Uddrag fra Goldman/ Zerohedge

Goldman’s Big Picture summary

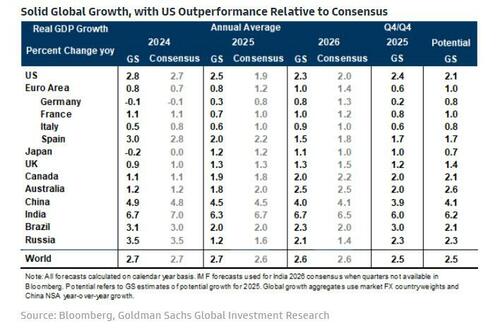

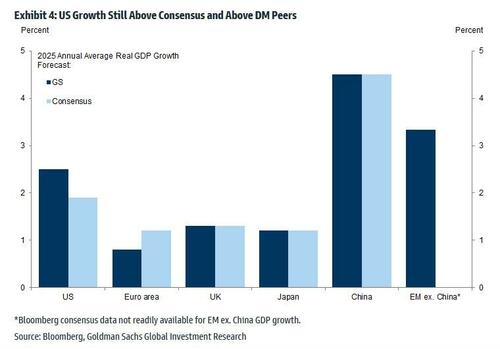

- US: Goldman expects the second Trump administration to bring higher China tariffs, much lower immigration, some fresh tax cuts, and regulatory easing. If so, the US economy should grow 2.5% in 2025, highest within DM (Goldman is higher than consensus). US core PCE inflation should slow to 2.4% by late 2025. This forecast would rise to around 3% with an across-the-board tariff of 10%. The bank still expects significant further rate cuts over the next year. The Fed is likely to cut to 3.25-3.5%, with sequential moves through Q1 and a slowdown thereafter.

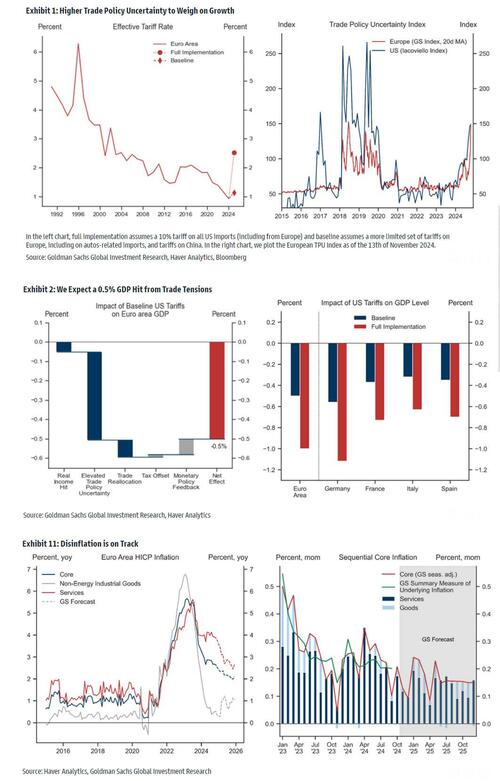

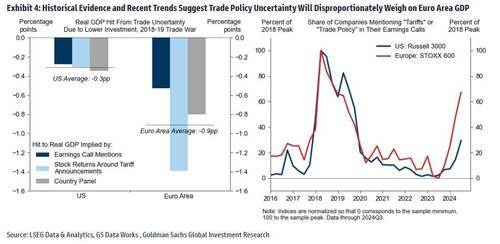

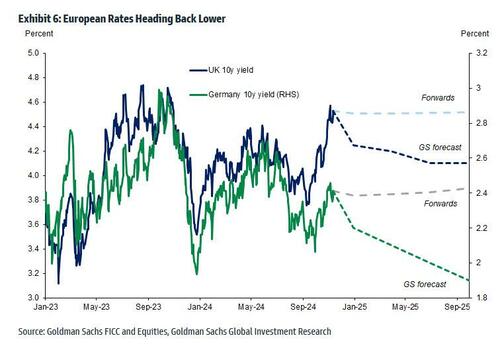

- Europe: Goldman cut its Euro area GDP forecast to a below-consensus 0.8% reflecting ongoing structural headwinds and a hit from trade policy uncertainty. The bank expects core inflation to slow to 2% by late 2025 and is less concerned about upside risks even with a broader trade war; also expects sequential ECB cuts and have lowered the terminal forecast to 1.75% on the back of our growth downgrade.

