferies or SNX last week) but, if they don’t incorporate the macro (lower guidance), investors may argue they haven’t seen it yet (see Accenture) – hopefully this gets priced in ahead of time.

What’s the Playbook: with the list of YTD winners in TMT and/or names that have been holding in not exactly being a ‘who’s who’ of Tech darlings (think Telcos, VRSK, CHTR, CTAS, IBM, ADP types) – other than holding low-gross and low net exposure in TMT (which, we are indeed seeing), a few talking points on what’s topical .. getting defensive (quality, idio names), but not going full ‘recessionary’ (as evidenced by names like V/MA hugging the highs) – think VZ / T, NFLX, SPOT, GWRE types being topical here … (patiently) picking spots on fav ideas, even if it doesn’t feel great (TSM, AMZN, META, TEAM, INTU, ANET types) …. being more nimble on the under-side of the portfolio (e.g. names that have mis-executed that are bouncing, esp if more transactional March qtr-end names and/or businesses that are trading like low-vol Defensives, but may not actually be ‘defensive’ business) …

Sign of the times: VRSN was up 10 days in a row heading into Friday; AT&T has o/p NDX on 6 of 7 days vs MSFT down 8 of 9 wks, AMZN down 8wks in a row, GOOGL down 7 of 8 wks, META down 6 in a row.

Reading the tape: handful of notes from GIR and results out from companies that feel indicative of the mood in TMT: e.g. Goldman trimmed ests in recent previews on Adyen (seasonality / FX) and Indian IT Services (a ~230 bps cut to FY ‘26 rev ests due to macro); we just got a guide below from SNX … and then, can throw in Gabriela/GIR’s recent checks on PANW: “On the demand environment, Palo Alto acknowledged that incremental uncertainty in the macro environment (e.g. policy actions including DOGE and tariffs, mixed consumer spending datapoints) drives more customer questions, leading to longer sales cycles. However, even in this backdrop, security tends to be relatively resilient as a category and most customers are even more acutely aware of maintaining a strong security posture, especially given ongoing geopolitical crosscurrents (that in turn increase the risk of nation state attacks). Furthermore, Palo Alto noted that it has a platform advantage that ultimately drives TCO for customers in a budget-sensitive environment”

Government tracker: published from GIR / GS Econ today (link) — a monthly US Government Activity Tracker to provide a data dashboard on government employment and spending and related developments … on the jobs front from GIR: “Federal government employment data shows some signs of reduction in force (RIF) mandates. Initial unemployment claims for federal employees increased in late February and early March before pulling back slightly in the last two reports. The Indeed.com Washington DC job postings index currently stands 11% lower than at the beginning of the year. We track RIF mandates to have affected 49.3k federal employees so far (1.6% of all federal employment), including roughly 21k probationary employees. Plans for further reductions have been reported at the Department of Veterans Affairs, Department of Defense, and Internal Revenue Service. The impact on overall employment and labor market activity remains small, however.” [GIR]

Notes from the road: Goldman hosted meetings (or documented takes) from PLTR, MSFT, ACN, PANW event, SEMICON China (27+ mtgs), China Internet Tour (BEKE, Kuaishou, YMM, BZ, NTES & more), Worldpay, AAC (2018.HK) – need?

Tariffs: latest from GIR markets strategy (link) on how to approach the day:

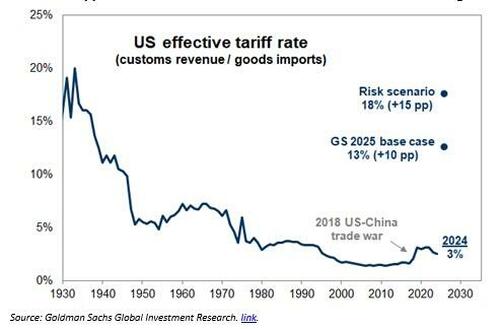

“Both market-based and survey evidence suggest to us that the market is incorporating assumptions that are close to (though perhaps a little less than) an overall 10pp tariff increase. Both sources also suggest, however, that the market is putting a fairly low weight on much more aggressive tariff proposals and could be quite vulnerable to those outcomes. As our US economists have argued, this tilts the outcomes towards a negative surprise. Although the market will also be sensitive to any clues about the possibility of negotiating initial proposals, we worry that investors are drawing too strong a conclusion from recent experience that upcoming announcements could be quickly reversed”

