Uddrag fra Goldman Sachs/Baank of America/Polymarket/ Zerohedge/

Why is Germany having elections?

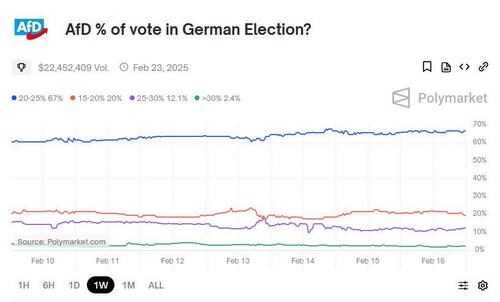

Germany is set to hold a federal election on February 23, 2025, following the collapse of Chancellor Olaf Scholz’s three party coalition government in December last year. The conservative CDU/CSU is currently leading in the polls, with the populist, anti-immigrant, AfD – which has been endorsed by Elon Musk – in second place and rising, and which could spoil Wall Street’s party expecting a boost to fiscal stimulus, if it outperforms.

- The coalition, comprising the Social Democratic Party (SPD), the Greens, and the Free Democratic Party (FDP), faced internal division after several months of dispute over the country’s economic policies. The Greens/SDP proposed a debt-financed fund to stimulate corporate investment. However, this proposal conflicted with Germany’s constitutional debt brake, which limits annual structural deficits to 0.35% of GDP per year.

- In response, the fiscally conservative FDP released a policy paper advocating for halting new regulations, implementing tax cuts, and reducing public spending, including on climate initiatives. This stance was at odds with the SPD and the Greens, leading to intensified disputes within the coalition.

- The discord culminated on November 6, 2024, when Chancellor Scholz dismissed Lindner from his position as finance minister, citing a loss of trust. This effectively dissolved the coalition and Scholz called for a vote of confidence in his government, which he lost on December 16, 2024, leading to snap elections.

Why is this election important?

- As Goldman FICC strategist Jonathan Luey writes, the upcoming election is, in effect, a defacto referendum on fiscal reform given this was the reason the last government failed and the the proposals from the leading parties would challenge the debt brake in its current form.

- The proposals from the leading parties will face substantial fiscal challenges under the current limit with an average funding gap of 23bln or 0.5% of GDP (above the current 0.35% debt brake).

- According to Goldman Sachs research, options to create fiscal space include:

- (1) Reforming the constitutional debt brake

- (2) Creating an off-budget defence fund

- (3) Establishing a special infrastructure investment fund

- All of these options will require a 2/3 constitutional majority

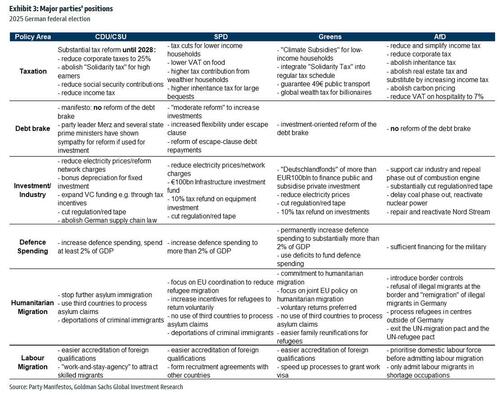

Who are the parties and what are their policies?

There is a brief description of the main political parties at the end of this piece. Goldman research has put together a handy table showing the major party positions

- As alluded to, the most important policy stance is the party’s attitude towards fiscal reform.

- In this regard the parties on the left- SPD, Greens, Die Linke and BSW- are more open to reform.

- The CDU/CSU believe in the enforcement of the debt brake, however the party’s proposals have focused on cutting taxes and increased defence spending. As such, some fiscal reform is likely to implement these policies.

- The AfD and FDP are against reform.

Why the composition of the upcoming government matters?