- China: Here too Goldman cut its 2025 China GDP forecast to 4.5% because of higher US tariffs that are only partially offset by easier macro policies. The combination of tariffs and policy support will rotate China’s growth towards domestic demand (ex-housing) in 2025. Goldman estimates that a 20pp increase in the average US tariff on Chinese goods (our baseline assumption) would reduce Chinese GDP by about 70bp.

The biggest risk for Goldman’s US, Europe & China GDP growth estimates is “a large across-the-board tariff by the US, which would likely hit growth hard globally.”

Next, we take a closer look at the summary outlook of Goldman chief economist Jan Hatzius’ Macro outlook 2025 (excerpted from “Macro Outlook 2025: Tailwinds (Probably) Trump Tariffs” available to pro subscribers)

Goldman expect the second Trump administration to bring higher China and auto tariffs, much lower immigration, some fresh tax cuts, and regulatory easing. If so, the US economy should grow 2.5% in 2025, outperforming consensus expectations and other DM economies for the third year in a row. The biggest risk is a large across-the-board tariff, which would likely hit growth hard.

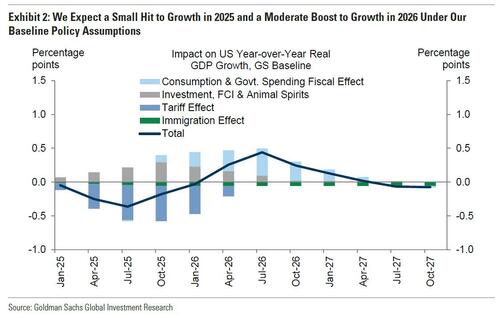

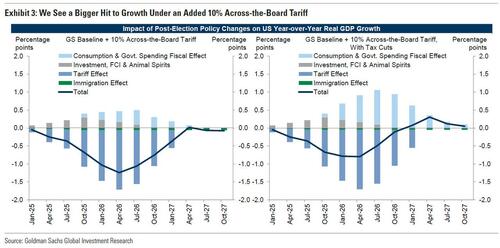

The effects from the new policies on US GDP are small and largely offsetting under the baseline outlook. Assuming that the trade war does not escalate further, the team expect the positive impulses from tax cuts, a friendlier regulatory environment, and improved “animal spirits” among businesses to dominate in 2026, with a net boost to growth averaging 0.3%.

In Goldman’s tariff risk case, by contrast, the modest negative impulse from the China and auto tariffs gives way to a bigger negative impulse from the across-the-board tariff, both because the hit to real income increases and because trade policy uncertainty builds further. In 2026, this results in a net drag on growth averaging 1.0% and peaking at 1.2%, although the peak drag declines to 0.8pp if we assume that the increased tariff revenue is fully recycled into tax cuts.

The experience of the first Trump administration shows that tariffs are largely passed on to consumer prices. If tariffs are confined to China and autos from Europe and Mexico, this analysis implies that the US inflation impact will be a relatively modest 0.3-0.4pp. Barring significant second-round effects via expectations or wages, however, tariff effects are price level effects, so the inflation impact subsides in 2026-2027.

Hatzius does not expect the US election outcome to derail the policy normalization process that is currently underway, and see most major central banks easing significantly further through 2025. GS Econ forecast that the Fed will cut to 3.25-3.5% with sequential moves through Q1 and a slowdown thereafter. If anything, the threat of a near-term growth drag from tariffs and the Fed leadership’s continued preference for frontloaded policy normalization have strengthened their confidence in sequential cuts through early next year.