Translating this to equities talk: our forecast for 7% EPS growth in 2025 assumes that US effective tariff rate increases this year by 10 pp to 13%, the highest rate since 1938. We estimate each 5 pp incremental increase in the effective tariff rate would weigh on S&P 500 EPS by roughly 1-2% (link)

Charts in Focus

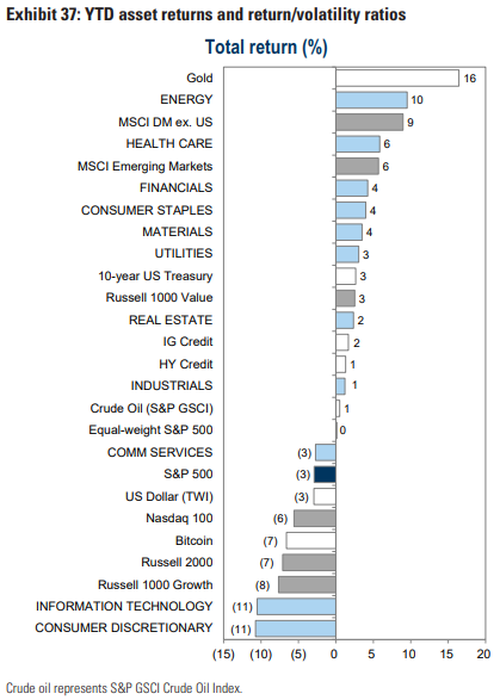

YTD action: best performers are Gold, Energy, non-US DMs, HC, Ems, Fins, Staples, Materials, Utes … basically everything not named TMT nor ‘beta’.

Source: GIR link. past performance is not indicative of future results.

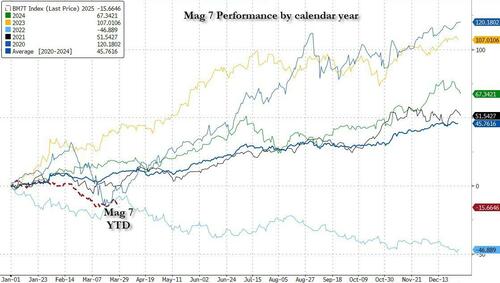

The Mag 7 is now down ~15% to start the year (dashed red line below) matching 2020 (an up 53% year) and 2022 (a down 46% year) as the slowest starts to a year in the last decade; as colleague S. Tuteja (head of etf / synthetic vol trading) puts it — ‘Looking back at the Q4 2018 sell-off, the large cap tech names struggled initially, but once growth started to slow, they acted defensively versus the rest of the market (similar to how it acted at the end of 2018 in a risk-off tape and in April 2023 when the market rebounded)‘

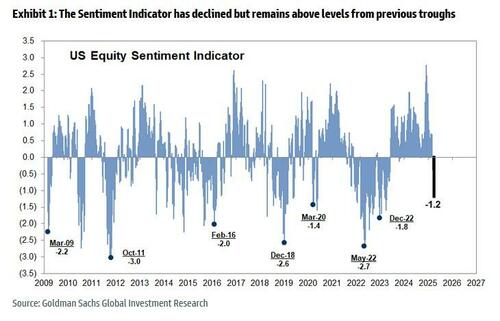

Goldman’s US Equity Sentiment Indicator of investor positioning declined further this week to -1.2, the lowest reading since April 2023, but remains above levels typically reached at the trough of other major drawdowns during the past 15 years.

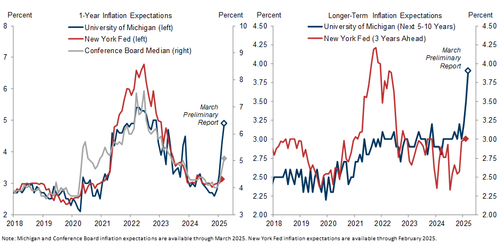

US-inflation expectations: Both short-term & long-term inflation expectation rose notably over the past few months.

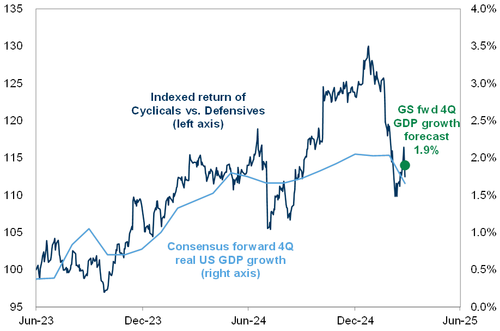

This benchmarks our cyclicals-vs-defensives pair (dark blue line) vs our expectations and market consensus for US GDP growth. perhaps suggestive of equilibrium .. for now.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her