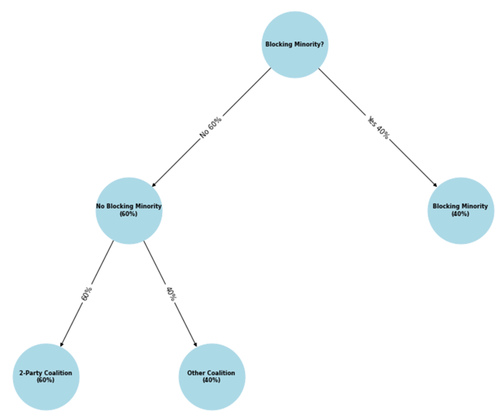

- A 2/3 majority is required for constitutional reform. Put another way, a 1/3 constitutional blocking minority could prevent the government from reforming the debt brake and implementing their fiscal agenda.

- It should also be noted that “the 5% rule” or “Fünf-Prozent-Hürde” is a threshold that requires a political party to receive at least 5% of the national vote (or win at least three direct constituencies) to gain seats in the Bundestag.

- Currently 3 parties (Die Linke, BSW and FDP) are polling around this 5% threshold. If 2 of them were to gain over 5% and AfD were to outperform the polls, this would likely lead to a 1/3 constitutional blocking minority.

- Though Die Linke and BSW are not necessarily against fiscal reform it is unclear (and probably unlikely) they would vote with the government. The FDP are the most economically conservative and are against fiscal reform.

- Currently 3 parties (Die Linke, BSW and FDP) are polling around this 5% threshold. If 2 of them were to gain over 5% and AfD were to outperform the polls, this would likely lead to a 1/3 constitutional blocking minority.

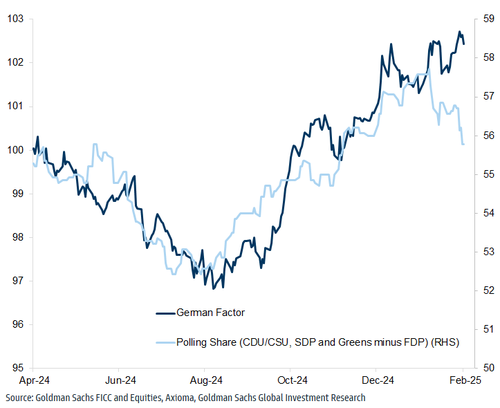

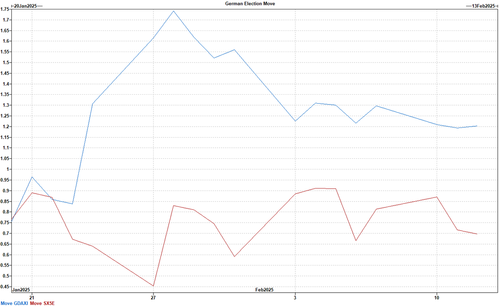

- Indeed the broad “German factor” has been correlated with support in opinion polls for CDU/CSU + SDP + Greens – FDP:

What do polls and betting markets say?

- Recent polls have the legacy CDU/CSU (whose approval is falling) leading, followed by the ascending AfD and the flatlined SPD.

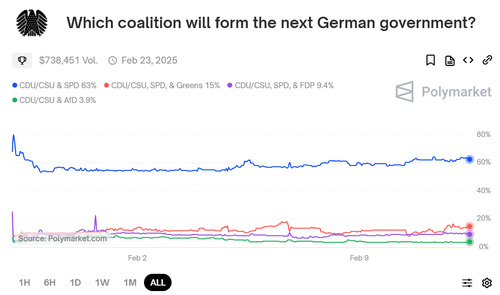

- The most likely coalition outcomes based on current polling are a Grand Coalition of the CDU/CSU with the SPD or a Black-Green coalition.

- The CDU/CSU manifesto includes tax cuts, welfare spending reform and immigration controls, while the SPD focuses on lower-to-middle income tax cuts, industry subsidies, aid and a higher minimum wage.

- The Greens propose investment subsidies, and a subsidy to low- and medium-income households for climate-related price increases.

- All parties promise to reduce taxes or charges on electricity prices.

