Uddrag fra Goldman Sachs:

Garrett warns that “bears have increased the volume, technicals are taking over the narrative, liquidity is challenged, and a healthy dose of risk prudence has only just started (shorts increasing, nets decreasing, etc).”

Below Garrett shares some observations from the Goldman trading desk on how we ended what was otherwise a stellar year (the S&P is up 24% YTD) and what they think is ahead: the punchline is that while the first year of trump presidency 1.0 ushered in one of the least volatile calendar years in decades (6.9 realized on 31dec17), hip shot suggests 2.0 will not be the same.

As a result, the Goldman desk…

- favors equal weight vs market cap weight;

- favors mid caps over large caps;

- says to allocate some assets to gold;

- allocate some assets to 6m downside;

- says to keep an eye on VVIX (north of 110 alert set);

- look at m&a targets (especially outside of the US, given the strength of the dollar).

Finally, some charts from the full report:

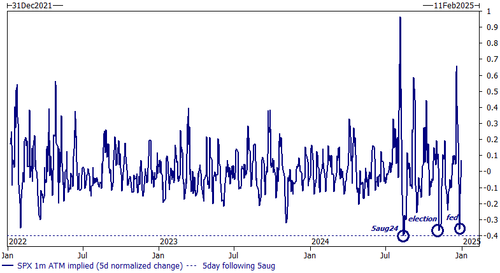

1. The largest vol lesson i am taking away from 2024 will be the speed at which the SPX surface is learning to “compartmentalize”: the rapid ascent and even more rapid descent following pockets of risk-off are effectively unrivaled going back 3+ years … the structural supply of index gamma very likely the reason for this … should we enter into a prolonged period of weakness, its likely these short dated options will retrace “too quickly” and offer great buying opportunities.

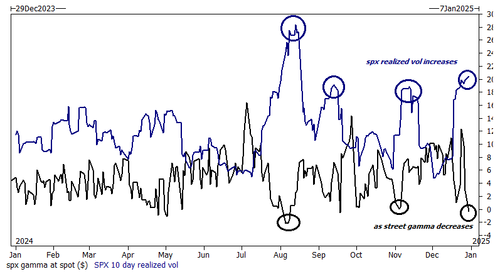

2. On the point of structural supply of gamma: for every participant that says “gamma doesn’t matter” – i would point simply to the last few days of December as a reminder that it does … the correlation of these two was never a “thing” until about 2 years ago but now is a part of the daily morning ritual.

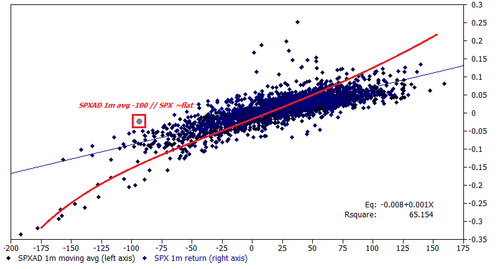

3. The month of December has seen a significant decrease in market breadth: ~70% of the trading sessions in December saw more SPX names declining vs advancing (1m avg SPXAD -100) … negative market breadth of this magnitude has extremely fat tails, and yet SPX index has been extremely resilient vs the regression … 1m avg SPXAD of -100 suggests spx down 10-15%.

4. Another way of looking at the breadth is comparing the return of the SPX equal weight vs the SPX mkt cap weight index … largest underperformance of “stocks” relative to “stock market” in 2024 (-6%)

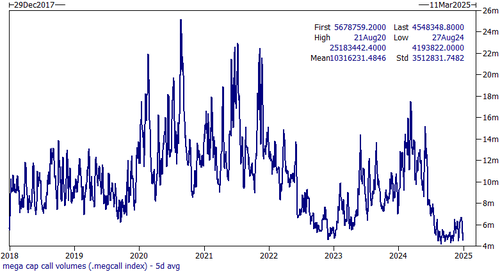

5. While there were episodic periods of retail frenzy during 2024, i would highlight that the speculative “mega cap tech” call buying has decreased significantly: down 75% from peak … not as fun when these names “grind up” vs “crash up.”

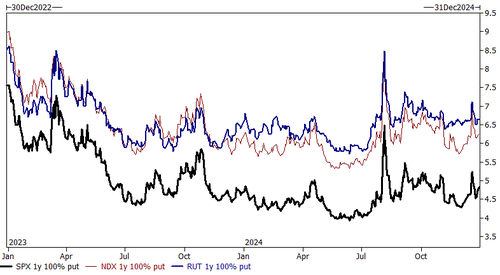

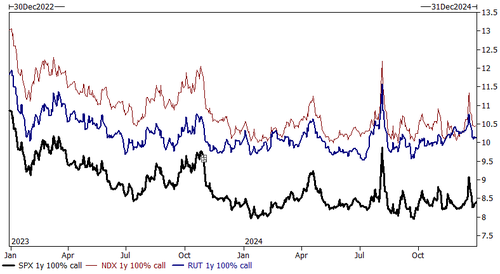

6. You can’t have a year end note without referencing the cost of the 1 year ATMS put / ATMS call: given where rates and dividends are trading, the breakeven for the call is quite high – using the GS price target of 6500 would only yield ~20% return on your premium at expiry (ie, 31dec25 5900 call costs 500 points)

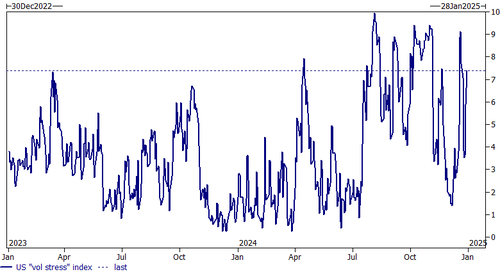

7. Vol stress index: this is going going bid into the end of the year: reminder this is a custom index of rolling 2y percentile rank across VIX vol, ATM vol, skew and term structure (7.5 last)

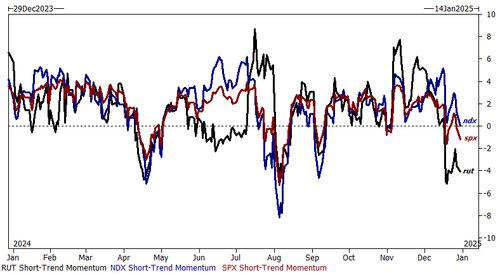

8. Systematic: given the price action, there is a renewed interest in how the systematic community is set up: Russell and S&P have both crossed below their short term momentum threshold (NDX right there) … Goldman calculus suggests that this cohort has already sold ~$28BN of global equity over the last week, and set up to sell another $28bn over the coming week (flat tape); this will get air time over the first sessions of 2025.