* * *

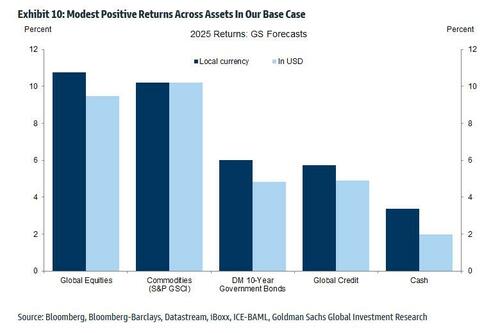

Turning to markets, Goldman highlights 10 core investment themes that drive many if not all of the bank’s market views (much more in the full note “Markets Outlook 2025: Trading Tails and Tailwinds” available to pro subs)

1. A wider distribution after the soft landing: Solid growth, higher equities and stronger Dollar in base case, but markets have moved and tails are fatter.

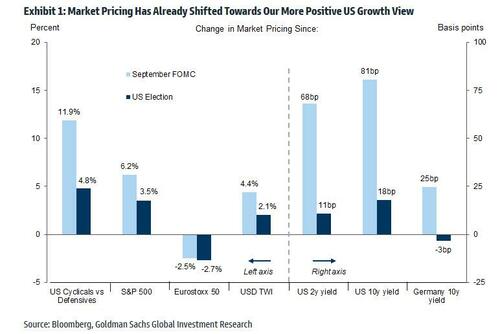

“Our baseline forecast remains essentially benign for the US: solid growth, cooling inflation and further non-recessionary rate cuts, alongside a range of policies that could be friendly to corporate earnings. And while the US is a clear outperformer, non-US economies still see stable growth, falling inflation and monetary easing in our central scenario. This backdrop would naturally push towards a friendly risk asset backdrop, alongside US outperformance. Although our forecasts for 2025 have that flavour, two issues complicate those judgments. The first issue is that markets have already moved a long way towards pricing this kind of outlook. Both ahead of and since the election, markets have upgraded US growth, pushing US equities and the USD higher, and building in a larger divergence between US and European rate markets. We think our baseline forecasts justify higher equity prices and further USD outperformance, but that judgment is more finely balanced than it was. As US equity markets take more credit for potential favourable policies, the risks of disappointment as the policy agenda ultimately becomes reality will rise.”

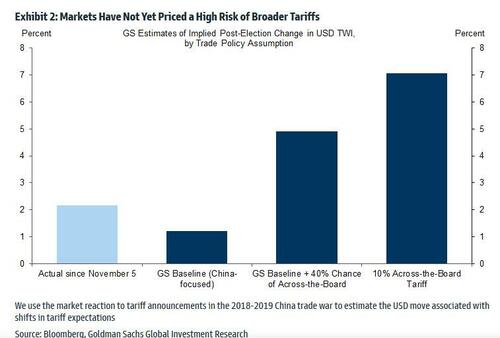

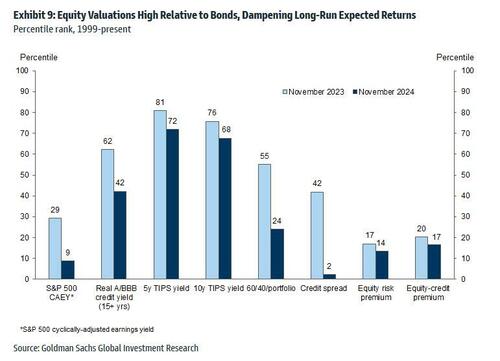

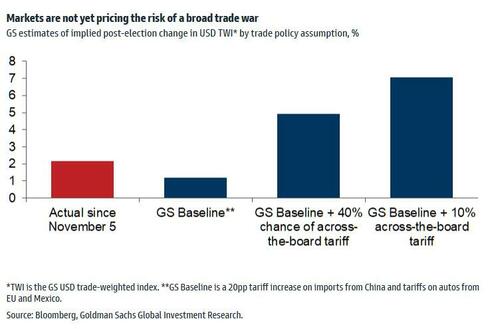

“The second issue is that the tails around our base case look quite fat and the US election outcome—the broad mandate it has given to President-elect Trump—widens the distribution of possible policy shifts. We generally worry less about a sustained increase in fiscal risk premia in bond markets, though ongoing fiscal support could push views on the neutral rate higher. But while the market has focused on risks to the most likely tariff recipients, the risks of a broader trade war look underpriced. If the market comes to place more weight on that outcome, we think that would reinforce USD upside, but add to pressures on non-US, and ultimately US, equities. Unusually high US equity valuations may amplify the reaction to any economic weakness and dampen long-term expected returns. Positive tailwinds are also possible if tariffs are narrowly targeted, if oil prices fall more sharply on enhanced supply, or if inflation or fiscal fears prove overdone. We think this backdrop justifies investors maintaining upside exposure to US equities, while diversifying or using options to limit the major tail risks.”