- The modal outcome on betting markets is a CSU/SPD two party coalition (~63% chance) and 37% chance of some other coalition forming.

- Perhaps more important is the probability of constitutional blocking minority

- Assuming AfD gets around 20-25% of the vote, if 2 of either FDP/Linke/BSW get over 5%, then there will likely be a constitutional blocking minority.

- Using current betting market odds, the joint probability is ~43%.

What are the Scenarios?

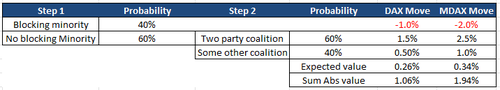

- According to Goldman, a two party coalition (CDU/CSU + SPD > 50%) government without a constitutional blocking minority is the most bullish outcome.

- The coalition would need to make less concessions to a smaller coalition partner allowing for larger fiscal reform and creation of a defence fund.

- Goldman estimates a €240bln Defence fund (3% GDP) and a more significant reform of the debt brake (€15bln per year) would boost 2026-2028 GDP by 0.3% on average.

- A 0.3% boost to German GDP (and 0.1% for the rest of the Euro area) would increase DAX and MDAX earnings by around 1-2%.

- A three party coalition (CDU/CSU + SPD + Greens/FDP) without a constitutional blocking minority is mildly bullish.

- The addition of a 3rd coalition member may limit the size of fiscal reform and defence spending.

- The bearish scenario is if the CDU/CSU + SPD underperform the polls and a constitutional blocking minority (AfD+ FDP + Die Linke > 33%).

- This scenario would likely result in no additional fiscal impulse.

- This gives a step probability decision tree:

- Here is how the Goldman economists summarize the post-election scenarios:

- Substantial Upside Scenario (20% probability): Defense spending increases to 3% of GDP via a EUR240bn Defense fund, and a more significant reform of the debt brake provides EUR15bn per year. They estimate this would boost 2026-2028 GDP by 0.3pp per year on average.

- Limited Upside Scenario (50% probability): Defense spending rises to 2.5% of GDP through a EUR160bn Defense fund, and a minor reform of the debt brake provides EUR6bn a year. This would boost 2026-2028 GDP by an estimated 0.2pp per year on average.

- No Additional Fiscal Support Scenario (30% probability): In this scenario, there is no additional fiscal support relative to current plans. This could happen if parties opposing Defense spending and higher deficits achieve a one-third blocking minority (e.g. if the FDP and Die Linke enter parliament).

- Below is the Goldman desk’s reaction function for DAX and MDAX

- We think the distribution skews slightly positive on the event with MDAX having higher beta (given more domestic exposure).

- The breakevens are inline with current option market pricing:

- Bank of America’s Michael Hartnett agrees in principle with Goldman, and notes that German fiscal stimulus will come under 2 of 3 of likely election outcome scenarios:

- 1. most bullish scenario = 2-party coalition of CDU/SPD winning over 50% of vote (they currently polling 47% per Politico Poll of Polls) leading to “fiscal ‘bazooka”/constitutional change of German “debt break” (can’t run structural budget deficit),

- 2. mild bullish scenario = multi-party coalition (BofA base case – see Euro Area Viewpoint: Germany: fiscal hope springs eternal 04 February 2025) and one-off fiscal stimulus in ’25,

- 3. bearish scenario = far-right/left AfD/BSW parties win >33% of vote (currently polling 23% per Politico Poll of Polls) resulting in no stimulus/policy stalemate (as mainstream parties unlikely to vote for AfD/BSW immigration demands in exchange for fiscal stimulus).

Not everyone expects the most favorable outcome however, and as Goldman trader Mark Wilson pointed out, “the reality of recent history is that political pollsters have been wrong-footed by the ‘silent’ voters, especially related to non-mainstream or non-frontrunner candidates”. As such, the Musk-endorsed AfD could logically cause similar problems in German polling. But while the detailed analysis would suggest AfD outperformance vs current polling will curtail the ability to deliver on increased fiscal expansion, Wilson thinks the bottoms-up budget impact would be over-shadowed by centrists embracing a more dramatic ‘change’ agenda to counter.

