De olierige lande ved Den prsiske Golf bliver ramt hårdere end først antaget af corona-krisen på grund af faldet i olieprisen og den stærkt reducerede afsætning.

Uddrag fra BNP Paribas:

GCC – Counting the cost of Covid-19

KEY MESSAGES

We now think the GCC is more vulnerable to the

Covid-19 epidemic than previously assumed.

Proximity to Iran and heavy reliance on foreign

workers leaves the Gulf highly exposed to the viral

spread.

The main economic hit will likely come through lower

oil prices and exports revenue.

In particular, the impact on regional tourism,

investment flows and healthcare expenditure reinforce

our already bearish outlook on regional growth and

budget balances in 2020.

Covid-19 has spread rapidly: The GCC has emerged

in recent days as the epicentre of the Covid-19 outbreak

in the Middle East.

To date, the region has seen over 200 reported cases of

Covid-19, a sharp upswing from just three infections in

the UAE on 28 January, when the virus seemed largely

irrelevant to the GCC and broader Middle East.

The Gulf in particular appears susceptible to the

outbreak in neighbouring Iran, where there are

thousands of suspected cases and the numbers look set

to rise further.

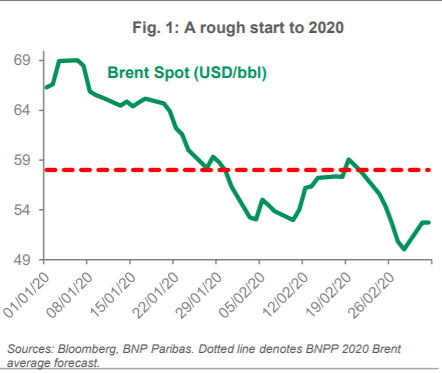

OPEC unlikely to fully mitigate demand loss due to

Covid-19: The immediate Covid-19 impact on the GCC

comes through oil prices (see EM trade tracker – Weak

Momentum, 19 February). Since the start of the year,

Brent has fallen by 20.5% to USD52/bbl (Figure 1). While

the signing of a US-China phase 1 trade deal in January

eased economic concerns, these have been revived by

the negative demand shock that the Covid-19 outbreak

represents. The 2003 SARS epidemic, while a useful

benchmark to gauge Covid-19’s impact, is not an entirely

comparable one, with Covid-19 appearing more

contagious and hence more difficult to circumscribe.

Demand for oil products has fallen heavily in China with

industry containment measures, but a comparable

decline in China’s imports for crude oil is, in our opinion,

less likely. Past buying patterns suggest that China

would leverage an opportunity to purchase discounted

crude oil, contingent on storage capacity. This week,

OPEC is holding ministerial level meetings and we

expect that the producer group, along with its non-OPEC

allies, will not extend supply cuts and agree some

measure of incremental output restraint for Q2 (see

OPEC+ proceeding as planned, 21 February). In

addition, with G7 countries and central banks ready to

safeguard economic growth, we are wary for now to

make downward revisions to our already bearish Brent

price view. We expect Brent to average USD54/bbl in Q2

before making a recovery in H2 2020 (see Global growth

downgrade on Covid-19 shock, 18 February).