Resume af teksten:

Donald Trump har erklæret mødet med Kinas præsident Xi som “fantastisk” og en succes, hvilket markerer et vigtigt skridt i de anstrengte forbindelser mellem USA og Kina. Mødet fører til en etårig våbenhvile i handelskonflikten, og der blev opnået enighed om flere økonomiske områder. Afgifter på fentanyl-relaterede varer sænkes, mens Kina vil samarbejde om fentanyl-problematikken. Samtidig bliver eksportkontrol lettet, og sanktioner mod kinesiske virksomheder rulles delvist tilbage. Kina vil genoptage importen af amerikanske soyabønner, og portafgifter mellem de to lande suspenderes i et år. Trods de positive toner, eksisterer langsigtet strategisk konkurrence mellem landene fortsat, og fremtidige misforståelser kan påvirke aftalen. Langsigtet stabilitet afhænger af, om denne positive udvikling kan opretholdes.

Fra ING:

President Trump declared that the long-awaited meeting with Xi was amazing, outstanding, a “12 on a scale of 10”, with the Chinese President expressing a willingness to work with his US counterpart to lay a solid foundation for China-US relations and reassure the world economy

Donald Trump declared yesterday’s talks with Chinese President Xi a huge success.

Top level meeting firms up the “hard won consensus”

The long-awaited meeting between the presidents of the world’s two largest economies marked a major milestone in what has been a period of friction for US-China ties. The meeting concluded on a positive note, setting up a year-long truce. In terms of the immediate implications, the successful meeting defuses the immediate prospects of another sharp cycle of tariff and non-tariff escalations and the potential economic and market fallout that would accompany it.

While all eyes were on the high-profile meeting between US President Donald Trump and Chinese President Xi Jinping, the groundwork for this meeting took place earlier in the week, when a “hard-won consensus” was achieved between the main negotiators of China and the US.

The key talking points have been well publicised in the past few months, and both sides appeared to secure some benefits after the talks, though follow-up work remains to be finalised. Initial reports indicate agreements on some of the following categories:

Fentanyl-related tariffs to be lowered by 10%, bringing the effective tariff rate on Chinese products to around 47%. In return, China is set to cooperate on the fentanyl issue, though specifics were not provided. The lowered tariffs, combined with higher tariffs on many other global economies, will help improve Chinese exporters’ competitiveness on the margins, especially for the categories which are not impacted by sector-specific tariffs. With that said, exports have remained resilient this year as China has diversified its exports away from the US.

Export controls will not be tightened. On China’s side, the extended rare earth export controls requiring export licences to sell products containing Chinese rare earths shocked markets earlier this month. An agreement was reached to delay these expanded export controls for a year, which should help alleviate fears.

Rollback of sanctions expansions on majority-owned Chinese companies, which would have led to more companies falling under a sanctions umbrella. This could have implications for various Chinese firms.

Expansion of agricultural trade. China is set to resume purchases of US soybeans, though the scale of these purchases remains uncertain, and reports have been that China has secured most of its soybean demand for early 2026 already.

The proposed port fees on Chinese ships and China’s corresponding retaliation on US ships may be rolled back for one year.

Dialling back bilateral tensions should help remove a source of uncertainty, and extending the truce periods from the three-month frameworks of the past few agreements to a year-long agreement should help reduce an intermittent source of uncertainty for markets.

While cautious optimism may be the prevailing mood after the meetings, it should be noted that many milestones must go well for this truce to last for the entirety of the one-year term. While neither China nor the US wish to see a mutually damaging re-escalation, the countries nonetheless remain locked in a longer-term strategic competition, and as we have seen in the past few months, miscalculations can easily occur along the way.

In the longer term, we still appear to be heading towards a world where more economies are focused on economic security. Our first look at China’s next Five Year Plan has emphasised the importance of tech self-sufficiency and innovation. The “de-risk China” theme has been prevalent in recent years, but at the same time, China has diversified its export structure and foreign reserve holdings in recent years as well, reducing its exposure to the US. While a return to win-win cooperation and globalisation would be welcome boosts for the outlook, time will tell if the positive tone can truly last.

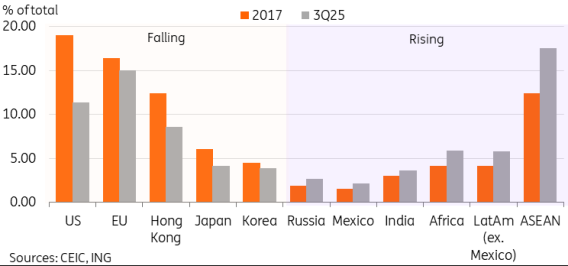

De-risking has caused a major shift in China’s export structure away from the US

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.