What trades does the Goldman trading desk like?

- There is positive convexity in owning upside in MDAX:

- Buy MDAX 21st March 102/106% CS for 1.1% (delta 25)

- Priced indicatively // max loss = premium

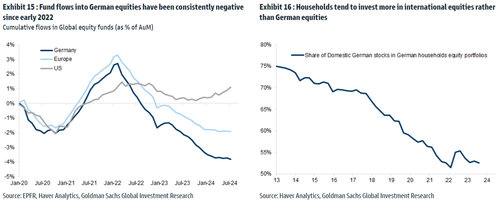

- MDAX has been a perennial laggard since the Russian invasion of Ukraine in Feb 2022

- Since then it has underperformed the SXXP by over 45% (note MDAX is a total return index)

- In addition, it was one of the few indices globally to register a negative return in 2024

Equity fund flows into Europe in general and Germany in particular have been consistently negative since early 2022:

- An outcome in which in which there is no constitutional blocking minority, and subsequent fiscal impulse has the potential to shift Germany’s (and broader Europe’s) growth narrative.

- One of the key policies from CDU/CSU is to cut corporation tax from 30% to 25%

- All major parties plan to cut regulation

- This policy mix has similar undertones to the US and aims to create a more business friendly environment which should benefit small/midcap companies

- From a technical standpoint, following the 2022 derating post the start of the Ukraine/Russia conflict, MDAX has consolidated in a tight range. It is now testing the upper bound:

Brief description of main political parties:

- The Christian Democratic Union (CDU) and the Christian Social Union (CSU) are two closely aligned center-right political led by Friedrich Merz(CDU) and Markus Söder(CSU). They are running on a platform of tax cuts, welfare spending reform and immigration controls. In general the party is fiscally conservative and opposed to reform of the debt break, however Merz has shown some sympathy for reform if used for investment.

- The Social Democratic Party of Germany (SPD) is a center-left party currently led by Saskia Esken and Lars Klingbeil with Olaf Scholz as candidate running for Chancellor. The SDP focuses on lower to middle income tax cuts, industry subsidies and a higher minimum wage. The party supports reforming the debt brake to allow more government borrowing for investments.

- The Greens (officially Alliance 90/The Greens, or Bündnis 90/Die Grünen) are a center-left, environmentalist party led by Franziska Brantner and Felix Banaszak with Robert Habeck as candidate for Chancellor. They are proposing investment subsidies and a subsidy to low/medium income households for climate-related price increases. They support investment oriented reform of the debt break.

- The Alternative for Germany (AfD) is a populist party led by Alice Weidel and Tino Chrupalla. It has gained significant support in recent years due to its strong opposition to immigration, the European Union, and mainstream political elites. Despite polling in second place with approximately 20% of the vote, no major party is willing to form a coalition with the AfD, making it unlikely to govern at the national level after the upcoming election. They are opposed to any fiscal reforms (including the debt brake) and, as such, their vote share could have a significant impact since it would form the bulk of a constitutional blocking minority.

- The Free Democratic Party (FDP) is a pro-business, free-market liberal party led by Christian Lindner. It traditionally supports low taxes, individual freedoms, and a strong private sector, making it the most economically conservative of the major German parties. Crucially for this election it believes in balanced budgets and strict enforcement of the debt brake.

- Die Linke (The Left) is a democratic socialist and left-wing populist party led by Ines Schwerdtner and Jan van Aken. It advocates for wealth redistribution, stronger worker protections, higher social spending, and a more pacifist foreign policy (opposed to NATO and military spending). The party is in favour of abolishing the debt break, however they are opposed to increased military spending.

- The Sahra Wagenknecht Alliance (BSW) is a new left-wing populist party in Germany, founded in 2023 by Sahra Wagenknecht, a former leader of Die Linke. The party combines economic leftist policies with conservative social and immigration stances, making it unique in German politics.