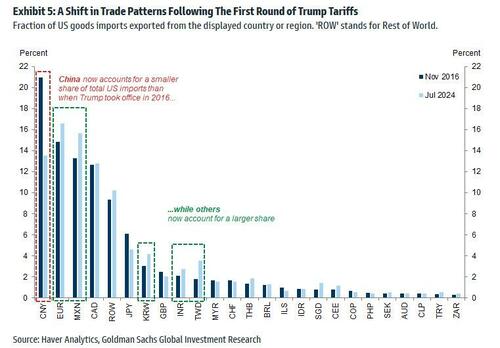

2. Weighing the tariff tail: Tariffs on China are largely expected and manageable; ‘across-the-board’ tariffs would be more inflationary, more USD-positive and more ‘risk-off’.

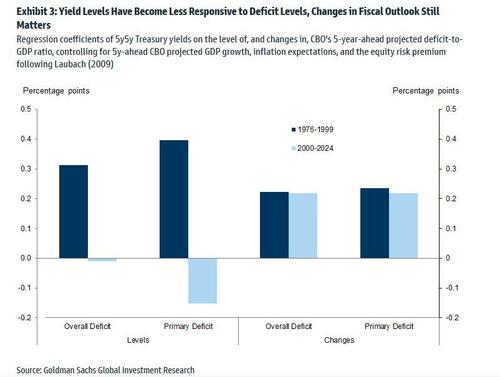

3. Finding terminal rates in a world of fiscal risks: US post-election fiscal expansion (joining Japan, UK and some EMs) raises risks of higher terminal rates.

4. Renewed divergence reinforces Dollar strength: US growth stronger than DM peers, and consensus; broader tariff agenda is where the real Dollar upside remains.

5. China in the cross-hairs but some scope to respond: Ultimately, challenges and prospects for China asset picture still mainly rest on domestic policy delivery.

6. Europe and EM—a more challenging picture: European growth and EM face headwinds from Trump agenda, raising bar for capital inflows.

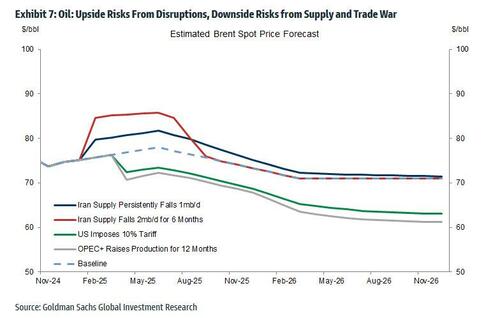

7. Energy markets—ample supply, watch the tails: Range-bound oil: upside from geopolitics in short term, downside from spare capacity as the year goes on.

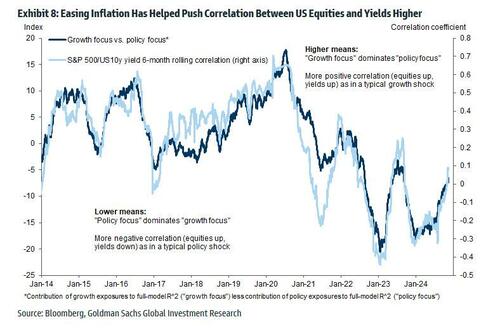

8. A bit more inflation risk but growth shocks still in focus: Equity-yield correlations likely to drift higher; value in Treasuries/TIPS, and especially Bunds and Gilts, in portfolios.

9. The growing valuation challenge: US equity valuations highlight long-term challenge; valuation penalty normally paid when cycle turns, fattening downside tail.

10. Diversification, tails and hedges: Friendly (US) base case with protection. Optionality in equities after vol reset; long USD alongside tails in oil and gold; 2017 parallel suggests non-US assets could benefit if risks recede.

