The gift that keeps on giving

European equities are climbing steadily as economic data beats expectations, financial conditions ease, and rate cuts begin. Domestic investors are buying again, and Germany’s long-awaited policy momentum may be turning the tide after years of stagnation. When a super-tanker turns in macro-trading, you do not want to get out too early.

European MoMo

Equities keep grinding higher and Momentum shows no sign of reversing.

Source: Barclays

Europe’s new-found love for Europe

Domestic investors are buying European equities after a long period of being sellers.

Source: EPFR

10-year strong

We have seen some of the strongest inflows into European equities since 2015.

Source: EPFR

Europe’s got the surprise factor

Economic surprises up in EU, but down again in US.

Source: Barclays

Market expects more cuts

25 bp cut as Lagarde hints approaching end of monetary policy cycle, markets expect more.

Source: Macrobond

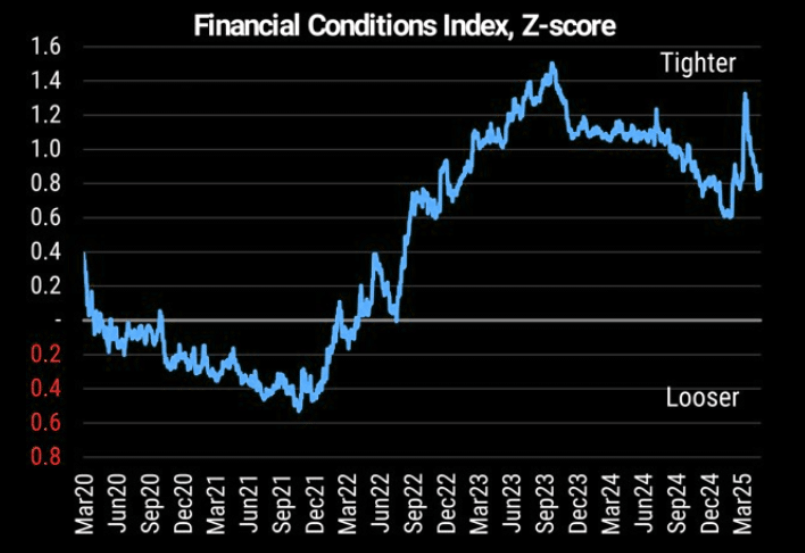

Getting easier

Financial conditions remain tight, but have eased since the beginning of April.

Source: Morgan Stanley

Pause cut cut

Morgan Stanley: “After the June rate cut, we see the ECB pausing in July, then cutting in September and December.”

Source: Morgan Stanley

Markets still expect more to come

Downward revision to HICP projections aligned with recent signs of further fall in inflation.

Source: Macrobond

Germany starting to deliver

“Recent developments in Germany have been incrementally positive, in our view, addressing investor skepticism around domestic policy delivery and US tariffs. On policy delivery, Germany’s cabinet approved a €46 billion package, including an “investment booster” for capex (beginning this year) and corporate tax cuts (phased in from 2028). On tariffs, Friedrich Merz had a successful White House meeting… While the German market has delivered impressive returns YTD, we remain Overweight in our European country strategy. Within Germany, we maintain our preference for mid caps. The MDAX has only started to unwind previous underperformance, trades at a historically rare valuation discount to Large caps, and will benefit more from domestically-focused policy stimulus.” (CITI)

Source: LSEG Workspace

Only way is up…

Germany hasn’t grown for years, and it avoided contraction only due to growing government employment during that time. Only way is up…