Who are the top candidates and what are their policies?

Friedrich Merz (CDU)

The frontrunner for the vote is Friedrich Merz of the Christian Democratic Union (CDU). The latest opinion polls show the CDU leading with 30%, representing a significant lead of 10 percentage points ahead over the AfD in second place. Merz himself is also the country’s preferred chancellor, according to surveys, leading comfortably with 32%.

His party is pushing for tax cuts, reform of the country’s ailing military as well as a radical overhaul of the country’s immigration and asylum rules — a proposal that has triggered chaos in the Bundestag weeks ahead of the election.

Merz — a former investment banker and once rival of his party leader predecessor Angela Merkel — has presented “Agenda 2030”, which aims to revitalise Germany’s economy. It wants to lower corporation tax to 25% and raise the level of when the top income tax rate kicks in to €80,000 from around €67,000.

Merz’s party has proposed investing in Germany’s domestic security, equipping so-called “danger areas” with surveillance systems. It wants to continue spending at least 2% of GDP on defence, revamp the country’s military — including introducing some form of compulsory military service — and continue providing aid to Ukraine.

He has suggested he would find the cash for at least some of his changes by altering Germany’s benefits system, including withdrawing payments from adults that show “unwillingness to work”.

While the party wants to stick to limits set by Germany’s constitutional debt brake, Merz has recently suggested he might be willing to reform some rules, in particular to increase defence spending.

The CDU has, in recent weeks, cemented immigration as one of its top priorities.

The party has passed a non-binding five point plan that, among other things, calls for turning migrants away from Germany’s borders — a measure which is out of step with European-wide asylum law.

Other suggestions include the removal of family reunification for those with subsidiary protection — a measure Merz tried and failed to push through parliament last week — deportations of migrants to Syria and Afghanistan, revoking passports for naturalised Germans convicted of crimes, and scaling back aid programmes for asylum seekers.

Merz’s party wants Germany to play a stronger role on the international stage and to build a national security council. It has also pushed to reduce bureaucracy in the EU and make it more competitive.

Alice Weidel (AfD)

AfD candidate Alice Weidel has made headlines for her unexpected bond with tech billionaire Elon Musk. The former economist, who speaks fluent Chinese and lives with her partner in Switzerland, is currently in fourth place as preferred chancellor — on 13% — while her party is second with 20% of the vote, according to the polls.

The party is well-known for its tough stance on immigration. The AfD want to close Germany’s land borders and has called for mass deportations under what they call “remigration”.

Weidel has proposed lower taxes and a radical reduction on bureaucracy. The AfD wants to stick to the debt brake, but its manifesto is vague on how the party would fund extra spending.

The party is friendly towards Russia, calling for the end to sanctions against the Kremlin and cutting off military aid to Ukraine. It also wants to introduce compulsory military service and spend higher on defence.

The AfD, and Weidel, have long been critical of the European Union, and have said Germany should exit the bloc, which the party believes should be shrunken down to a free trade zone.

Elsewhere, it wants to pull Germany out of its international climate pacts, reinstate nuclear energy and rebuild the Nord Stream pipeline to import Russian gas.

Olaf Scholz (SPD)

Outgoing Chancellor Olaf Scholz’s SPD has been polling steadily in third place for several months, with the latest survey putting the party on 15%. Scholz himself is also in third place as German voters’ preferred chancellor — on 18% — the polls show.

The party’s popularity has taken a hit since Germany’s last election in 2021 when it came first with 25% of the vote — largely as a result of leading an unpopular and acrimonious governing coalition.

Unlike the CDU, the AfD and the pro-business FDP, the SPD wants reform of the debt brake, which it says could be used to stimulate public investment and invest in infrastructure.

This includes a debt-financed investment fund worth €100 billion to increase public investments in infrastructure and the green transition. The SPD also wants to lower income tax for most households and increase taxes on the super-rich.