Finally distilling all of the above in just 5 bullet points of key takeaways, we get the following:

1. Trumponomics 2.0

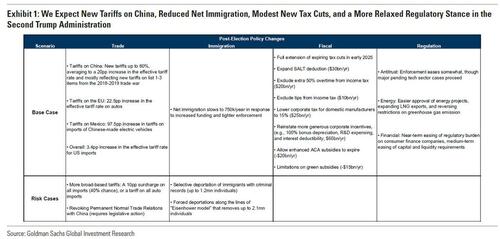

Goldman expects US economic policy to shift across four key areas under the second Trump Administration.

- On trade, Trump will impose additional tariffs averaging 20% on imports from China as well as increase tariffs on autos from the EU and Mexico, which will likely be announced relatively soon after Inauguration Day (January 20).

- On fiscal, look for a full extension of the 2017 tax cuts that are set to expire next year and a reduction in the corporate tax rate for domestic manufacturers from 21% to 15%.

- On immigration, expect net immigration to slow sharply to 750k/year in response to increased resource funding and tighter enforcement.

- And on regulation, expect a relaxed regulatory stance in the energy and financial industries. The impacts from these new policies on US GDP will be small and largely offsetting, with a net drag averaging 0.2pp next year.

2. (Still) better growth in the USA

While Trump’s tariffs will weigh on US growth next year, they will have a larger growth impact elsewhere. Goldman estimates that a limited trade war will only modestly lower US growth, but reduce real GDP growth in the Euro area by 0.5pp and by 0.7pp in China next year. As a result, the bank recently lowered its 2025 Euro area GDP growth forecast to a below-consensus 0.8% (from 1.3%) and its China GDP growth forecast to 4.5% (from 4.7%), with macro stimulus and RMB depreciation providing only a partial offset to the growth drag there. The smaller growth impact from tariffs, combined with expectation that productivity growth will remain significantly stronger in the US than elsewhere, leads Goldman to expect another year of US growth outperformance with an above-consensus US GDP growth forecast of 2.5% next year.

3: Watch the trade and fiscal tail risks

The broad mandate for change reflected in the election outcome widens the distribution of possible US policy shifts, with the potential for a larger trade war a key tail risk. The bank estimates that the US and global growth impacts of a 10% across-the-board tariff would be much larger than those in our baseline, with such a tariff also likely to raise US and, to a lesser extent, global price levels. Markets currently appear to be underpricing the risk of a broad trade war, and a firmer shift in this direction could lead to meaningful further Dollar upside, weigh on US equities and bond yields, and add to downward pressure on non-US equities and yields. There is also see scope for additional fiscal expansion, though any incremental fiscal expansion will be more modest than that following the 2016 or 2020 elections and, accordingly, Goldman is skeptical about the prospect of a sharp increase in fiscal risk premium in Treasury markets. That said, post-election fiscal loosening in the US as well as in the UK, Japan, and some EMs could push terminal rates higher globally.

4: Double the valuation challenges

While the macro environment we forecast implies a friendly risk asset backdrop next year, we think two valuation challenges complicate that judgment. First, markets have already moved a long way in the direction of our relatively optimistic outlook. So, while we think our forecasts justify higher US equity prices and further Dollar outperformance, further upside from here looks more limited even if our optimistic baseline plays out. Second, US equity valuations are historically high, and we find that the price for rich valuations is often paid disproportionately when the cycle deteriorates. While our baseline forecast means that such a challenge should be avoided in 2025, if growth risks rise materially, equity downside could be faster and deeper than normal.

5: Protection is key

The key challenge heading into next year is to maintain upside exposure to US equities given the friendly US macro environment while limiting exposure to the major tail risks. Diversification within and across assets can help address this challenge. Bonds, particularly non-US bonds, should provide some protection against growth risks, and TIPS may also offer a good portfolio hedge. Broadening US equity exposure toward mid-cap equities or a more equal-weighted allocation could mitigate valuation and concentration risks. Long Dollar positions should also provide protection against both US rate upside and broadening tariff risks. And, as was the case this year, there is value in using options to protect against tail risks, with lower equity volatility post-election making it easier to gain upside exposure to US assets through calls, deeper downside exposure looking more attractively priced, and long Dollar optionality remaining appealing.