The party is in favour of Germany’s current social security system but has said it would increase pressure on the long-term unemployed to find work. To help low-income workers, it has proposed raising the national minimum wage from €12.41 to €15 an hour.

The party has hardened its stance on immigration and says it wants to accelerate the deportation of rejected asylum seekers and maintain border controls at land crossings.

It does, however, want to stick to its citizenship law that allowed dual citizenship and make it easier for IT experts and other qualified professionals to come to Germany from abroad.

Scholz has found himself under fire during the election campaign for blocking support to Ukraine, citing a lack of available funds and backed by some war-weary SPD members.

Despite this, Ukraine is a prominent part of the SPD’s manifesto with the party proposing to support the country with weapons and equipment, as well as Ukrainian President Volodymyr Zelenskyy’s vision of a peace deal. The SPD wants to keep spending at least 2% of GDP on defence — which it achieved last year — and deepen EU integration.

Robert Habeck (The Greens)

The Green party has been polling between third place — tied with the SPD — and fourth place. Robert Habeck, the former vice chancellor, is in second place as preferred leader for the country — on 24% — according to the latest surveys.

The Greens, similar to the SPD, want to introduce a special debt-finance public fund to modernise Germany’s infrastructure and transition the country to net-zero. It has also suggested reforming the debt brake in order to promote more investment.

The party has backed off on some of its hardline climate policies, and wants to build overhead power lines instead of more expensive underground cables. It also wants to lower electricity taxes to the EU and cover the cost for grid fees.

On migration, the Greens want to set up a panel of experts to advise on policy decisions and has opposed outsourcing of asylum procedures to third countries.

Habeck’s party has seemingly abandoned its pacifism of the past and now supports spending 2% of GDP on the country’s defence. The Greens also want to promote more joint arms procurement in the EU and support Ukraine joining NATO.

The party is pushing for reforms in the EU that replace unanimity with majority decisions and cut funding for members that undermine the rule of law. It also believes the EU should source its own financial resources.

Sahra Wagenknecht (BSW)

The Sahra Wagenknecht Alliance (BSW) — founded last year by Sahra Wagenknecht and others who split from the Left Party — originally enjoyed strong performances in both European and state German elections, but recently has been polling between 4% and 6%.

The party has called itself the “only peace party” in German parliament and says it rejects the current “arms build up” as well as the delivery of weapons to conflict zones, including Ukraine.

The BSW wants cheap energy, including from Russia. The party says it is opposed to sanctions against Russia which its leader Wagenknecht has described as “having nothing to do with the Ukraine war”.

Its election manifesto proposes to take climate change seriously but, “not get lost in haphazard activism and burn billions of euros of taxpayers’ money in the process”. Similar to the CDU, the BSW wants to repeal the outgoing government’s heating law.

Elsewhere, the BSW is proposing raising the minimum wage, promoting citizens’ insurance over private and statutory health insurance, and reducing migration.

It advocates for a “cabinet of experts” who could advise on policy decisions.

Christian Lindner (FDP)

Scholz’s former Finance Minister Christian Lindner’s unceremonious firing following a bitter budget dispute effectively caused the ruling coalition to collapse. Since then, his pro-business FDP party has been consistently polling at 4%.

The fiscally conservative FDP is opposed to reforming the debt brake — a disagreement which led to his sacking. The party wants to reduce corporate tax to below 25% and cut VAT for restaurant food to 7%.

It aims to tighten rules for unemployment benefits and cut benefits to those who cannot prove they are actively looking for work.

It wants to postpone Germany’s climate neutrality aims by five years as well as revive nuclear power plants and expand the domestic production of natural gas.

Lindner and his party want to shrink the European Commission and support majority voting for foreign and security issues for the bloc. The FDP has proposed redirecting funds from Germany’s development aid to domestic interests.

On migration, the party has suggested taking authority for deportations away from Germany’s states and to a federal level.

The party is in favour of sending long-range Taurus missiles to Ukraine — a position Scholz has repeatedly rejected — and wants a German volunteer army.